Racial Wealth Divide Rises in Housing Market—Especially During COVID-19

Source: Brookings Institute

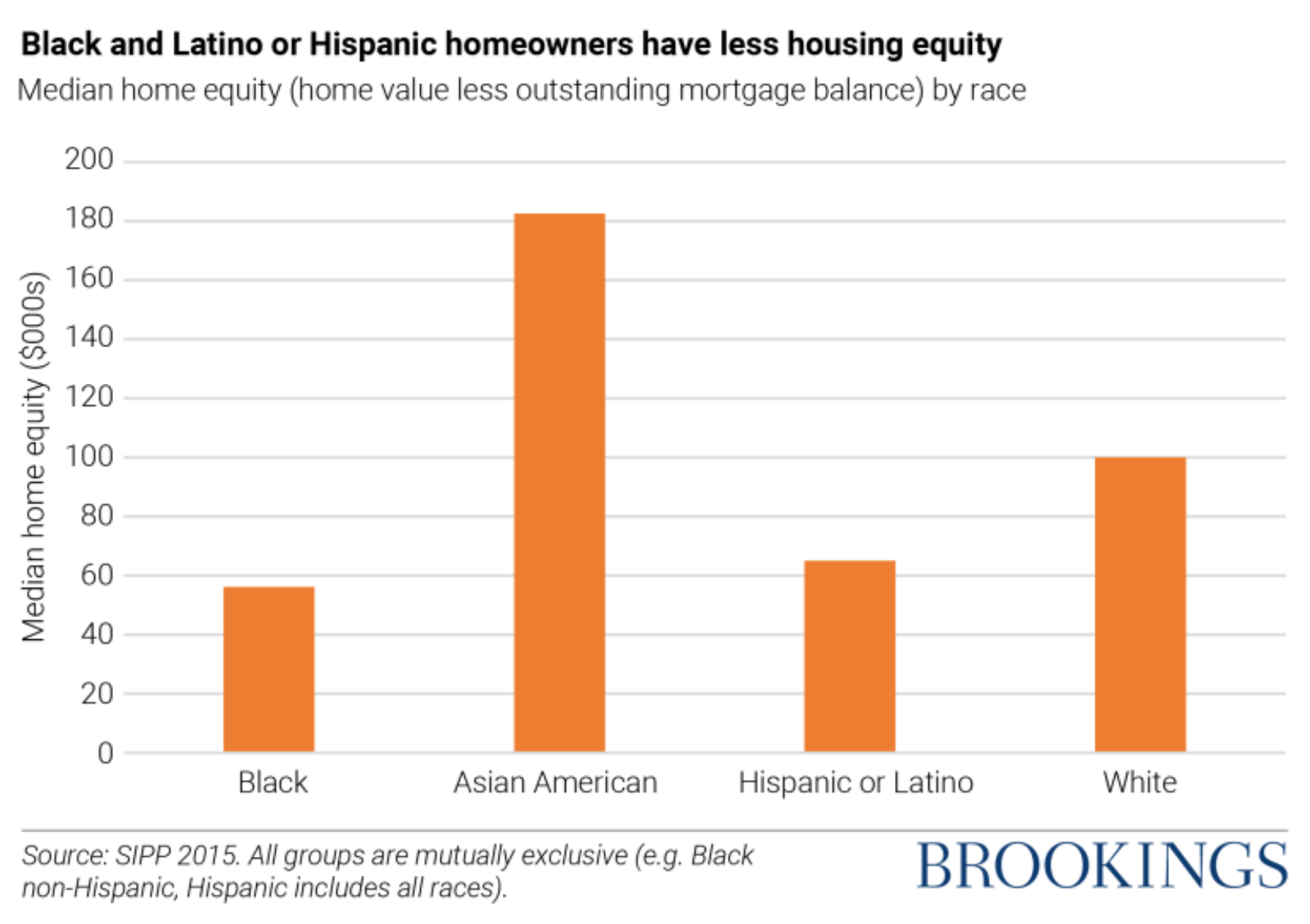

The U.S. racial wealth gap in housing is larger today than it was in 1934, with COVID-19 exacerbating long-existing household financial insecurity. Even when they have similar incomes, Black and Latino families are less likely to purchase a house than white families, according to the Brookings Institution. At the beginning of 2020, 44% of Black families owned their house, compared to 73.7% of white families.

Racial discrimination in the housing market was outlawed by the Fair Housing Act of 1968, but it continues to prevent people and families of color from becoming homeowners. Brookings Institute states that current homeownership subsidies are the main driver for this racial divide — particularly in mortgage lending. As of 2019, “the median white family has eight times the wealth of the median Black family.”

Homeownership remains one of the most common ways families can build their wealth in the U.S., especially for middle-class families. To eliminate racial discrimination in the housing market, the government can support first-time homebuyers by enforcing federal tax policies that are more balanced. The new U.S. administration plans to tackle affordable housing and anti-discrimination policies with a $640 billion, 10-year plan.