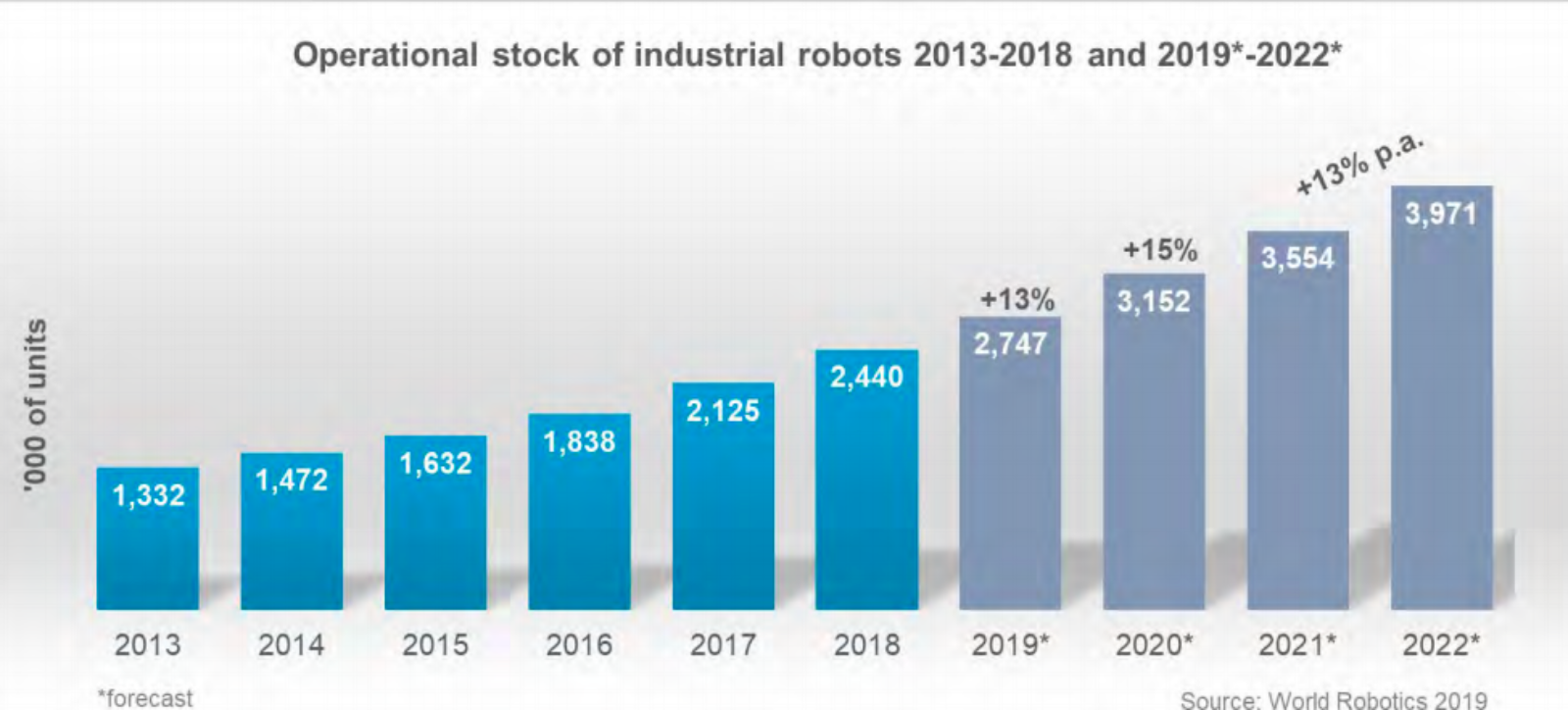

More Than 4 Million Robots Will Be in Industrial Operation by 2022

Source: IFR World Robotics 2019

Robots are flooding the world’s logistics and supply sector, with more than 4 million robots set to be in industrial operation come 2022. As shown above, Asia — and to be more precise, China — is dominating shipments of robotics, with the region witnessing consistent growth in the use of robotics over the past decade compared to America and Europe.

The slowed demand for manufacturing robots in the United States “may suggest it has hit a saturation point,” writes Ryan LaRanger of PreScouter. Meanwhile China, still the world’s main manufacturing hub, is increasingly turning to robotics to improve its production. As of 2018, China had 140 robots in the manufacturing industry per 10,000 employees — well above the global average of 99 robots.

As advances in robotic technology continue, LaRanger contends, additional industries, such as health care and construction, will open up to “robotic labor.” Training workers “to adopt new technologies into their already existing practice,” he suggests, is essential to ensuring a seamless interaction between human employees and technology, without the need for expensive retraining.