Online Education in China Spikes Due to COVID-19

A primary school teacher edits a video lesson he recorded in an empty classroom, for his students who have had their classes suspended due to COVID-19. Having online classes has been the main solution for schools and tutoring institutions amid the outbreak.

Photo: Issac Lawrence/AFP via Getty Images

The private sector for education in China has been adversely affected by the COVID-19 outbreak, arousing extensive societal attention and discussion. The outbreak has had a tremendous and profound impact on the market’s landscape and dynamics.

First, all educational institutions, from public schools to after-school tutoring centers, have either delayed recommencement or switched to online learning. Traditional offline tutoring institutions have been suffering from a cash flow shortage — a lot of clients have demanded refunds since the classes were disrupted. On the other hand, downloads of online tutoring apps soared five to 30 times the numbers seen before the outbreak.

We estimate that China’s private education industry will witness negative growth in 2020. While private school education providers will remain stable due to resilient demand, training businesses, such as after-school tutoring, English language teaching and vocational training, as well as the experience-based education segment, which includes educational tours and early-years learning centers, will suffer a serious economic blow due to social distancing initiatives.

Conversely, the adoption of online education will accelerate. Having online classes has been the main solution for schools and tutoring institutions amid the outbreak. Some online tutoring apps have leveraged this opportunity to attract students by offering free or low-cost classes, leading to a surge in online education user numbers and adoption rates.

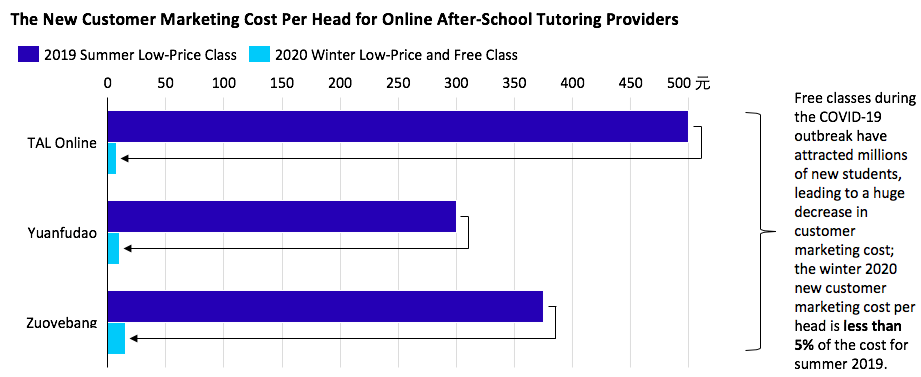

The New Customer Marketing Cost Per Head for Online After-School Tutoring Providers

According to Oliver Wyman, the market for China’s online after-school tutoring was 20 billion renminbi ($2.8 billion) in 2019. We expect the market to maintain a compound annual growth rate of 30% to 40% over the next five years.

Companies offering online solutions to schools and offline training providers also benefited from this exponentially growing demand for online education.

Online-Education Trend Emerging in Training Businesses

China’s training businesses (e.g., tutoring, test preparation, English language lessons, vocational training) have primarily adopted offline delivery models. During the COVID-19 outbreak, offline players have tried online delivery to offset the effects of both the outbreak and its associated regulatory impacts, while existing online players have leveraged free or low-cost classes to attract trial customers.

Leading Chinese online training providers have all reported more than 20 million new users during the second half of February. However, with a lot of customer overlap among competitors and low attendance rates, the quality of the trial users is relatively low. Thus, the conversion rate to full-fee paying users likely will not be as encouraging as expected. Nevertheless, online education is a growing trend, and customer acquisition costs should fall drastically in the short term.

Industry Competition and Consolidation

There will be a widening competition gap between the leading and lagging offline training providers. We believe the leading players, with their online product capabilities and agile long-tail operations, will survive during this period. However, we believe that over 70% of medium- to small-sized offline operators — which will only likely return to operation in mid-to-late May — will face a severe cash flow shortage, and nearly half of them may have to close. The circumstances should create a great opportunity for the industry consolidation.

In terms of online competition, the leading players will gain further domination in the market. Large online classes are the mainstream product right now, and they also offer the best economic model at present in terms of scalability and profitability. Interestingly, the current competition landscape still focuses on the respective players’ customer acquisition, conversion and retention capabilities. Product differentiation is not a priority at this stage. In the after-school tutoring segment, we believe that it will be very difficult for any late-comers to gain a significant market share from the current market leaders.

After the coronavirus outbreak subsides, we believe that the leading offline providers and some of the medium to small-sized ones will keep offering online courses as a supplement or tool to attract new customers. We also expect that online-merge-offline delivery, a blended learning solution that connects online and offline venue, content, teaching or services, will emerge as one of the key delivery models in the long run.

Online Solution Providers Are the Biggest Winners

China’s Ministry of Education has launched an initiative to ensure learning is undisrupted to encourage all schools to leverage online platforms to continue teaching. We believe that some countries with severe outbreaks may adopt similar online learning approaches, especially in the degree education sector.

Besides the collaboration tools that are already in place, educational tool providers are also playing an important role in providing both the public education system and private tutoring businesses with online resources to facilitate teaching, such as live streaming platforms, video conferencing, chatting rooms and online tests.

This segment consists of not only internet giants, but also educational sector specialists. With their large customer base and online traffic advantage, the internet giants already enjoy half of the market share and plan to build their own educational ecosystems. Vertical specialists have leveraged their strong track record in the education industry, as well as their comprehensive understanding of customer demands, to also enjoy a 50% market share.

Post-COVID-19

Content providers have advanced side-by-side and acquired many new customers. These customers are mostly medium- to small-sized training providers with relatively weaker teaching and operational capabilities. As such, they need support in terms of not only technology and tools, but content as well.

We expect that the active user ratio for both schools and training providers will decrease after the COVID-19 outbreak subsides and the delivery model shifts back to offline. The lingering question, then, for these businesses is how best to add more modules and other content online to increase customer stickiness.