ESG Issues Are Getting More Attention From Directors

Source: Global Network of Director Institutes (GNDI), 2020-2021

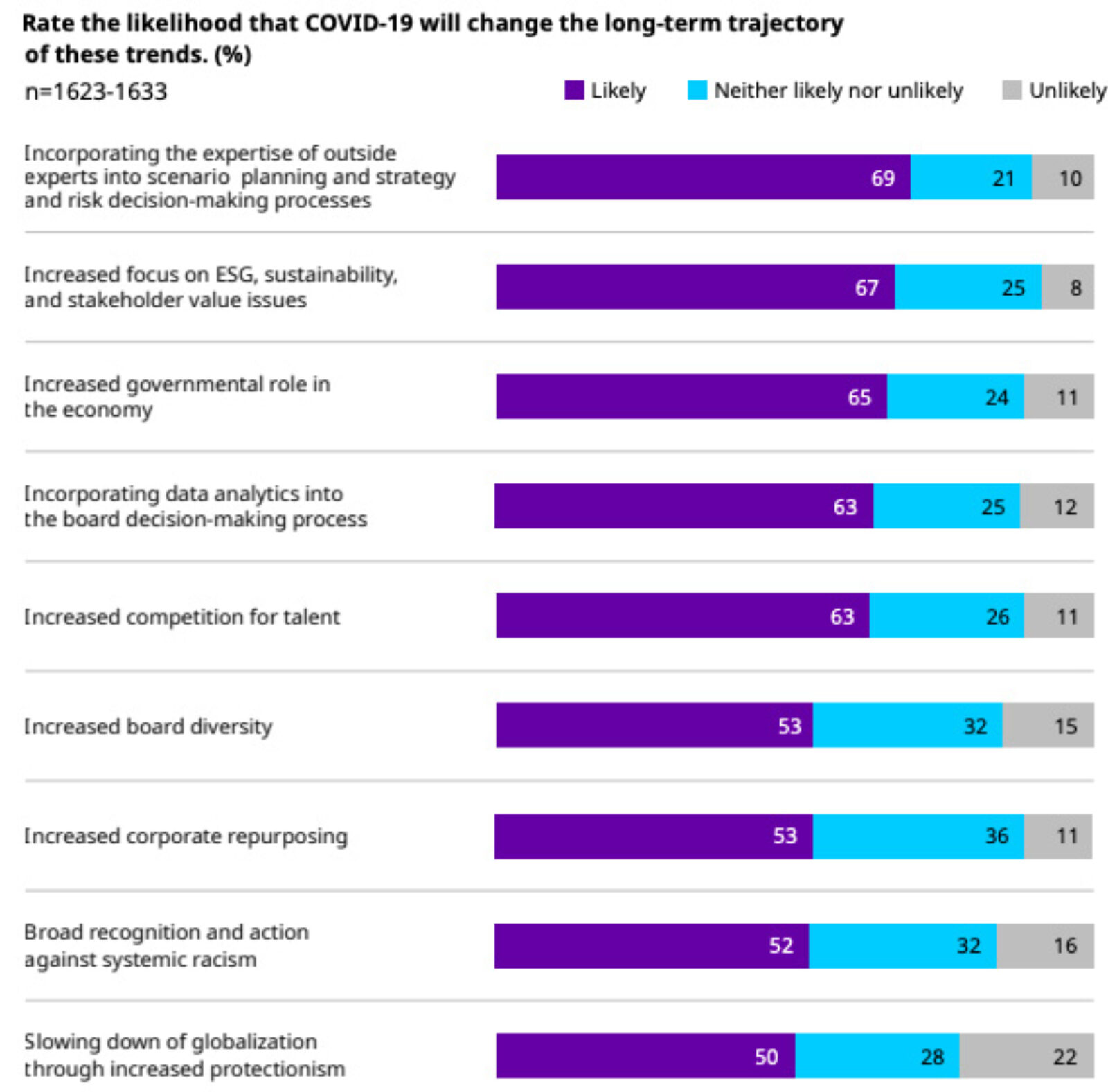

Over 60% of global business directors surveyed said that COVID-19 accelerated their focus on ESG, sustainability and stakeholder value issues. Out of 2,000 respondents, the majority agreed that risk-scenario planning and decision-making needs to involve outside experts, according to the latest GNDI survey.

This increased interest in ESG values correlated with other highly ranked trends throughout the survey. For instance, 63% of directors expect COVID-19 to increase the competition for talent. Past surveys showed how companies with better ESG performance are likely to have both better employee engagement and greater attractiveness to prospective talent. Over half of respondents also believe there will be a growing emphasis on corporate purpose and board diversity.

Just 17% of directors surveyed were satisfied with their response and ability to provide oversight during the pandemic. Although directors can learn from their response, they can also work with their management teams to prepare for future workforce changes — social and economic. By doing this, companies will be more equipped to absorb the shocks from these risks.