Qatar Moves to Take Over Natural Gas Market

Source: The Economist/McKinsey

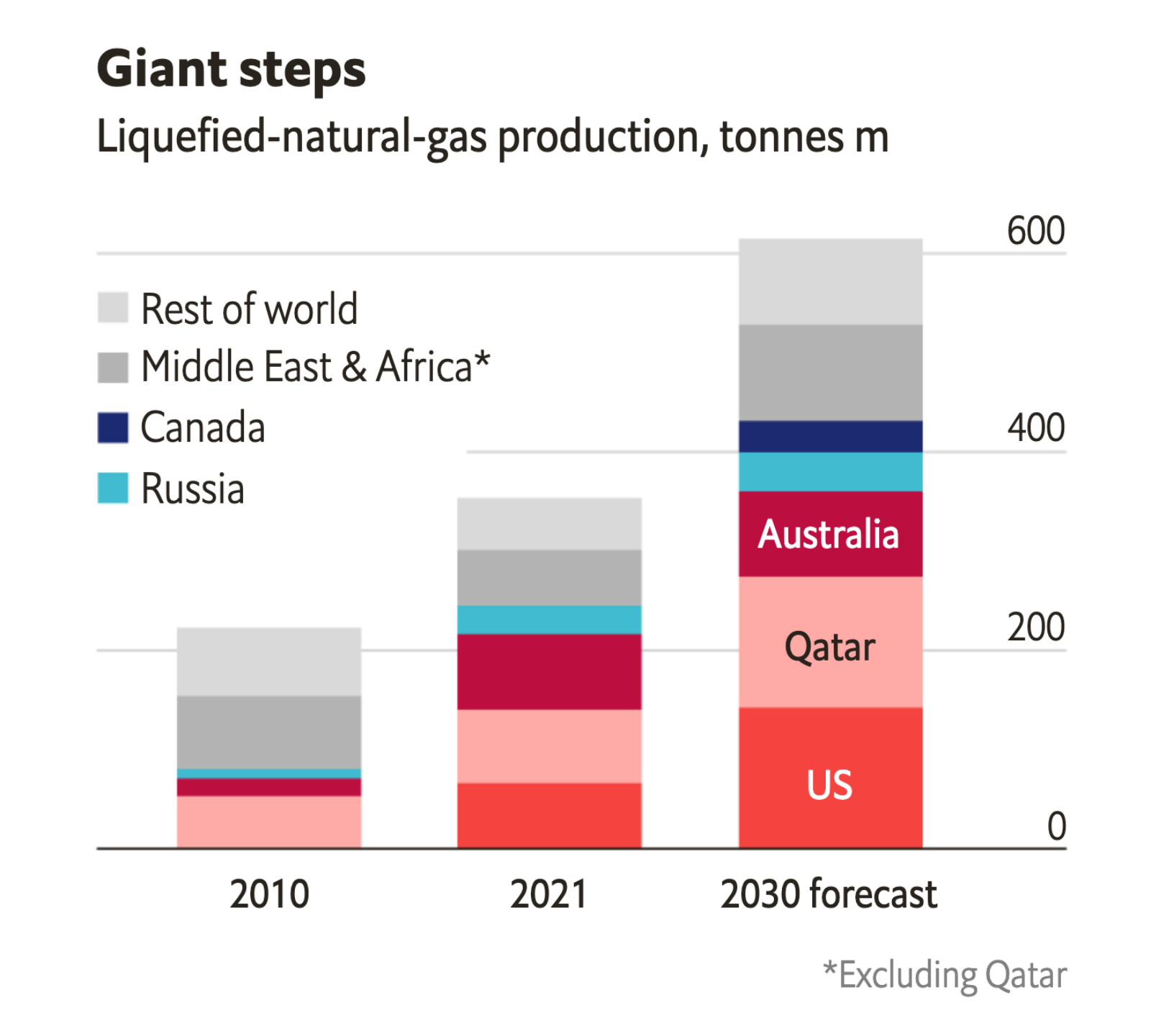

The crisis in Ukraine is re-ordering the world’s energy market, as Western countries look for natural gas in the Middle East instead of Russia. Europe, in particular, is looking for new sources of energy. Europe was the largest importer of Russian gas before the Ukraine conflict — it accounted for 76% of Russian natural gas exports last year. Now those exports are going to Asia, including countries like India and China.

As winter grows increasingly cold and heating bills hit record highs, the EU is relying on imports of liquified natural gas (LNG) from the U.S., Qatar and Nigeria. The U.S. almost doubled its export volume of LNG to the EU, compared to last year. Qatar is prepared to expand LNG production — the $30 billion North Field Expansion will tap one of the world’s largest natural gas fields in the Persian Gulf. The project is designed to increase Qatar’s natural gas production from 77 million tons per year to 110 million tons per year in 2026.

In the long term, Qatar plans to produce 126 million tons per year by 2027, or one-third of the global LNG market. But those exports are not necessarily bound for Europe. Qatar has signed partnerships with companies in China, India, Japan and South Korea — as well as five of the West’s largest oil and gas companies.