The Cost of Cybercrime Outweighs Investment in Cybersecurity

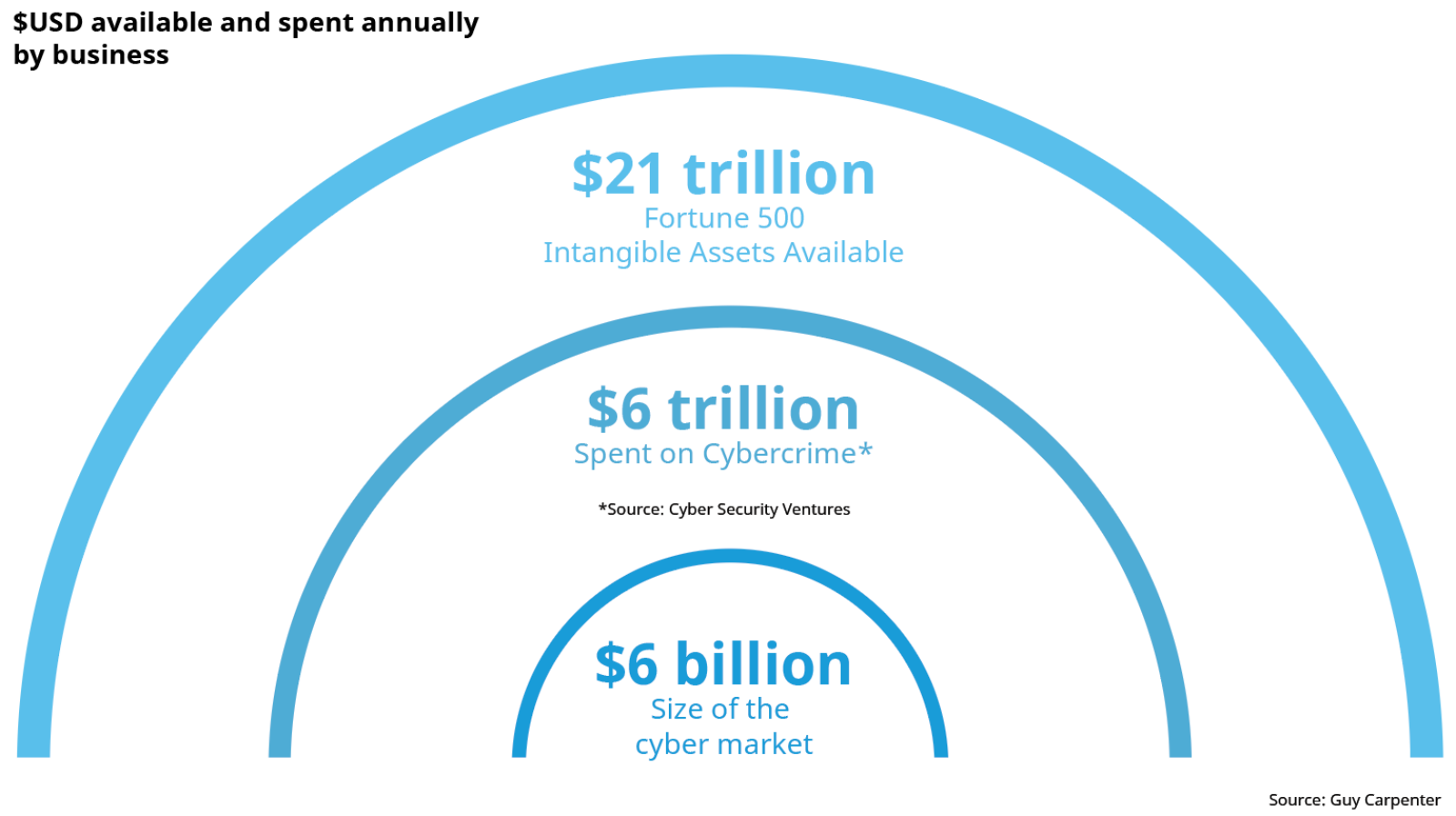

Guy Carpenter research shows that the size of the cyber market is $6 billion, and, according to Cybersecurity Ventures, only $6 trillion is spent on cybersecurity products per year. Only 42% of businesses invest in a cyber product, according to Marsh Specialty data.

This gap between spending and forecasted cost puts the almost $21 trillion in intangible assets of the Fortune 500 at risk.

These drastic costs are a result of more sophisticated and accessible forms of ransomware that are now available “off the shelf” to bad actors. At the same time, the “new normal” from the pandemic continues to foster distributed work environments that are often easier to penetrate.

A cohesive cyber strategy, as featured in MMC’s Cyber Handbook 2022, is critical to keep pace with sophisticated cyberattacks in complex and converging technology ecosystems. There is also a need for cyber insurance and reinsurance to help solve this expanding protection gap by developing a robust cyber risk transfer market with well-defined product options for intangible risk.