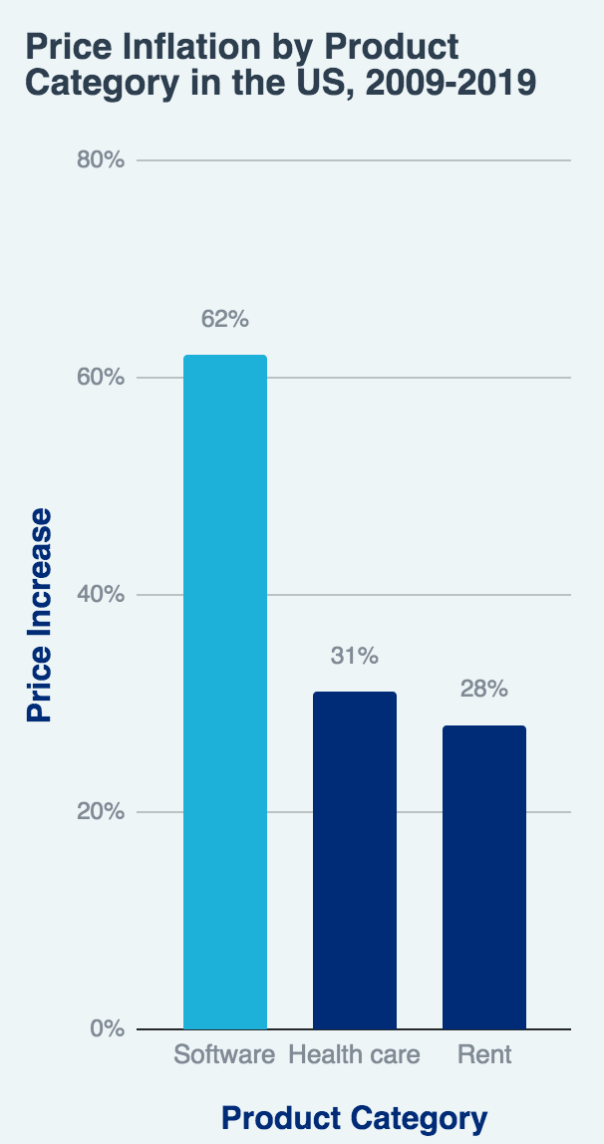

Software Prices Are Increasing Faster than Health Care and Rent Prices

Over the past decade, the rate of increase in software prices surpassed the rate of increase in both rent and health care prices, according to a recent analysis by the software pricing transparency initiative, Capiche.

“Of the hundred business apps we surveyed, prices went up an average of 62% — and that’s including apps that cost the same or got cheaper,” writes Matthew Guay, founding editor at Capiche. “If you’re paying for an app that got more expensive, there’s a strong chance it’s 98% more expensive today than it was a decade ago.” By comparison, health care costs increased by 31%; rent prices grew by 28%.

In particular, HR and CRM apps increased the most in pricing, by 259% and 119%, respectively. The only category of software that decreased in price was video calling, where prices decreased by 19%. Capiche’s data is available to read in a public Google Sheets document.