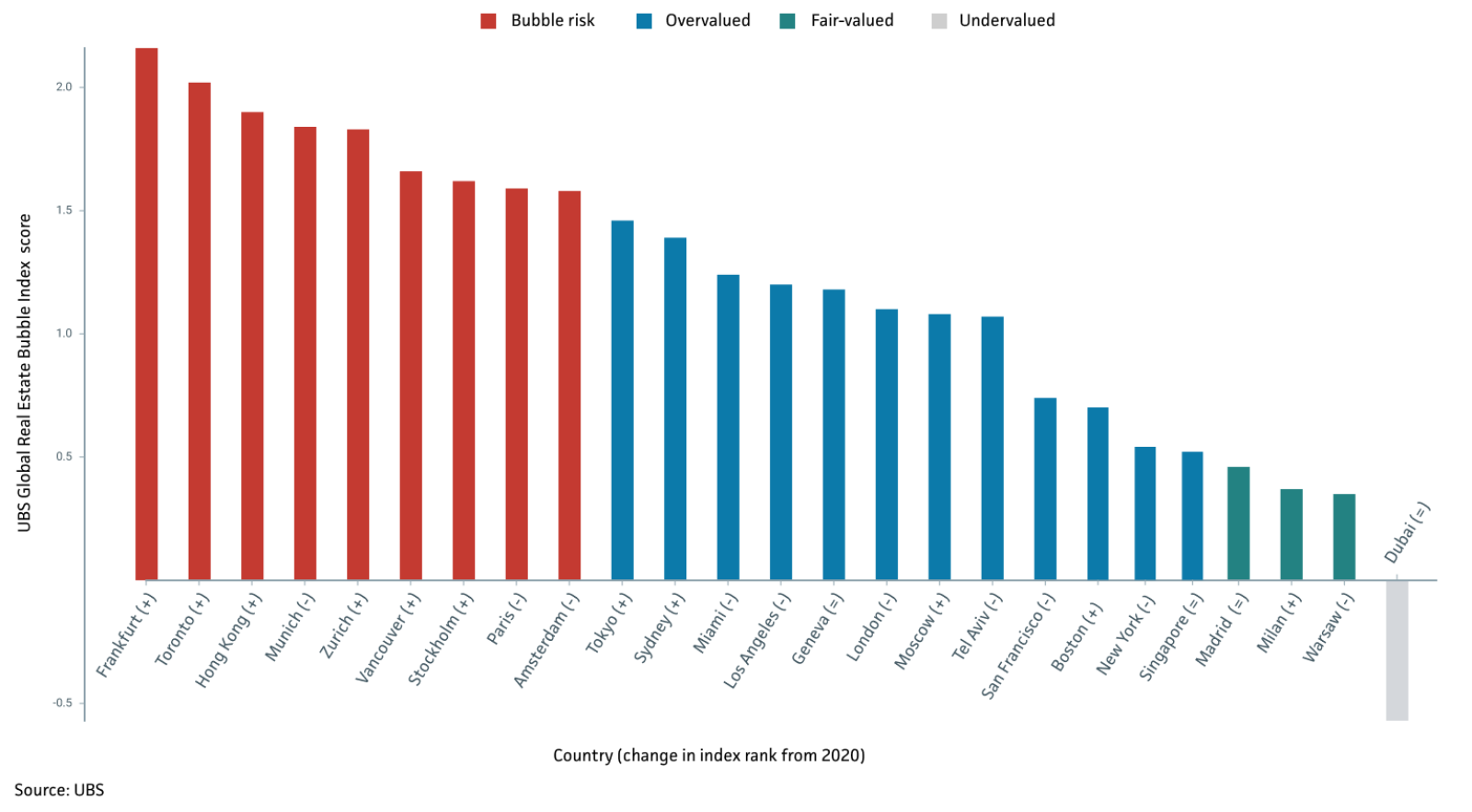

The Global Cities Most At Risk of a Housing Bubble

Frankfurt, Toronto and Hong Kong are the cities most at risk of a housing bubble, according to new research by Switzerland-based UBS. Its latest Global Real Estate Bubble Index found nine cities around the world that have a high index score. Meanwhile, Madrid, Milan and Warsaw are deemed to be cities with “fairly valued” housing, and Dubai has a negative index score, indicating that its housing is undervalued.

Overall, bubble risk has increased, along with the potential severity of a price correction, as a result of rising house prices across the world. UBS has found that growth in home prices increased 6% from mid-year 2020 to mid-year 2021 — the highest rate of growth since 2014.

To determine a city’s index score, UBS tracks whether a city shows symptoms of previous real estate bubbles, such as a decoupling of prices from local incomes and rents, and imbalances in the real economy, such as excessive lending and construction activity. In Frankfurt, for example, housing prices have increased steadily every year since 2016, in part due to a focus on building luxury housing, but the average price-to-income ratio has doubled in the last decade, leaving housing unaffordable for many. These trends point to a possible correction if the housing bubble were to burst.