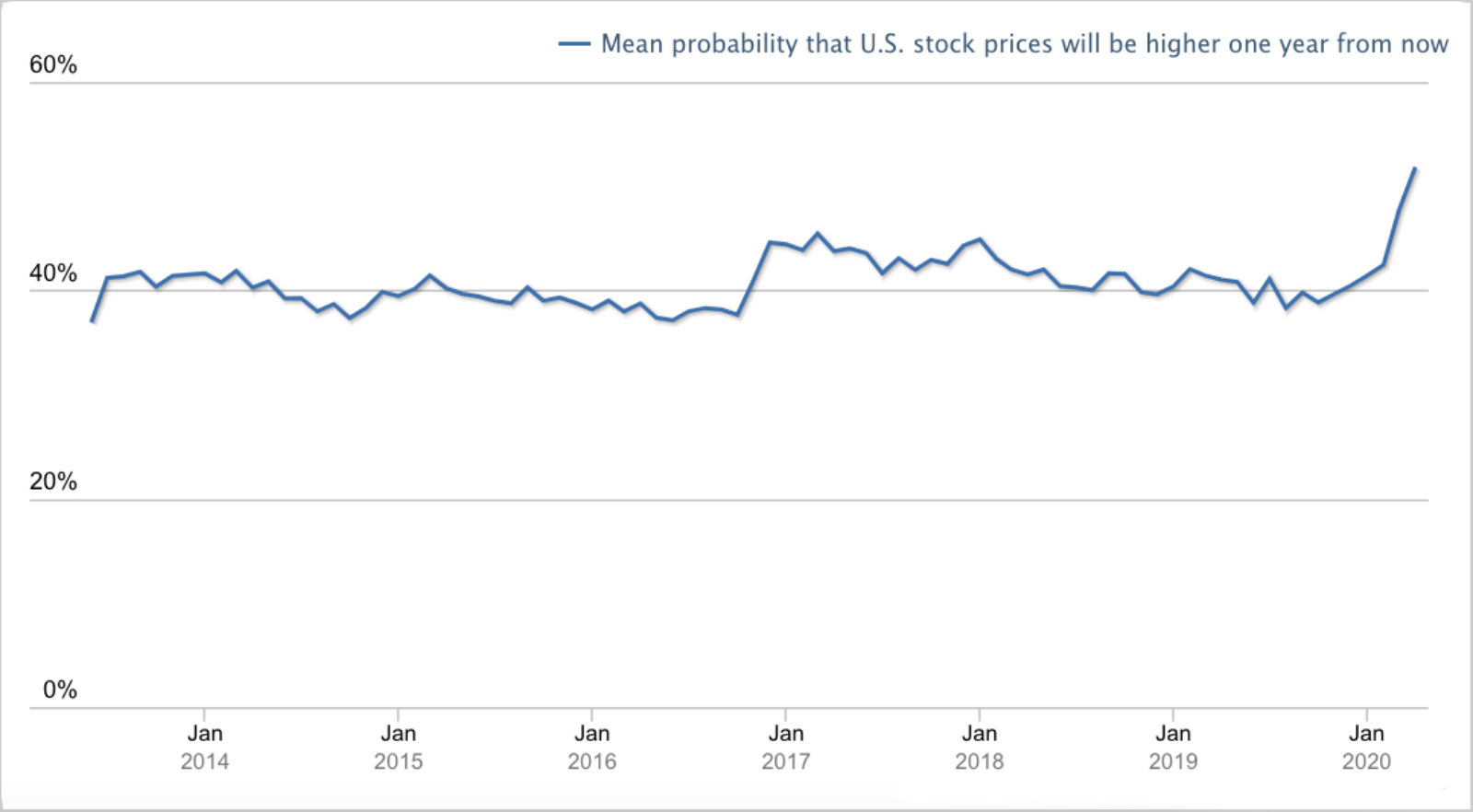

52% of Consumers Expect US Stock Prices to Be Higher One Year From Now

Source: New York Fed Survey of Consumer Expectations, April 2020

More than half of respondents to a New York Federal Reserve survey expect stock market prices to be higher in a year’s time, despite consumer expectations deteriorating sharply in other economic categories. Expectations for higher prices increased from 47.7% of respondents in March to 51.8% — higher than they’ve been for at least six years.

Conversely, the survey continued to show a steep decline in expectations for growth in household income, dropping from 3.10% of consumers in February who expected their income to be higher next year to 1.87% in April. Perhaps surprisingly, expectations for higher unemployment, though currently at a high, started to decline in April at 47.57% compared to 50.86% recorded in March.

With stock prices at record lows, some are wondering if this is a good time to buy stocks and hoping they’ll see substantial increases in value as the economy recovers. The stock value of some companies has actually risen due to the pandemic, according to Forbes. The companies seeing success have leveraged the increased demand for e-commerce and delivery services, setting themselves up for success in a post-coronavirus economy.