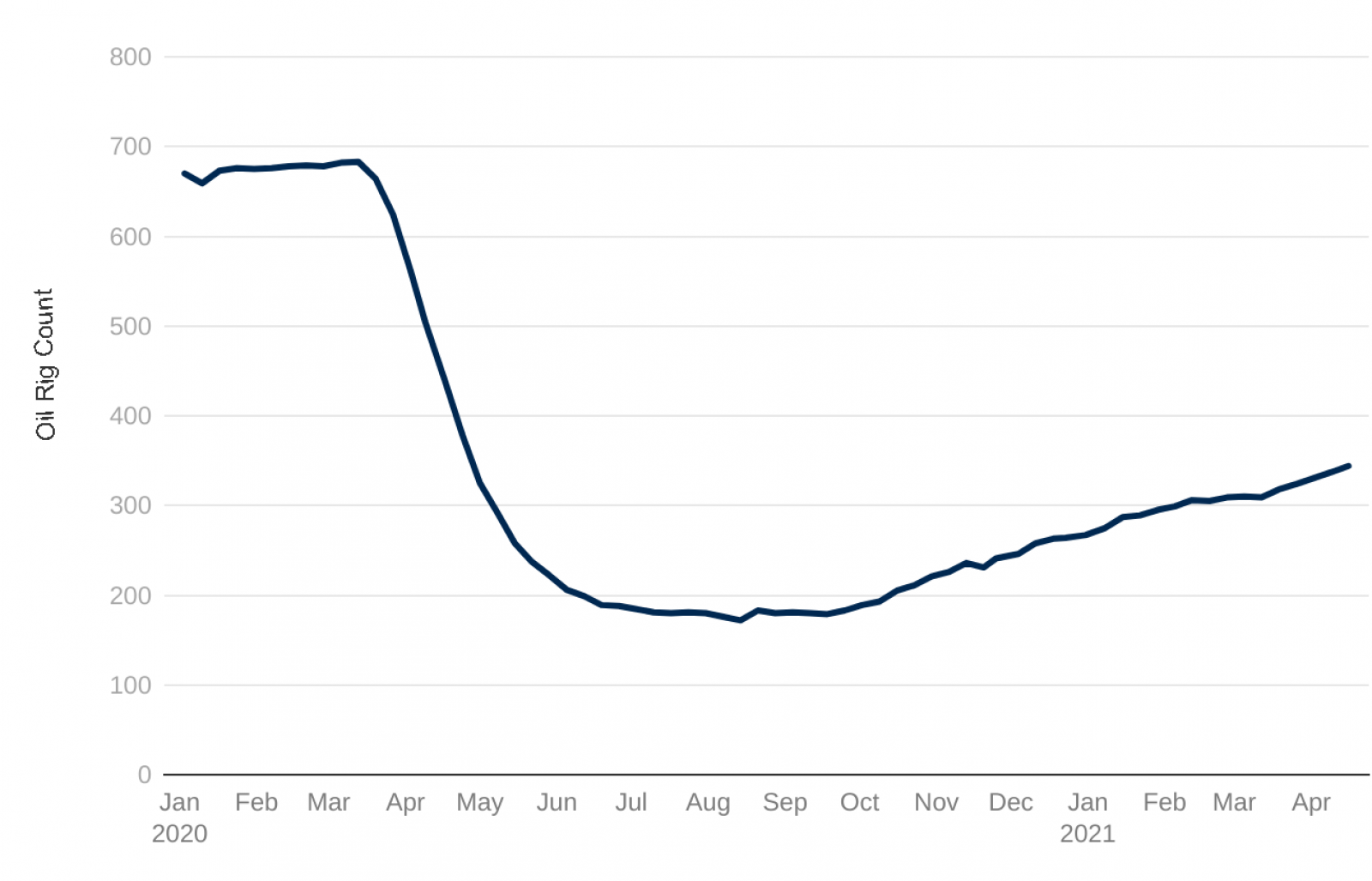

The Number of Active Oil Rigs Is Growing

Source: Baker Hughes; World Bank

The active oil and gas rig count has doubled from its lowest point of 172 in August 2020 to 344, according to the World Bank. Both the demand for oil and OPEC+ production are gradually returning to pre-pandemic levels. The World Bank predicts that crude oil prices will average $56 per barrel in 2021 and $60 per barrel in 2022.

The industry’s upward trajectory experienced a speed bump in early May when a major U.S. fuel pipeline operator halted operations following a cyberattack, resulting in supply shortages. The pipeline resumed operations less than a week later, but higher gas prices remain. While the industry has weathered numerous fluctuations in the market over the past decade, the World Bank states that “the U.S. shale industry has repeatedly proved more innovative and resilient to price collapses than expected.” It adds that the growth of oil prices will ultimately be determined by how successfully COVID-19 is contained, therefore rebooting travel and tourism.