How Will the Recession Affect Holiday Spending?

Source: Consumer Confidence Survey, Nielsen

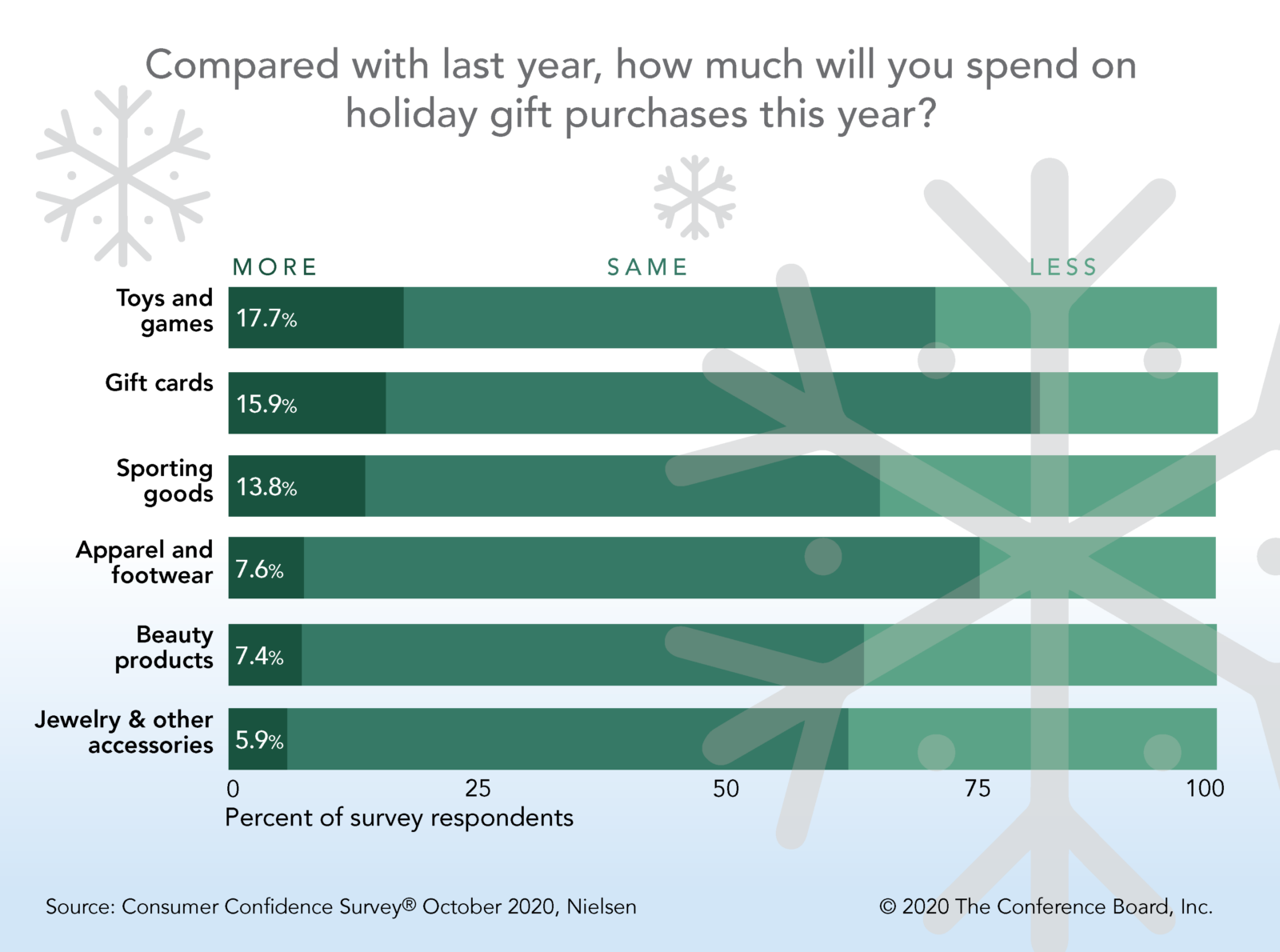

U.S. consumers plan to spend the same amount this year on holiday gifts as they did in 2019, despite the current economic recession, according to a survey by Nielsen for The Conference Board. Not surprisingly, respondents say they’ll spend more on toys and games, as they look for ways to stay entertained under stay-at-home orders.

The retail industry is preparing for pandemic-related changes to shopping behaviors, such as a longer holiday shopping season, increased e-commerce and reliance on shipping, and a drop in in-store holiday traffic. In fact, predictions indicate that online shopping will grow by 25% to 35% this holiday season.

The holiday season could help boost the economy in the final months of 2020, as retail accounts for 68% of GDP. Even though the country is struggling with low consumer confidence and high unemployment rates, shoppers are expected to spend $673 — just under the $675 household spending average from 2019.