Electricity Demand Could Drive Record CO2 Emissions

Source: International Energy Agency

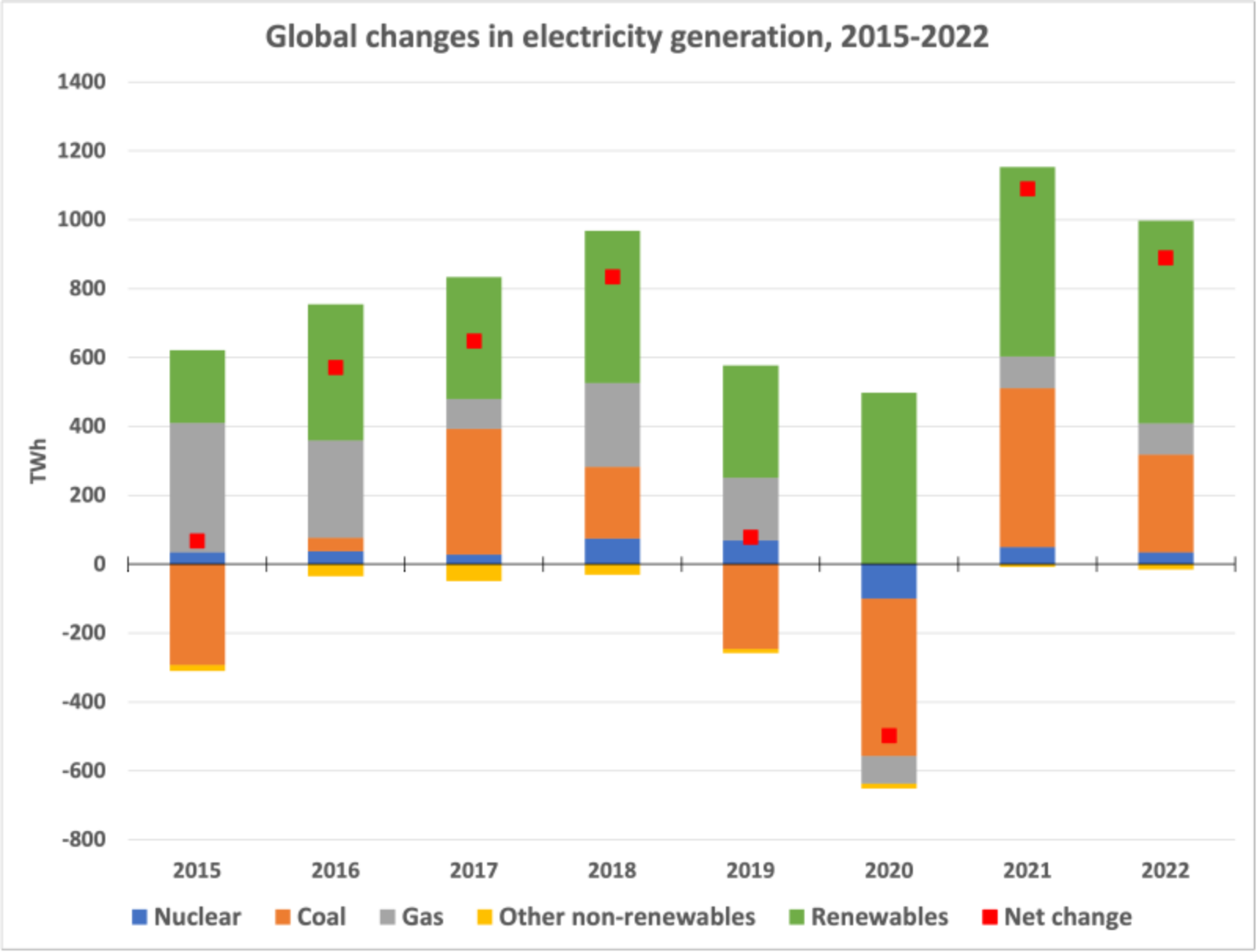

Carbon emissions produced by the energy sector will grow by 3.5% this year and by 2.5% in 2022, taking emissions to record levels. Almost half of this increase in electricity demand will come from fossil fuels that could push carbon dioxide emissions in the energy sector to record levels in the next two years.

Coal is expected to increase by almost 5% this year and an additional 3% in 2022, according to the IEA. Although renewable energy is expected to grow by 8% this year and 6% in 2022, IEA states that, “renewables will only be able to meet around half the projected increase in global electricity demand over those two years.”

In 2020, electricity demand fell by 1% due to less social and economic activity and extreme weather-related outages. Electricity demand is expected to rise by 5% this year and 4% in 2022, driven in part by global economic recovery. To improve the energy sector’s resilience, IEA states that “power systems need not only to maintain system adequacy but also to be flexible enough to balance supply and demand at all times.”