Europe, North America Lead Global Trends for Childless Households and Fewer Married Couples

Source: Regional values calculated by UN Women using published country-level estimates from the UN DESA 2018a. For this analysis, data on China are based on estimates produced and published in Hu and Peng 2015.

Note: Regional estimates marked with an asterisk (*) are based on less than two-thirds of their respective regional population and should be treated with caution: Europe and Northern America (41% of the population) and Northern Africa and Western Asia (36.1% of the population). Global and regional distributions of households by type may not total 100 due to rounding. Population coverage was insufficient for Oceania and therefore not shown.

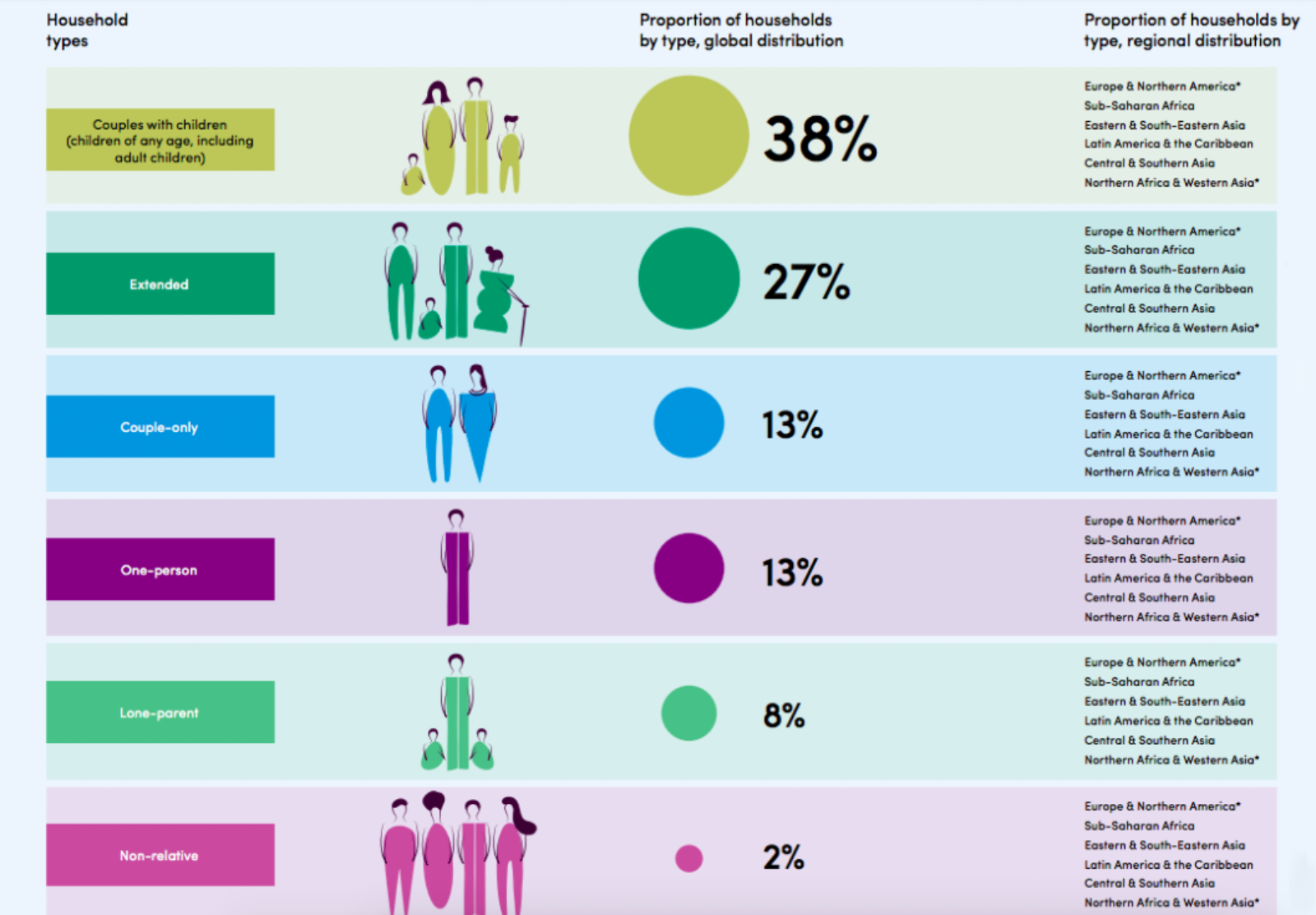

Family structures are rapidly changing, with fewer than four of every 10 households across the world reflecting the “traditional” composition of a couple with children, according to a new UN Women report.

But the trends diverge per region, with Europe and North America having the highest portion of couple-only (24%) and one-person occupancy households (27%). Conversely, 59% of households in the Middle East and North Africa include children.

Nevertheless, shifting employment trends and changing societal norms toward women and marriage are being felt globally, but at varying paces. For example, the proportion of women aged 45-49 to have never married has increased across the world since 1990, with the rate skyrocketing by 220% in Australia and New Zealand compared to just an 18% increase in Latin America.

To ensure socioeconomic prosperity, governments and employers need to enact policies that recognize evolving family dynamics, such as equal employment opportunities for women, paid parental leave and child-related support for lone-mother households. “The relationship between families, economies and governments is a symbiotic one: Each needs the other to flourish and to achieve stable and prosperous societies,” the report adds.