Consumers Are Delaying Big Purchases Until Coronavirus Subsides

Source: GlobalWebIndex

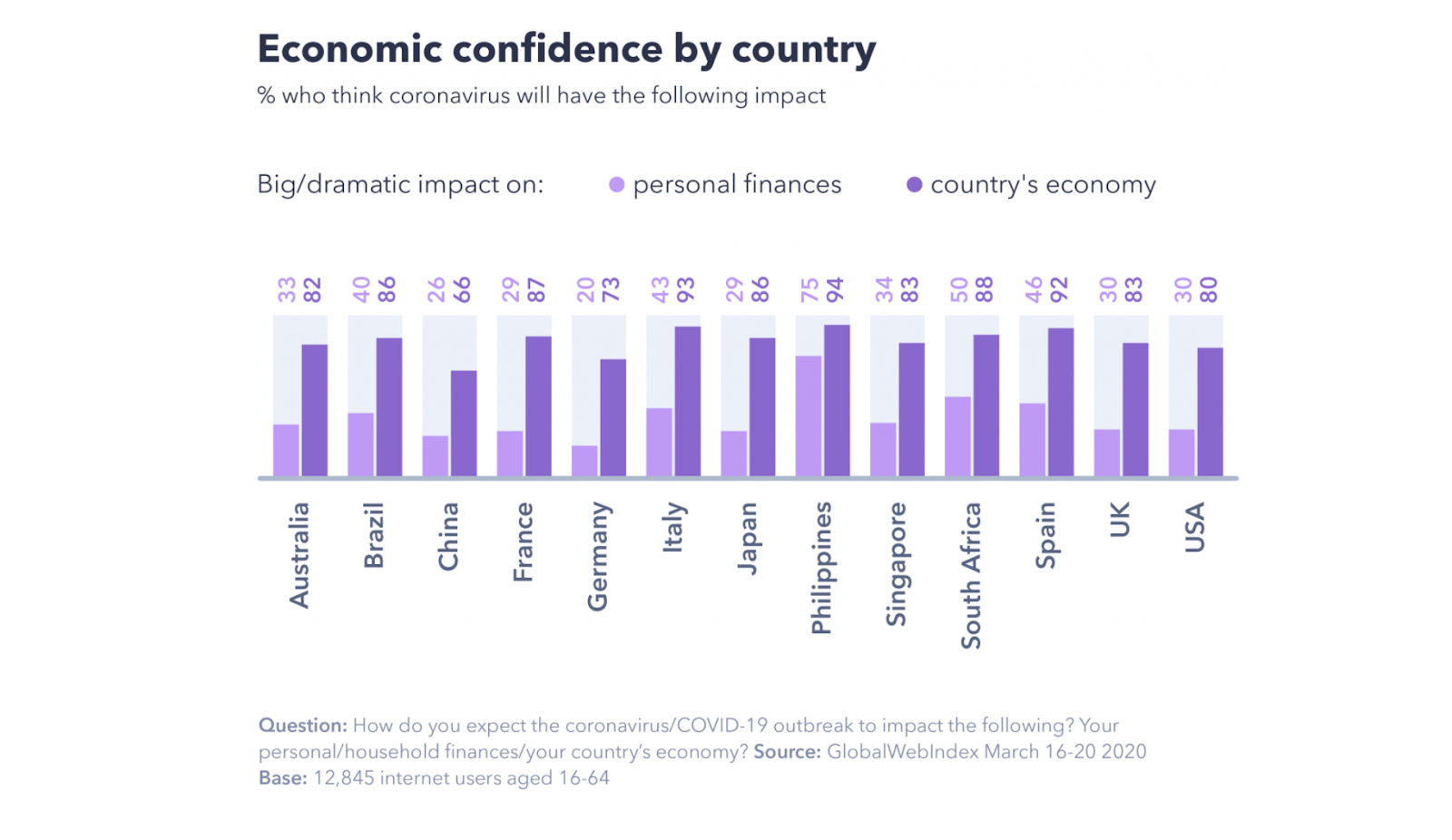

Global households are primarily concerned with COVID-19’s impact on their nation’s economy more than their personal finances, the latest survey results from GlobalWebIndex show.

But in a blowback to consumer spending, a significant portion — almost 40% of respondents — say they’ll be withholding on major purchases, including travel and appliances, until the threat of the coronavirus subsides in their country. And roughly 20% say they’ll wait until the pandemic subsides globally before taking out their wallet.

Conservative public attitudes toward spending come as much of the world imposes movement restrictions and social distancing to combat the disease, forcing many retail businesses and transportation services to suspend activity. The paralysis in consumer and business activity is expected to last for at least two months as governments across the world forecast a 60-day social distancing period to flatten the curve.