Global Food Prices Rise, Impacting Food Security

Source: Food and Agriculture Organization (FAO)

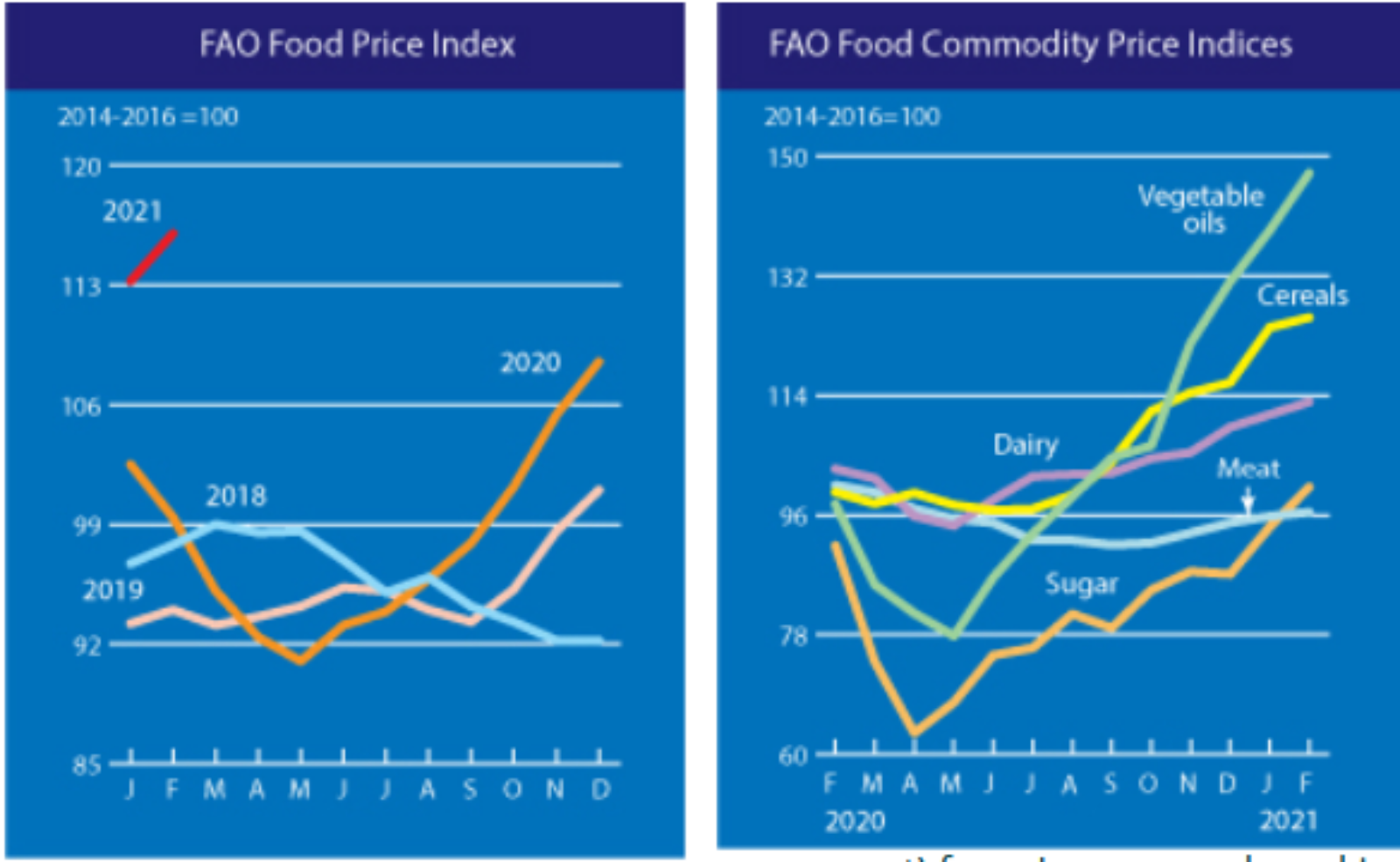

Global food prices rose for the ninth consecutive month in February, reaching their highest level since July 2014. Food prices increased by 26.5%, compared to the same time just last year. Pandemic-related disruptions to the food and agriculture industry — such as restrictions to global trading and economic distress — contributed to the lower supply of certain foods.

The FAO Food Price Index — which tracks changes in global food prices — found the biggest increase in the price of sugar — which is up 6.4%, “as production declines in key producing countries together with strong import demand from Asia prompted ongoing concerns over tighter global supplies.” Vegetable oil prices saw the second-highest hike in prices with a 6.2% increase, reflecting concerns about low production, inventory and export potential.

Food insecurity was growing prior to the pandemic, and estimates show that the virus could almost double the number of people experiencing hunger. International partners and governments are working together to monitor food supply chains and provide financial support for those who are unemployed and are unable to buy food.