Financial Flows to Developing Economies Are Shrinking

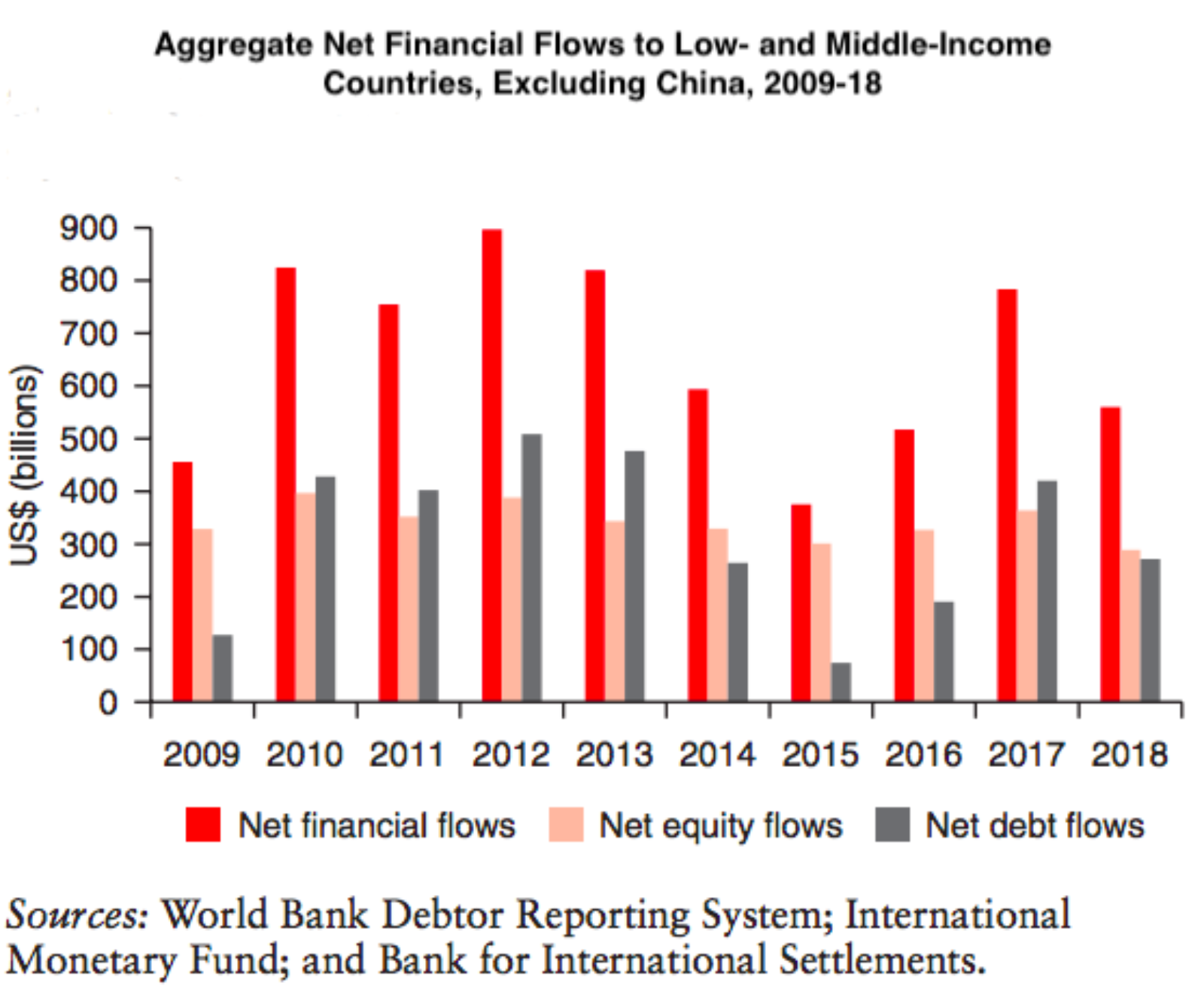

Financial flows to low- and middle-income countries decreased by an average of 29% in 2018, according to the newly released World Bank International Debt Statistics 2020 report.

This is indicative of “general concerns about a slowdown” in the growth of the world economy along with the political risks and trade pressures that have had ripple effects globally. Another contributing factor may be the high levels of debt that have accumulated in some countries due to unsustainable borrowing from international markets.

“Sustainable borrowing is an important tool for economic growth and poverty eradication. It boosts countries’ capacity for long-term financing to invest in infrastructure, education, employment, and health,” according to the report’s authors.

But the levels of debt carried by some of these countries warrant concern: “For both borrowers and creditors to safeguard debt sustainability, and for governments to design effective macroeconomic policies, debt transparency is critical.”