Coronavirus Is Reshaping the Global Risk Landscape

Source: COVID-19 Risks Outlook: A Preliminary Mapping and Its Implications. WEF

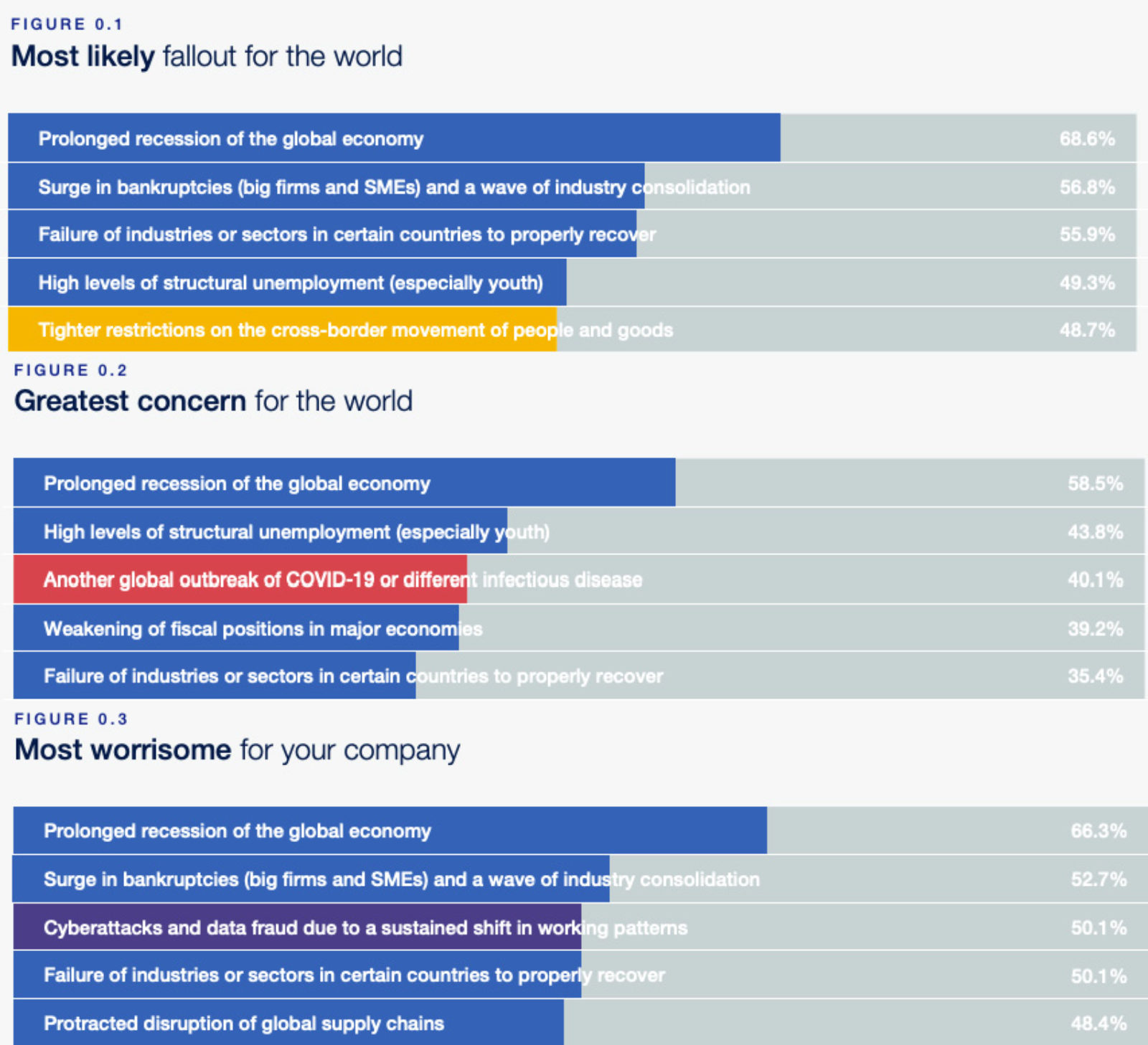

Two-thirds of senior risk professionals surveyed cite a prolonged global recession as the top concern for their companies due to COVID-19, followed by a surge in bankruptcies and an increasing vulnerability to cyberattacks.

Nearly 350 senior risk professionals analyzed 31 risks across the three dimensions seen in the chart above for the COVID-19 Risks Outlook survey. From this, four key shifts were identified in the risk landscape: economic shifts, sustainability setbacks, societal anxieties and technology dependence. The economic crisis will implicate each of these areas, for example, 18% of respondents expect a shortage in investment for climate action.

By recognizing these shifts, the World Economic Forum, which produced the report, hopes to raise awareness as governments and businesses design post-lockdown measures. “The results of the survey … are not intended as forecasts,” the report notes, “Instead, they are a reminder of the need for proactive action today to shape the desired new normal rather than one that may develop if emerging risks are not addressed.”