Global Support for Gender Equality Rises, But Challenges Remain

Source: Pew Research Center

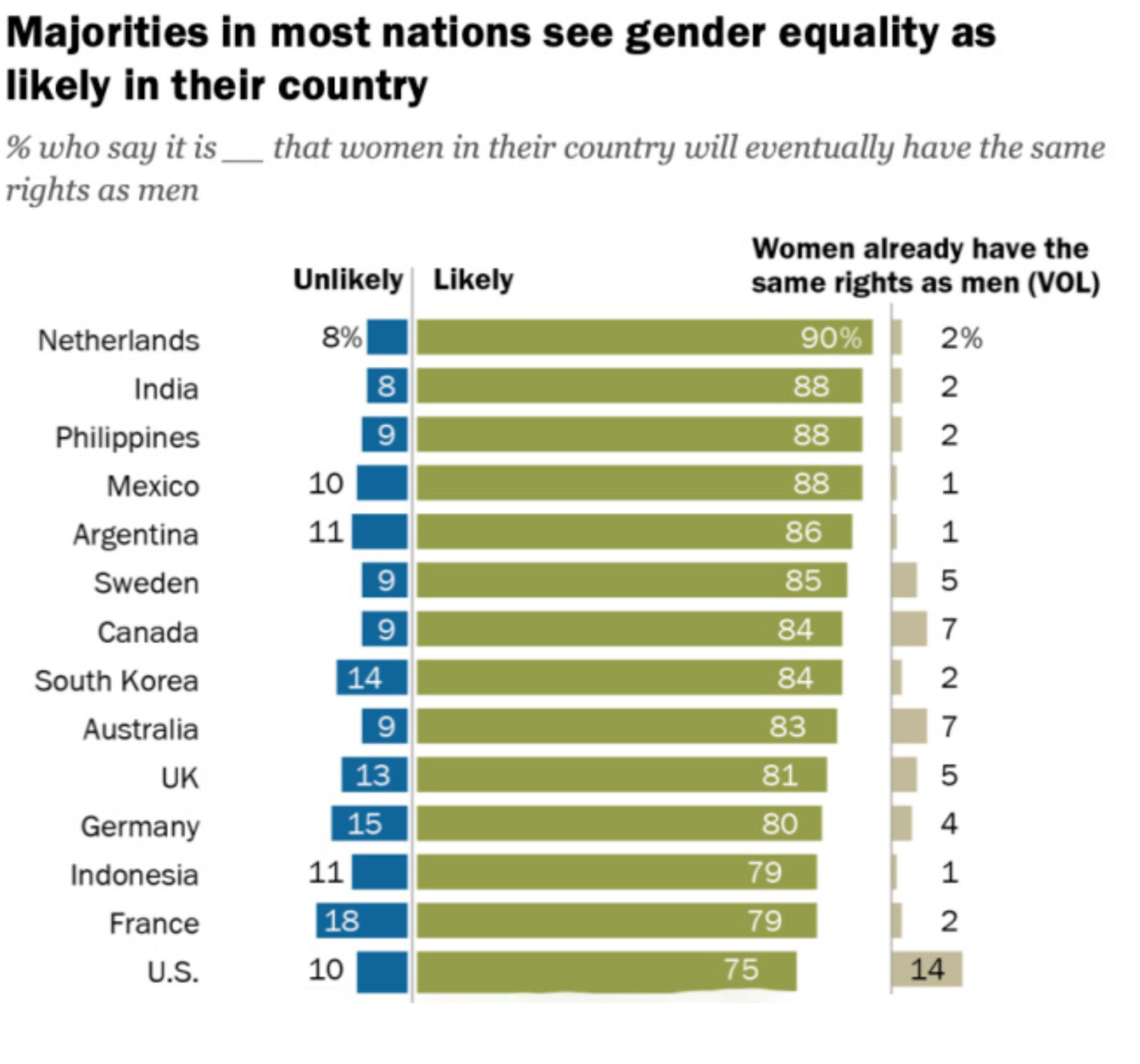

Support for gender equality increased in many large nations in 2020, with a median of 94% of those in surveyed countries agreeing that gender equality is important to have where they live. There is also a large sense of worldwide optimism for the future of gender equality, with a median of 75% of those in surveyed countries holding this view, according to a Pew Research Center survey conducted in April 2020.

However, Pew’s research also found that women are less optimistic than men are about the future of gender equality. Out of the 34 countries surveyed, a majority of the public believe that men have a better chance at getting higher paying jobs than women do, as well as a more opportunities to serve in a leadership role in their communities. A median of 46% of those surveyed across the countries also believe that men have “a better life” in their countries than women.

The COVID-19 pandemic has also had a negative impact on efforts to achieve gender equality — especially in the workplace. As 2021 approaches, many question what long-term effects the pandemic will have on women’s careers as they face setbacks in their incomes and career progression due to childcare arrangements.