Half of US Taxpayers Pay 97% of Income Taxes

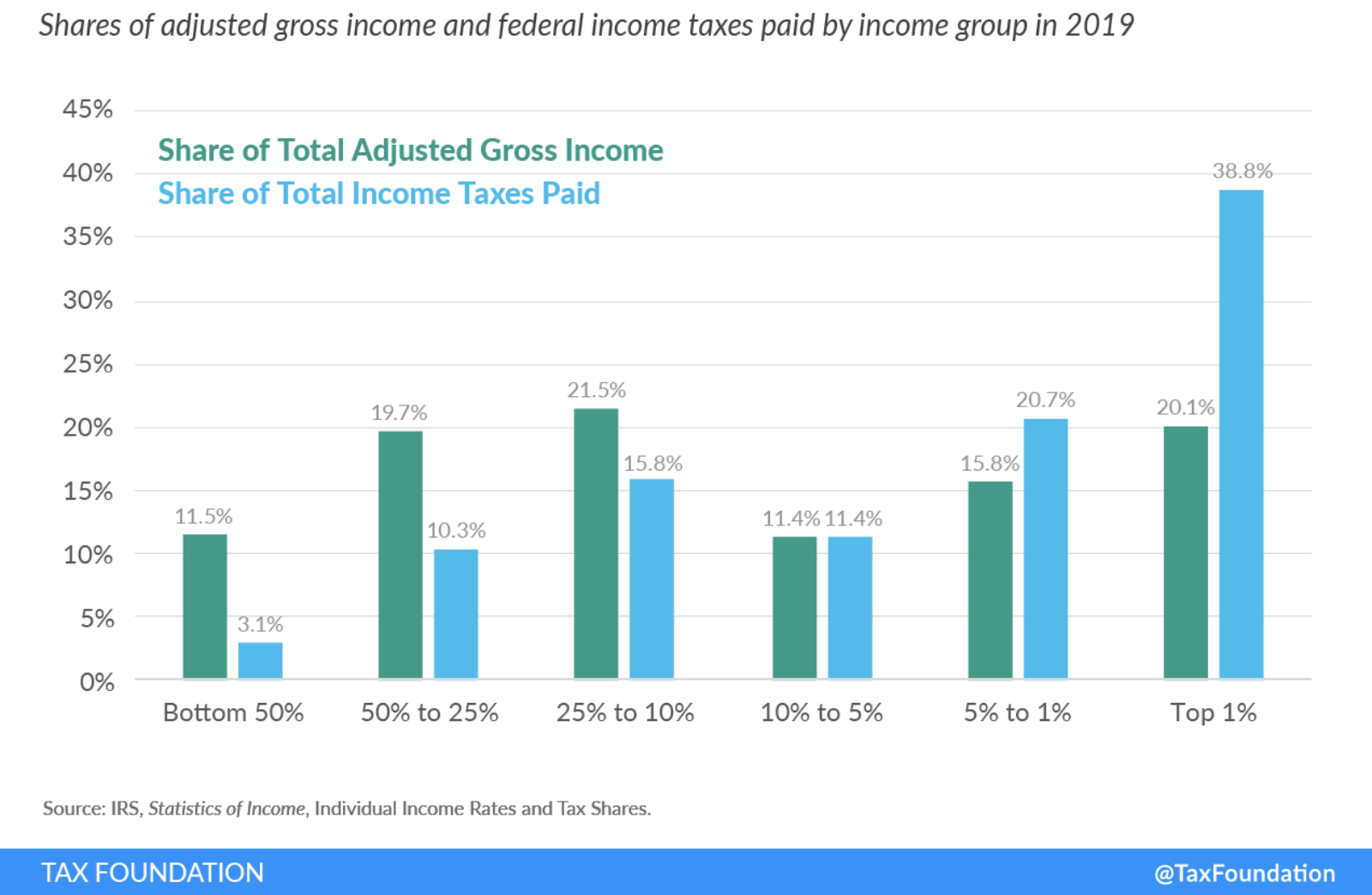

This week is the deadline for millions of U.S. taxpayers to pay their taxes. According to IRS data on income taxes in 2019, U.S. taxpayers paid $1.6 trillion in income taxes — and 96.9% of the taxes were paid by half of American taxpayers. The top one percent — Americans who earn $546,434 or more — earned one-fifth of all total adjusted gross income and paid 38.8% of all federal income taxes.

The share of income taxes paid by the high-income earners (the 1%) has increased over time. From 2001 to 2019, the 1% share rose from 33% to 38.8%. Over the same time period, their share of adjusted gross income also increased, from 17.4% to 20.1%.

The top 50% of taxpayers paid 97% of all income taxes, while the bottom 50% paid the remaining 3%. The bottom half of taxpayers — who earn below $44,269 a year — paid 3%, or slightly over $48 billion, of all federal individual income taxes. Their share of reported income decreased from 2001 to 2019, from 14.4% to 11.5%.