The Delta Variant Could Disrupt the Newest Job Market Gain

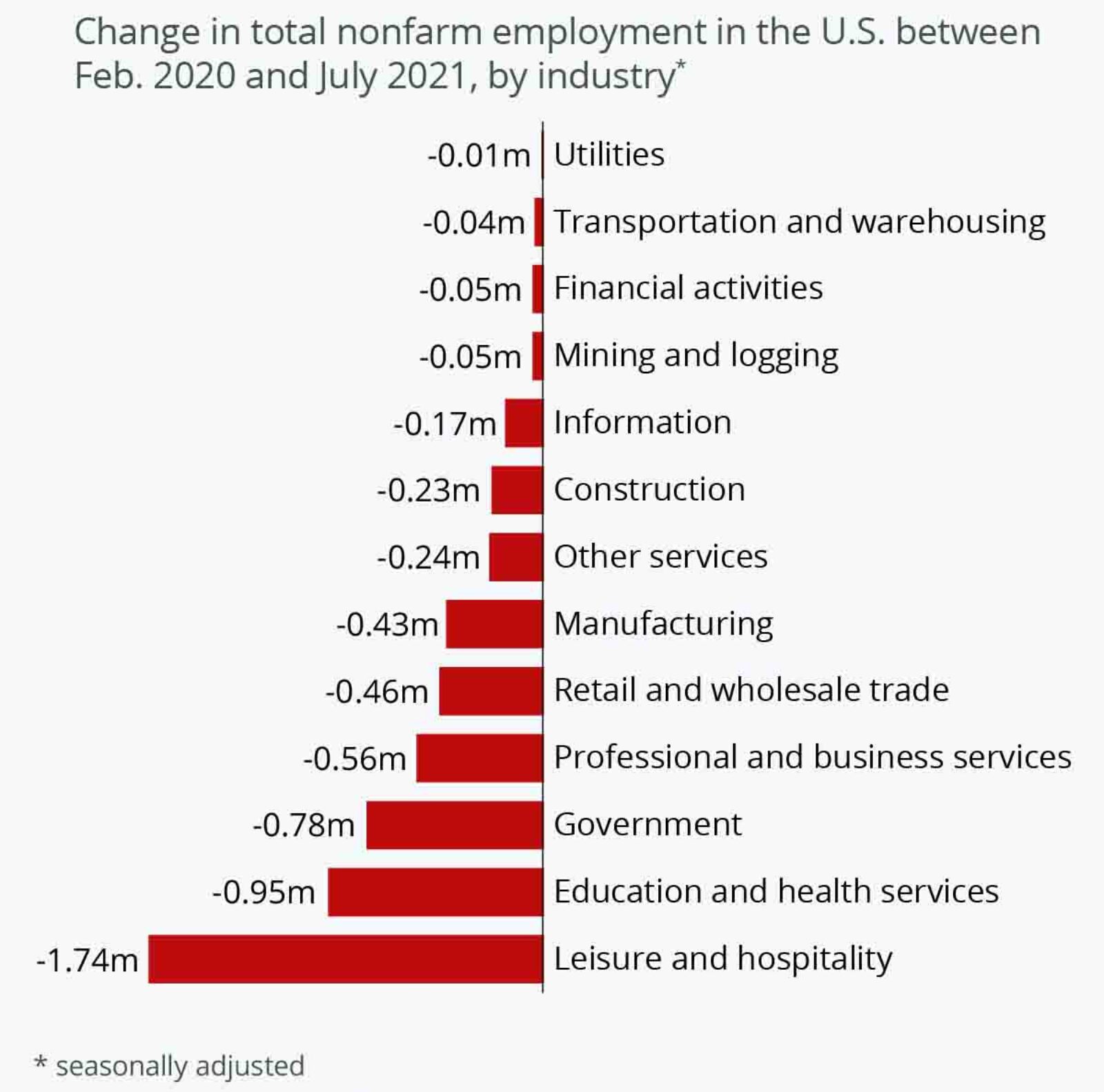

Source: U.S. Bureau of Labor Statistics

The U.S. labor market is still 5.7 million jobs short, on a seasonally adjusted basis, below its peak in February 2020. The leisure and hospitality sector accounts for 1.74 million jobs of the total 4.99 million lost in the service sector. In contrast, jobs in the utilities, transportation and financial sectors experienced a quicker recovery.

The July job report indicated the biggest gain in jobs since August 2020, with an additional 943,000 jobs added back into the economy. The leisure and hospitality sector accounted for more than one-third of the total at 380,000 jobs, followed by 230,000 jobs in local government and 83,000 education and health services jobs. U.S. unemployment dropped to 5.4% in July — a new low for the COVID-19 era — but the economy still has a long way to go. As the world tackles the Delta variant, governments are bringing back pandemic-related restrictions that could further jeopardize the labor recovery.