Does Your Supply Chain Have ‘Hidden Dependencies’ on Nature?

Source: Nature Risk Rising: Why the Crisis Engulfing Nature Matters for Business and the Economy, the World Economic Forum

Businesses worldwide will suffer supply chain disruption as biodiversity loss reaches alarming levels — even if they don’t rely directly on sourcing products from nature, according to a report from the World Economic Forum.

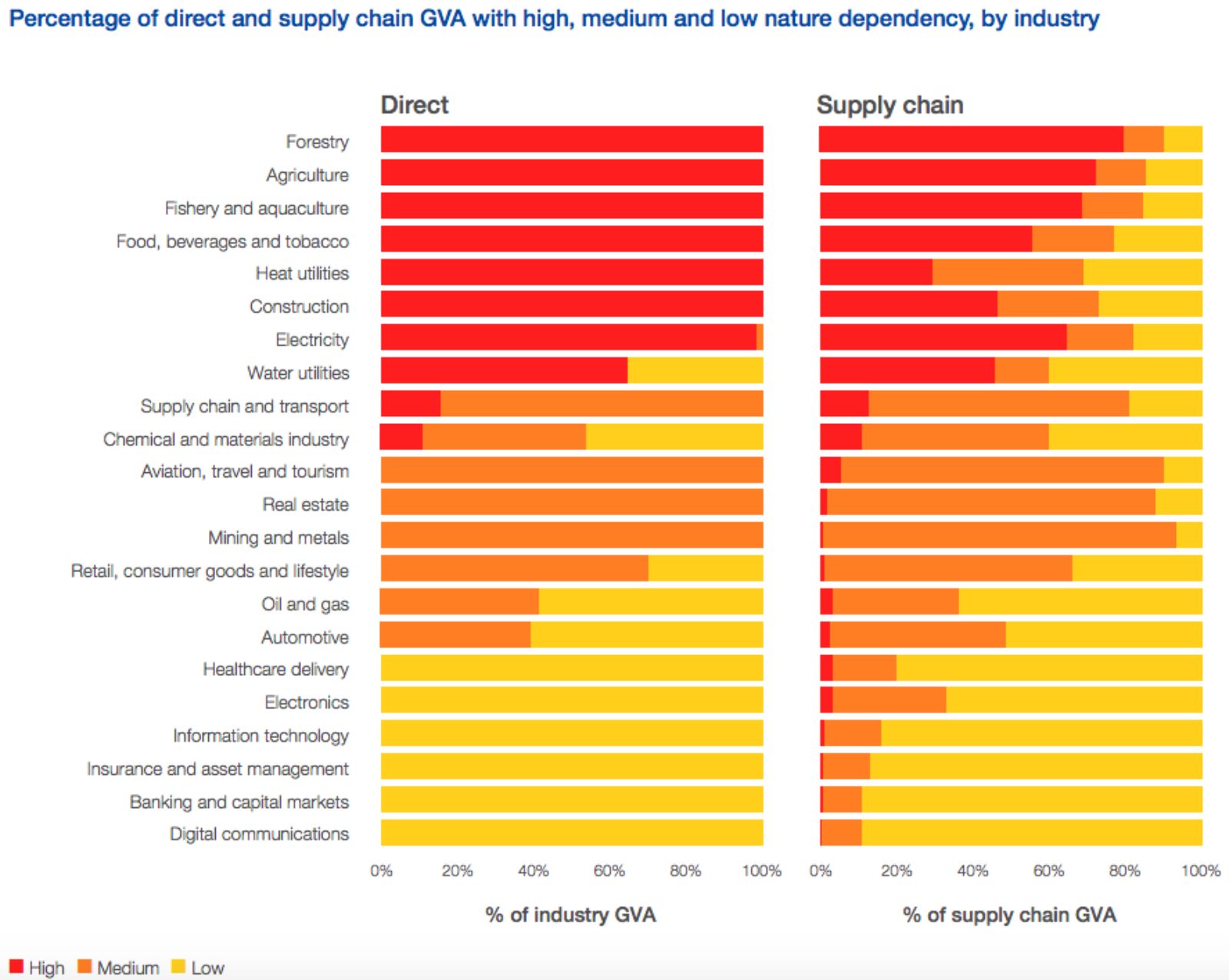

More than half of global GDP results from moderate or high dependencies on nature, and many supply chains have “hidden dependencies” on nature’s biodiversity, the report explains, meaning an industry’s supply chain operations may rely on nature to a much greater extent than the industry itself.

The graphic above shows six industries that receive at least 85% of their direct value without significant dependence on nature (chemicals and materials; aviation, travel and tourism; real estate; mining and metals; supply chain and transport; and retail, consumer goods and lifestyle), however, more than half of the value of their supply chains results from a moderate-to-high dependency on nature.

“Business leaders have a crucial role to play” in responding to the world’s deteriorating biodiversity, the report argues. It recommends adopting a risk management approach for “systematically identifying, assessing, mitigating and disclosing nature-related risks to avoid severe consequences.”