Amid Positive Energy Trends, Challenges Remain Around Security

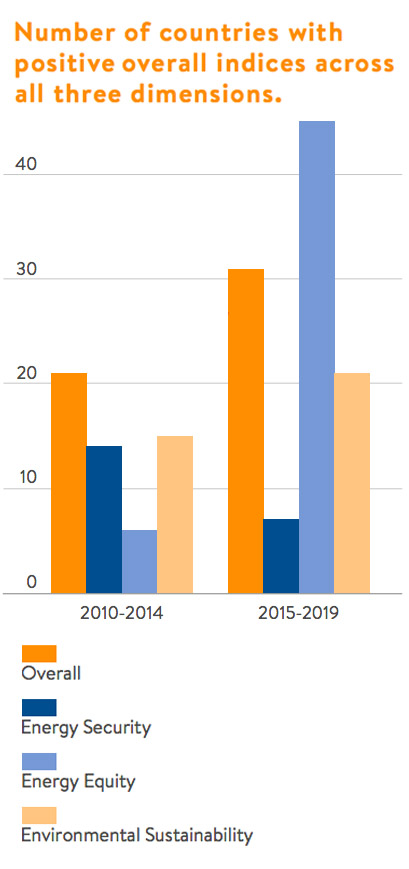

A recent ranking of countries’ performance in the global transition to renewable energy shows that a growing number of countries are pursuing and implementing policies that will deliver on the promise of the low-carbon transition. However, despite the overall positive trend, the data shows considerable variation in performance on the three dimensions the ranking tracks: energy security, energy equity and environmental sustainability.

In particular, the authors of the 2019 World Energy Trilemma Index found that while an increasing number of countries have achieved continuous improvement in equity and sustainability, fewer countries have managed to achieve continuous improvement in security — the ability to meet demand and withstand system shocks — in that same period. “The global energy transition has historically necessitated various trade-offs, where countries could manage one or two dimensions of energy performance, at the expense of the third dimension,” write the index’s authors. “The classic ‘trilemma’ challenge still remains relevant.”