Global Debt Is Setting New Records

The global costs of the pandemic last year resulted in the highest global debt levels in half a century, according to a report from the International Monetary Fund. Since the beginning of COVID-19 in 2020, governments around the world have taken on new debt to pay for higher health care costs, unemployment and food and to help businesses survive.

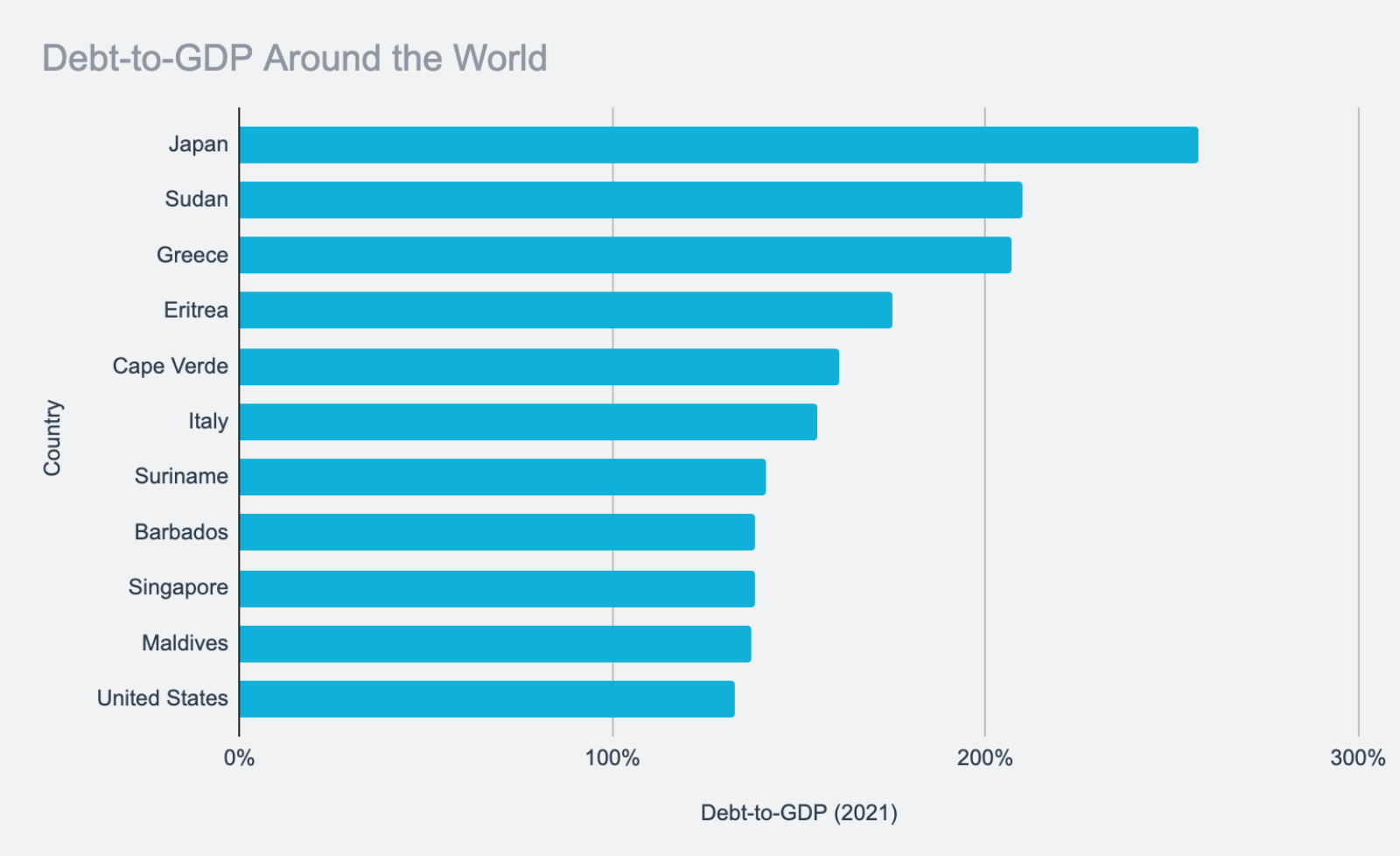

The debt-to-GDP ratio compares a country’s debt to its economic output. Countries with a debt-to-GDP ratio over 77% for prolonged periods of time experience economic slowdowns, according to a study from The World Bank. In 2021, Japan had the highest debt-to-GDP ratio in the world at 257%. Sudan and Greece also top the list with debt-to-GDP ratios above 200%, followed by Eritrea (175%), Cape Verde (160%) and Italy (154%).

By the end of 2020, global debt reached $226 trillion, the biggest one-year increase since World War II. Borrowing by governments accounted for over half of that increase, bringing the global public debt ratio to a new high of 99% of GDP. This crisis is hitting low- and middle-income countries harder than wealthier countries.