How to Determine When It’s Safe to Fly and What to Expect

Source: Oliver Wyman

Net bookings are down 99.5% year over year, and booked revenue is 103% lower in the U.S. airline industry, according to Forbes. The government and airline industry will need to reassure travelers with transparency about how they are measuring and responding to the risk caused by coronavirus.

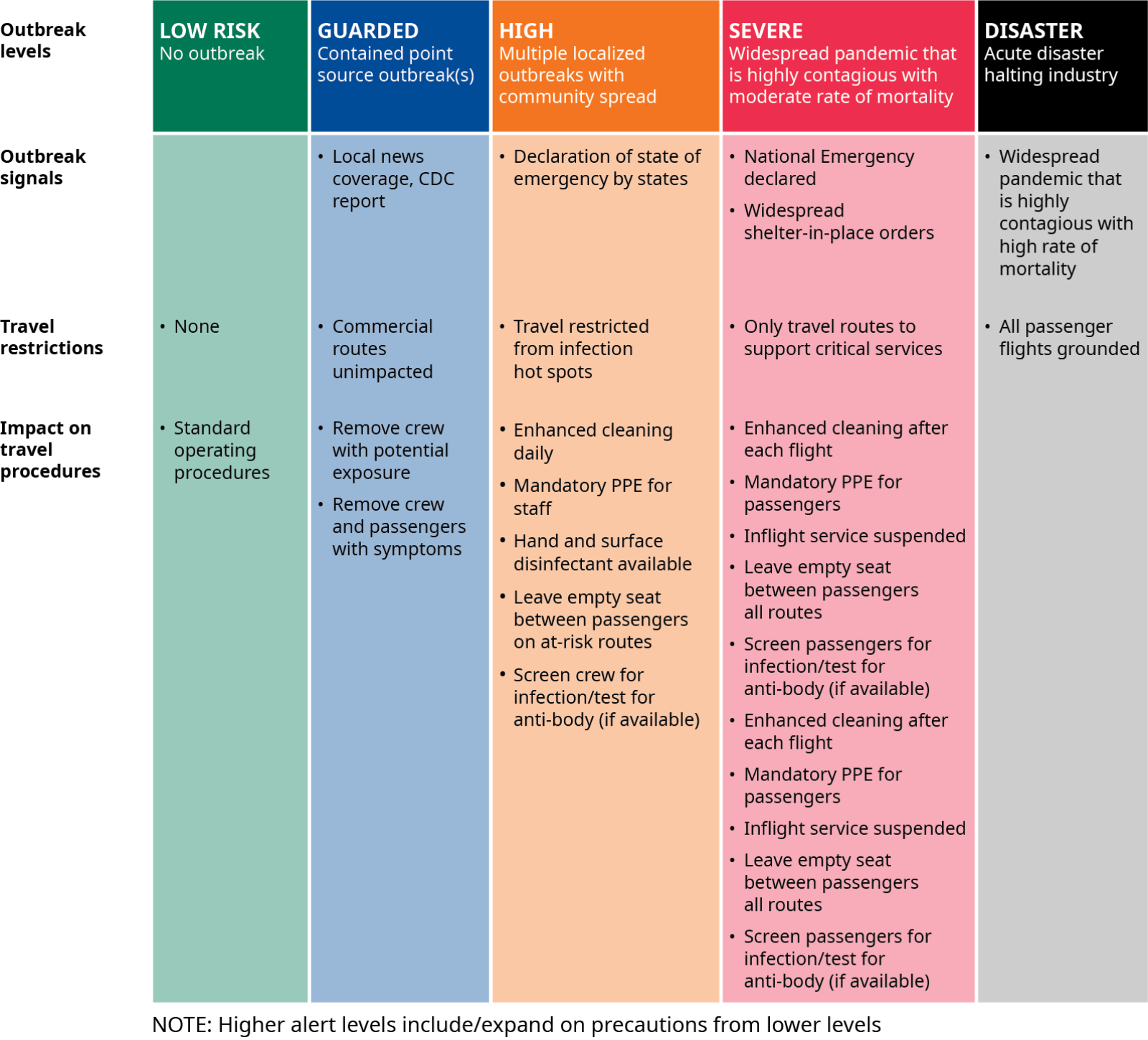

Establishing a threat-level assessment, as well as enforcing a safety roadmap for airlines to follow, is a starting point in building the confidence for travelers during the pandemic. Oliver Wyman has proposed a five-level color-coded threat assessment, like the one above, as a potential framework for governments and the aviation industry to code the pandemic threat level. With insight into how the industry is classifying risk, travelers can make informed decisions about when to travel and prepare for any new airport processes in place to detect and contain COVID-19.

Long-term impacts to the industry are expected: An analysis by IATA in May states that it doesn’t expect worldwide passenger demand to surpass 2019 levels until 2023. “Making the public feel safe is also important for the broader economy,” the Forbes article notes, as “a revival in air travel, most likely accompanied by a return of business travel, tourism, and hotel stays, would mean the economy is coming back.”