Are We in a Crypto Winter?

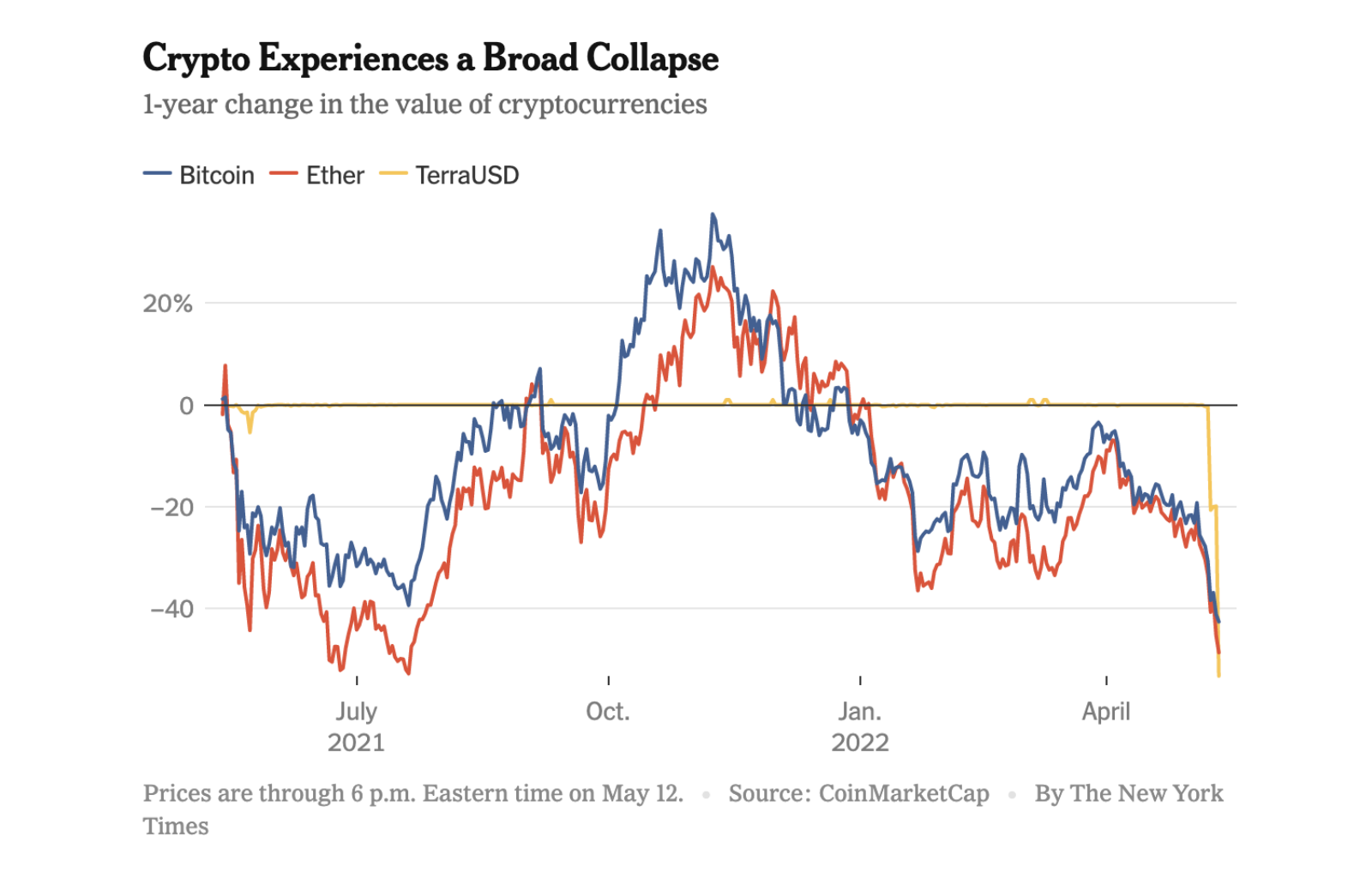

Digital currencies took a nosedive last month, with the price of Bitcoin dropping 20% across just five days in May. In the first five months of the year, its price dropped 60%, to $26K. Coinbase’s stock price was down 82% compared to April 2021. And Ether lost more than 30% of its value, according to The New York Times.

The combination of rising interest rates, inflation, and economic instability related to the Russia-Ukraine conflict contributed to this value plunge — but so did TerraUSD. TerraUSD is a “stablecoin” — supposedly backed by stable assets. In reality, it was linked algorithmically to another digital currency, Luna, which lost nearly all of its value and implicated TerraUSD’s value.

Though slow, the market is showing signs of recovery. In a piece for Forbes, Alkesh Shah, head of digital assets strategy for Bank of America, says that although “the media is writing as if it’s the end of the sector,” as of early June, “the market has corrected about 40% to 45%.” Similarly, the NYT notes that “Any panic might be overblown” as “the average Bitcoin owner on Coinbase would not lose money until the digital currency’s price sank below $21,000.”