Africa Debt Soared Last Decade, Says World Bank

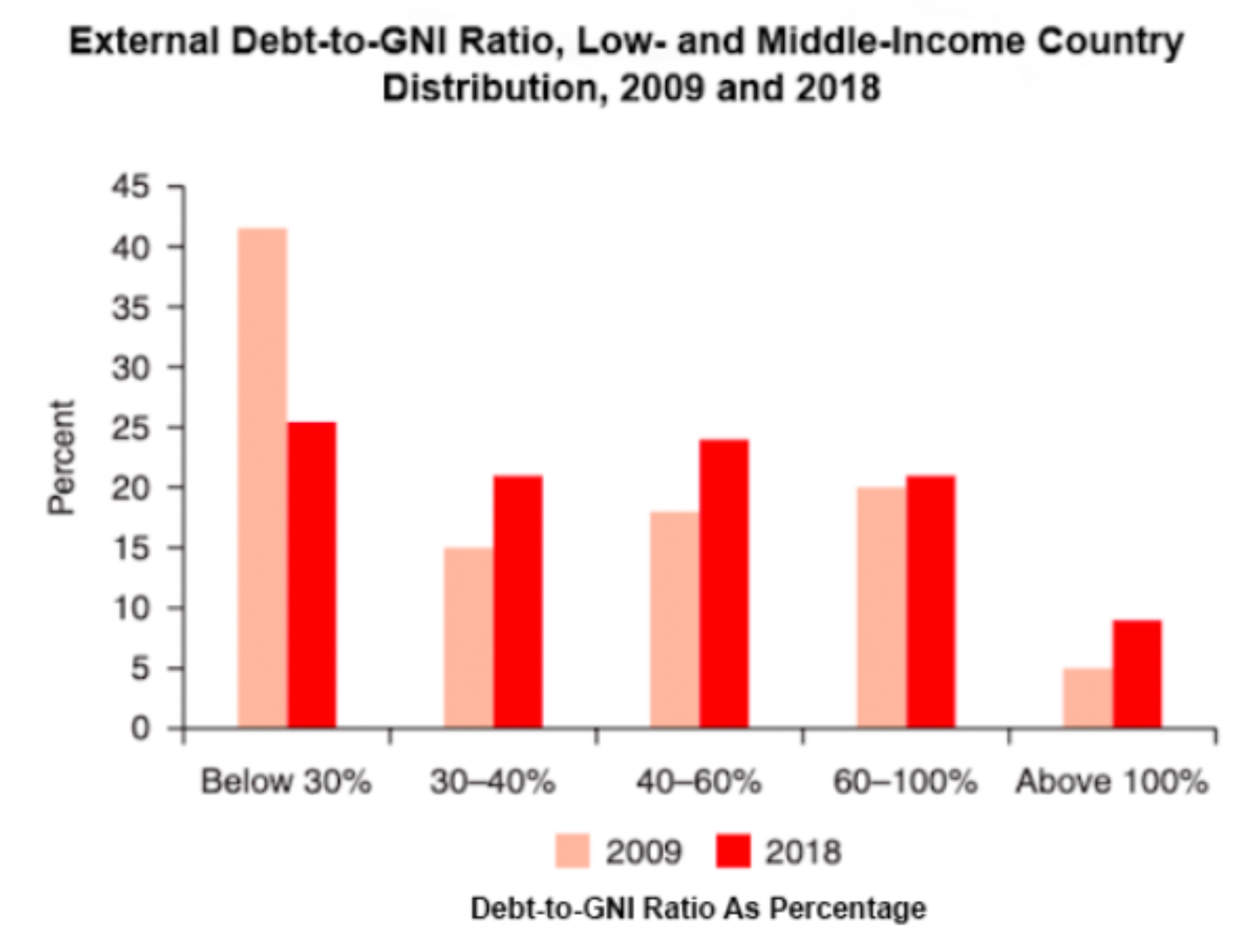

Source: International Debt Statistics, 2020, World Bank

The 2010s will go down as the decade that saw debt in low- and middle-income countries reach unsustainable levels. Sub-saharan Africa is driving the trend, designated as the region with the fastest growing debt levels in the World Bank’s International Debt Statistics 2020 report.

Several countries in the region have seen their external debt stocks more than double since the beginning of the decade, according to the report: “The average debt-to-GNI and debt-to-export ratios of countries in the region, excluding South Africa, [were] 32% and 127%, respectively; the comparable ratios for 2009 were 24% and 87%, respectively.”

Borrowing is essential for low- and middle-income nations in pursuit of poverty eradication and stable economic growth. But rising debt to unsustainable levels poses serious risks to internal economic and political stability, should governments find it increasingly difficult to meet creditor obligations. A current case in point is Lebanon, which has seen its financial crisis, spurred by unsustainable debt, spiral into political turmoil — Lebanon’s debt-to-GNI and debt-to-export ratios are 145% and 34%, respectively.