Organizations Recognize Risks Posed By Supply Chains — but Don’t See that Risk in Reverse

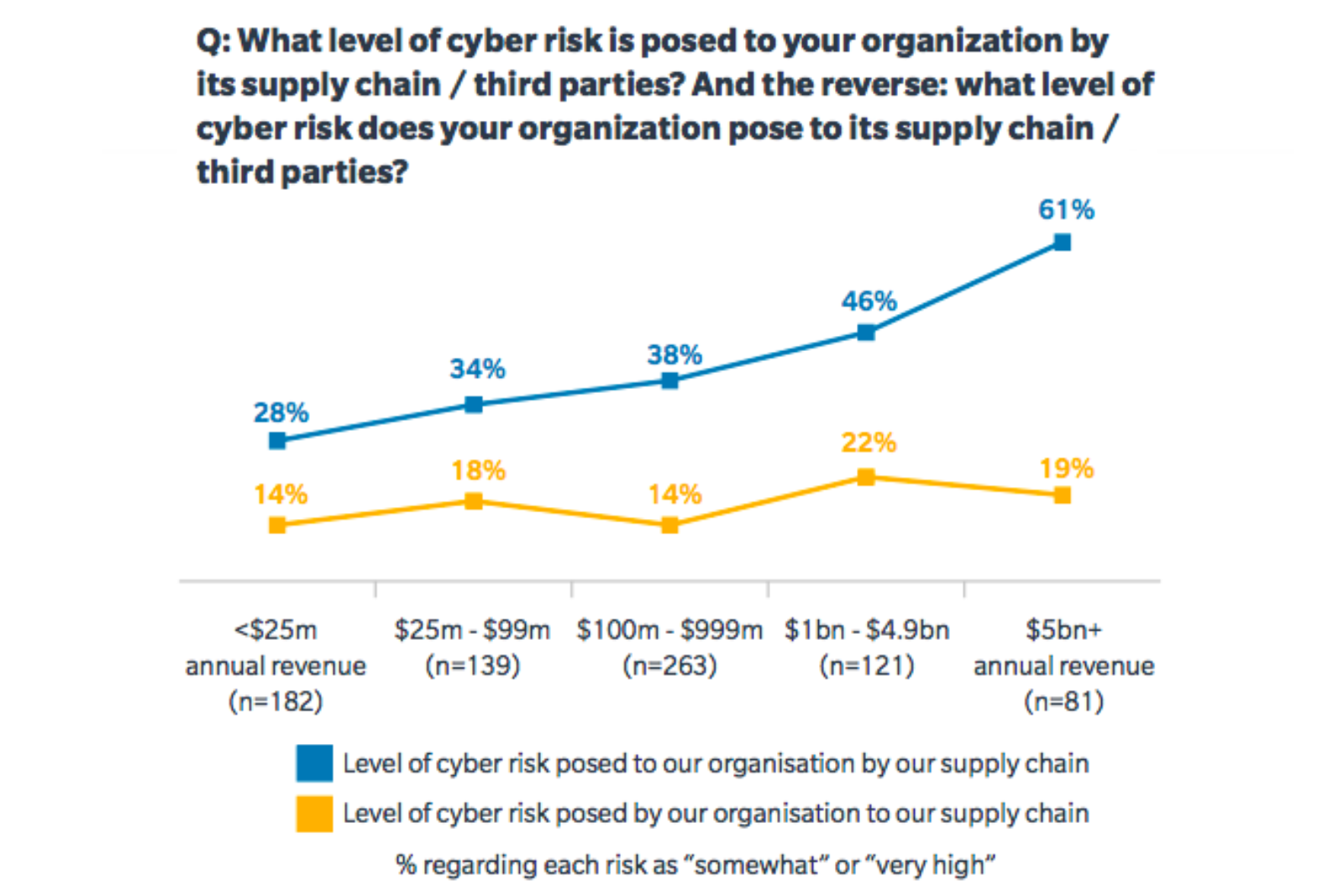

Organizations are cognizant of and concerned about cybersecurity risks posed to them by their supply chain. However, according to a new survey, they are much less concerned about the risks they may pose to the third parties they work with. This is especially true for larger organizations.

“This is a perception gap that many organizations, especially large ones, need to address in order to effectively protect their supply chain ecosystem — embracing their own technological social responsibilities,” write the authors of the 2019 Global Cyber Risk Perception Survey from Marsh and Microsoft. “Every organization needs to understand, have confidence in, and play a role in the integrity and security of the components and software of its digital supply chains.”