Rise in Carbon Emissions Brings Concern Over Building Sector’s Carbon Footprint

Source: The Global Status Report for Buildings and Construction (5th edition)

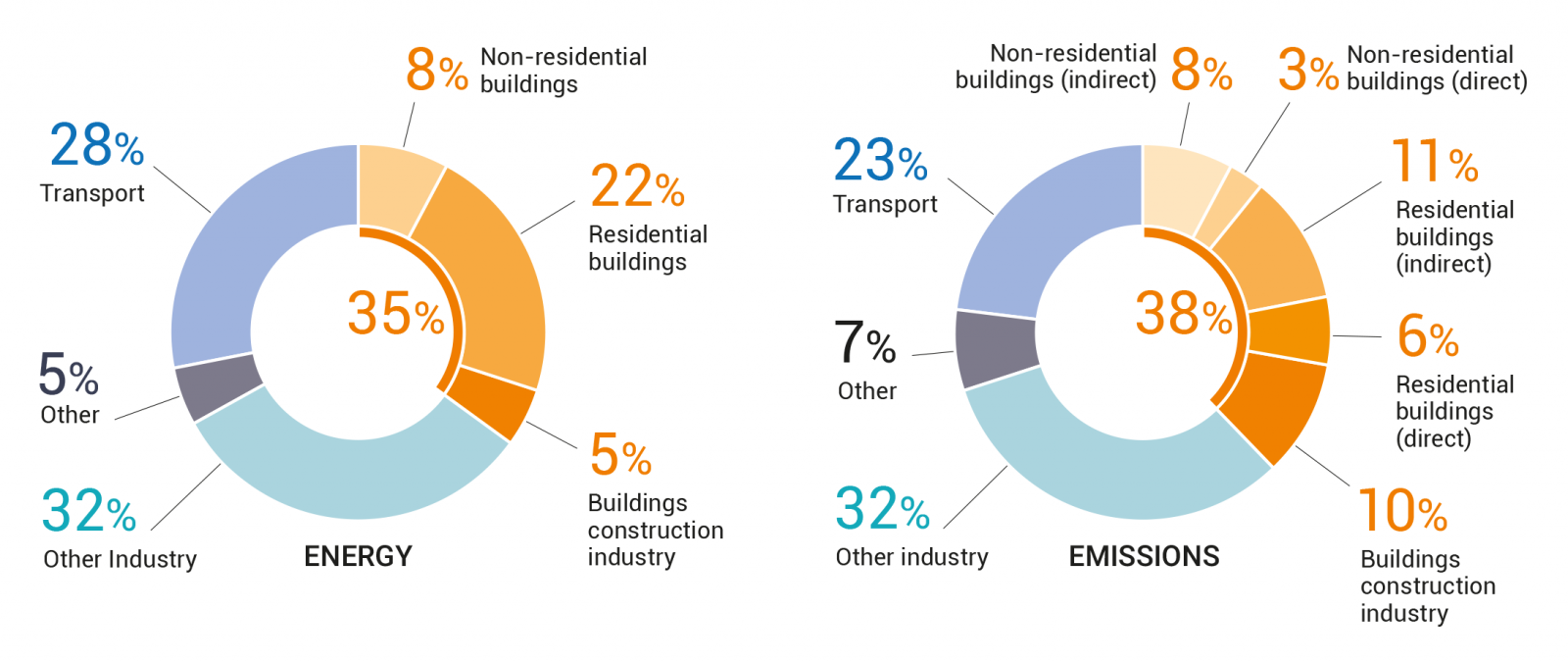

The operation of global buildings reached their highest-ever carbon emissions level in 2019 at 28% of total global energy-related carbon dioxide emissions, pushing the sector further away from achieving its Paris Agreement goals. That number jumps to 38% when emissions from building construction is accounted for, according to this year’s Global Status Report for Buildings and Construction.

This year’s report highlights the disruptions from COVID-19 in the building and construction sectors, as well as introduces a new index to track the progress of climate initiatives. The pandemic slowed global construction activity, which led to a drop in global energy demand and carbon dioxide emissions — 5% and 7%, respectively.

But COVID-19 also grew interest in and the market for “green” buildings as governments and key players in the buildings and construction sector plan for a post-COVID green recovery. However, these commitments and initiatives will need to rapidly increase in scale to get on track for a net-zero carbon building plan by 2050.