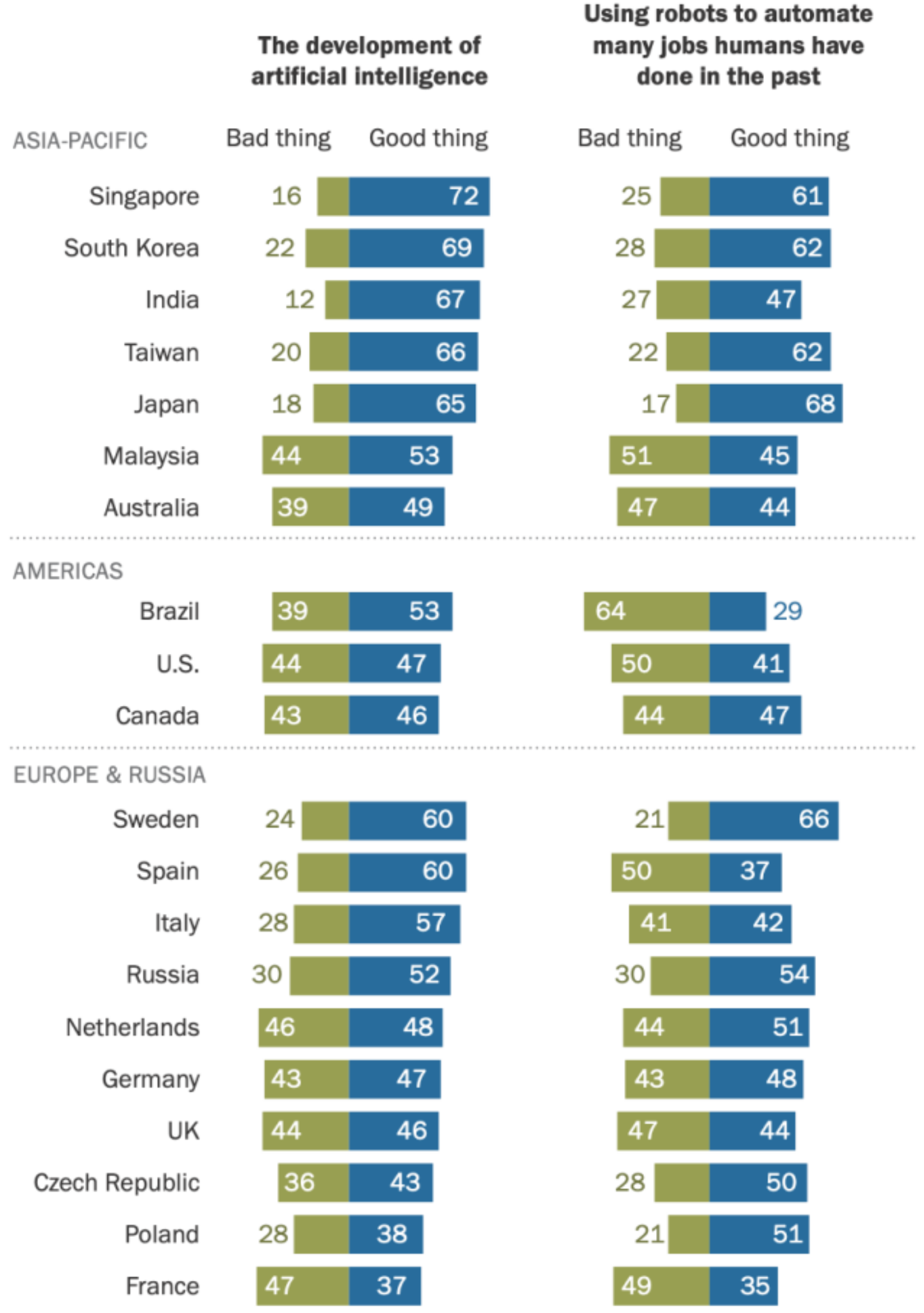

Asia-Pacific Embraces AI, While Other Countries Remain Wary

Source: Pew Research Center

More than half of the 20 countries surveyed believe that artificial intelligence brings value to their society, compared to 33%, which believe the technology creates a negative impact. This survey, by Pew Research Center, finds that less than half of the countries surveyed saw this technology having a positive impact on society in terms of job automation.

Views of AI were especially positive in the Asia-Pacific region, with 72% of the public in Singapore and 69% in South Korea seeing it as a good thing for their countries. Not surprisingly so, as many countries in this region have dominated the field of AI. For example, South Korea has the highest robots-to-human workers ratio in the nation, followed by Singapore. Singapore has also expressed a goal of becoming the world’s first “smart nation.”

The COVID-19 pandemic has accelerated the use of AI technologies. Half of global businesses have increased the speed of incorporating automating tasks in their workday, while many executives see this technology as a key lever for success in 2021.