The Global Trade Slowdown Is Expected to Continue in 2020

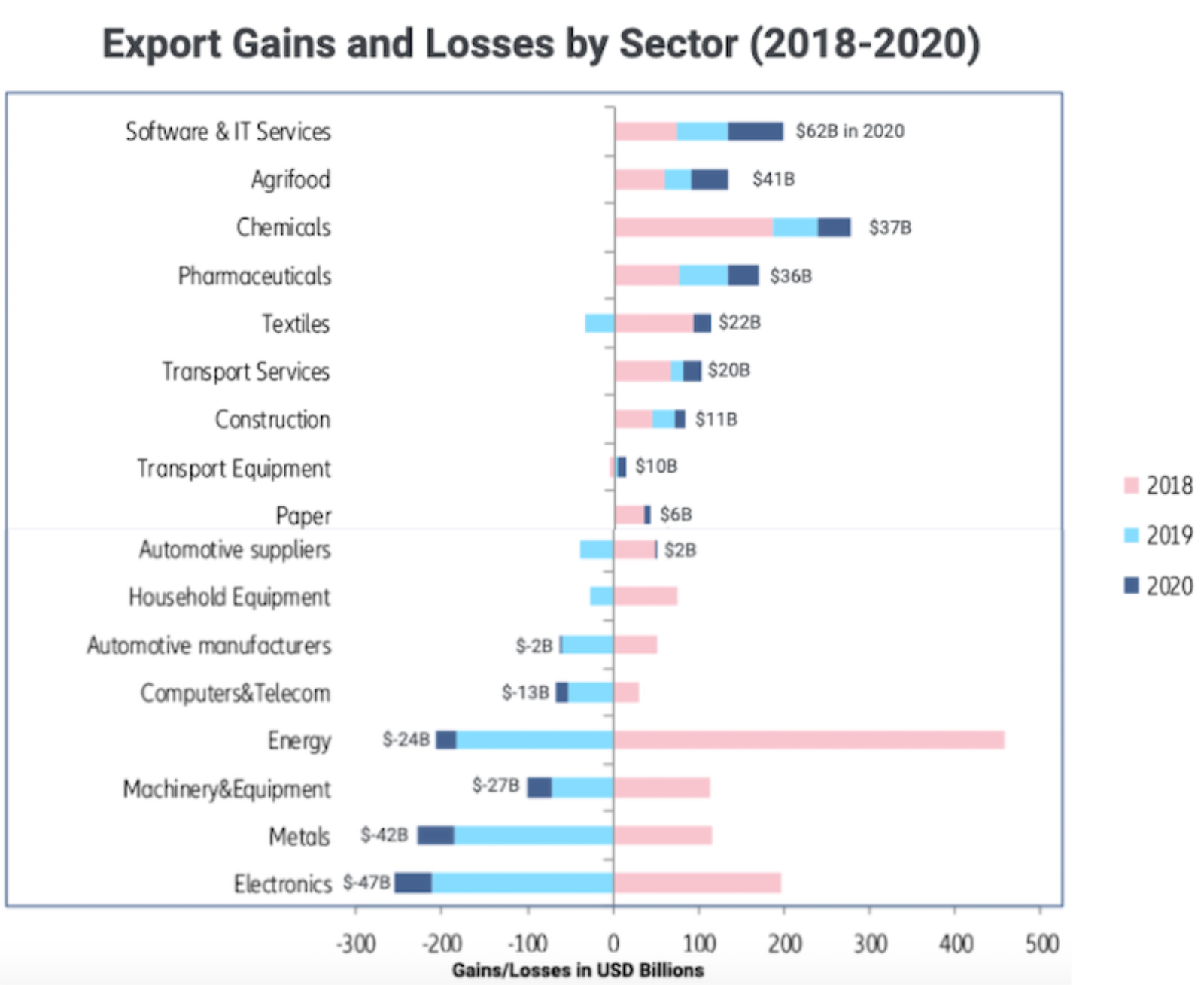

Sources: IHS Markit, Euler Hermes Actual and anticipated gains and losses are shown in billions of U.S. dollars.

Global trade in 2019 is on track for its slowest annual growth in a decade at +1.5% with “no hope for sizeable improvement” in 2020, according to a new report by Euler Hermes, which blames higher tariffs and uncertainty regarding trade policy for the slowdown.

Exporters are likely to see $420B in losses this year, according to the report, with modest 1.7% growth predicted for next year. Inside the 2020 number is a mixed bag with software and IT services (+$62B), agrifood (+$41B) and chemicals (+$37B) moving ahead, and electronics (-$47B), metals (-$42B), and machinery and equipment (-$27B) lagging behind.

“The so-called phase 1 deal between the U.S. and China, despite being superficial, may bring some comfort,” said Ludovic Subran, chief economist at Allianz and Euler Hermes.

“But renewed threats of tariffs and a busy political year in 2020 should bring higher volatility, leaving no hope for sizable improvement going forward.”