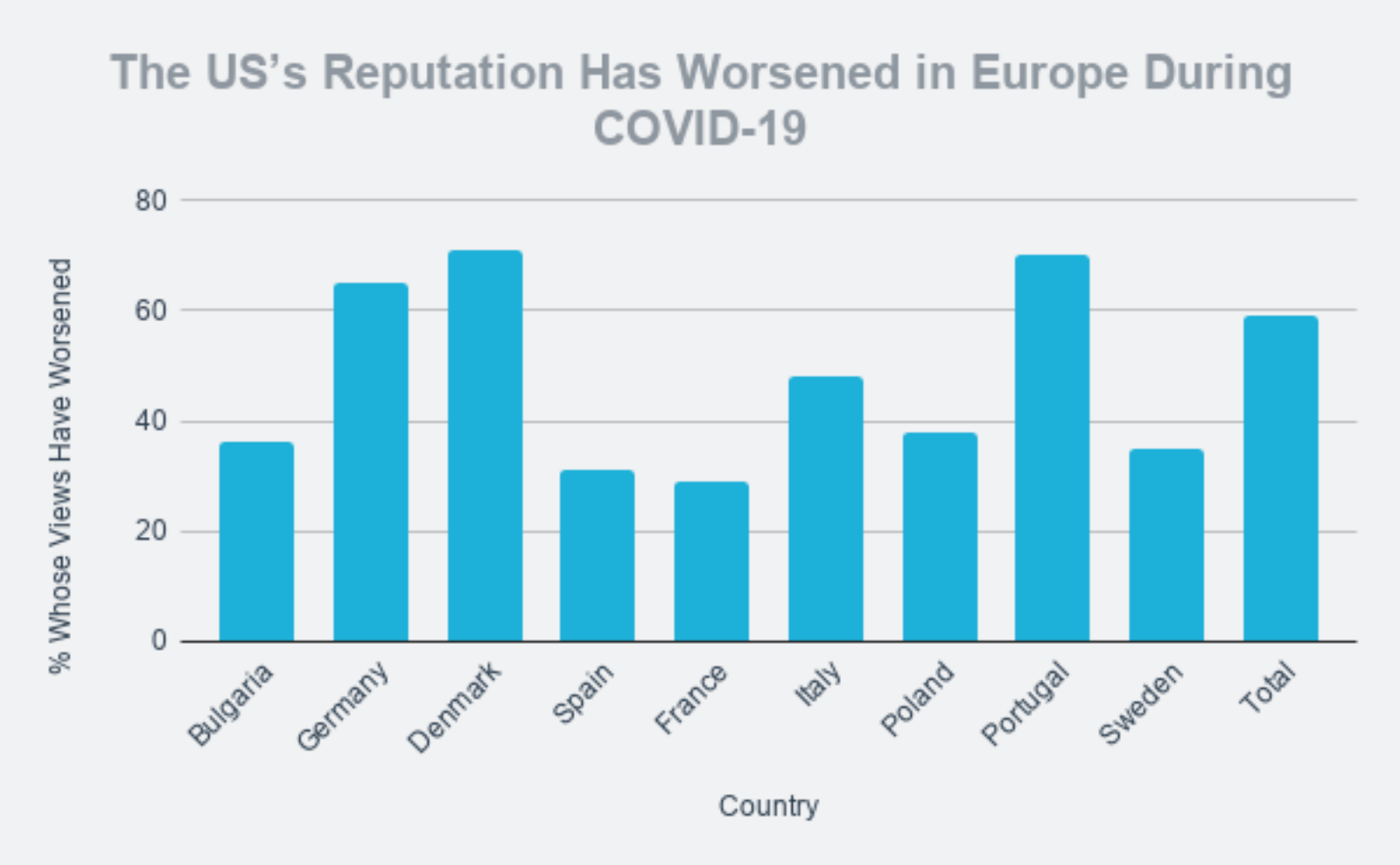

Over Half of Europeans View the US Less Favorably Than Before COVID-19

Source: European Council on Foreign Relations

The U.S. is viewed more negatively now compared to before the coronavirus crisis in the eyes of nearly 60% of Europeans. Over 70% of Danes and Portuguese respondents and 65% of Germans say their views of the U.S. have worsened — with views on China showing similar trends, according to a poll conducted by the European Council on Foreign Relations (ECFR) in June 2020.

The ECFR surveyed over 11,000 citizens in nine countries across Europe. The respondents said if cases continue to rise in the U.S., “many Europeans could come to see the U.S. as a broken hegemon that cannot be entrusted with the defense of the Western world.”

The EU is currently seeing an overall decline in COVID-19 cases, while this trend is only being recorded in two states in the U.S. The EU is preparing to open its borders, but most American travelers are expected to be banned, along with those from Brazil and Russia.