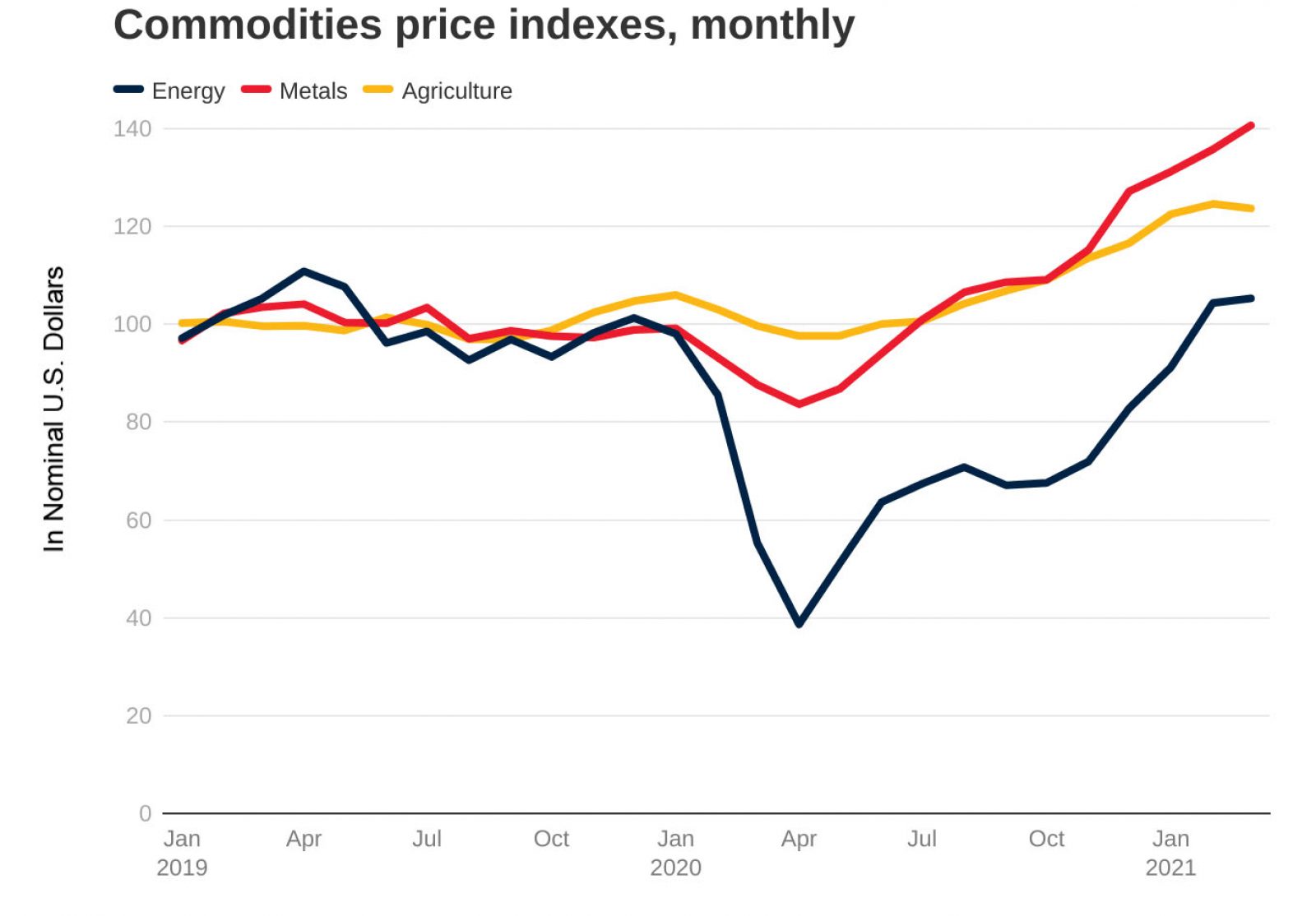

The Great Commodity Bounceback

Source: World Bank

Most global commodity prices were higher than their pre-pandemic levels during the first quarter of 2021. Metal prices are expected to continue their upward trend, rising by 30% during 2021, according to the World Bank. This jump in commodity prices parallels the rise in global economic activity, the impact of stimulus bills and changes in supply factors.

The crude oil industry saw a record-fast recovery after a price and demand collapse in 2020. The predicted average cost of crude oil for this year is $56 per barrel — about one-third higher than its cost in 2020. Natural gas prices also rose by one-third as a result of increased demand during the winter season.

The World Bank expects that price levels will “remain close to current levels throughout the year” driven by “global economic rebound and improved growth prospects.” The report notes that all commodity markets heavily depend on how long the economic implications from the pandemic last and how well the risk is managed by governments.