Public Support Grows for Big Tech Regulation in US

Source: Gallup

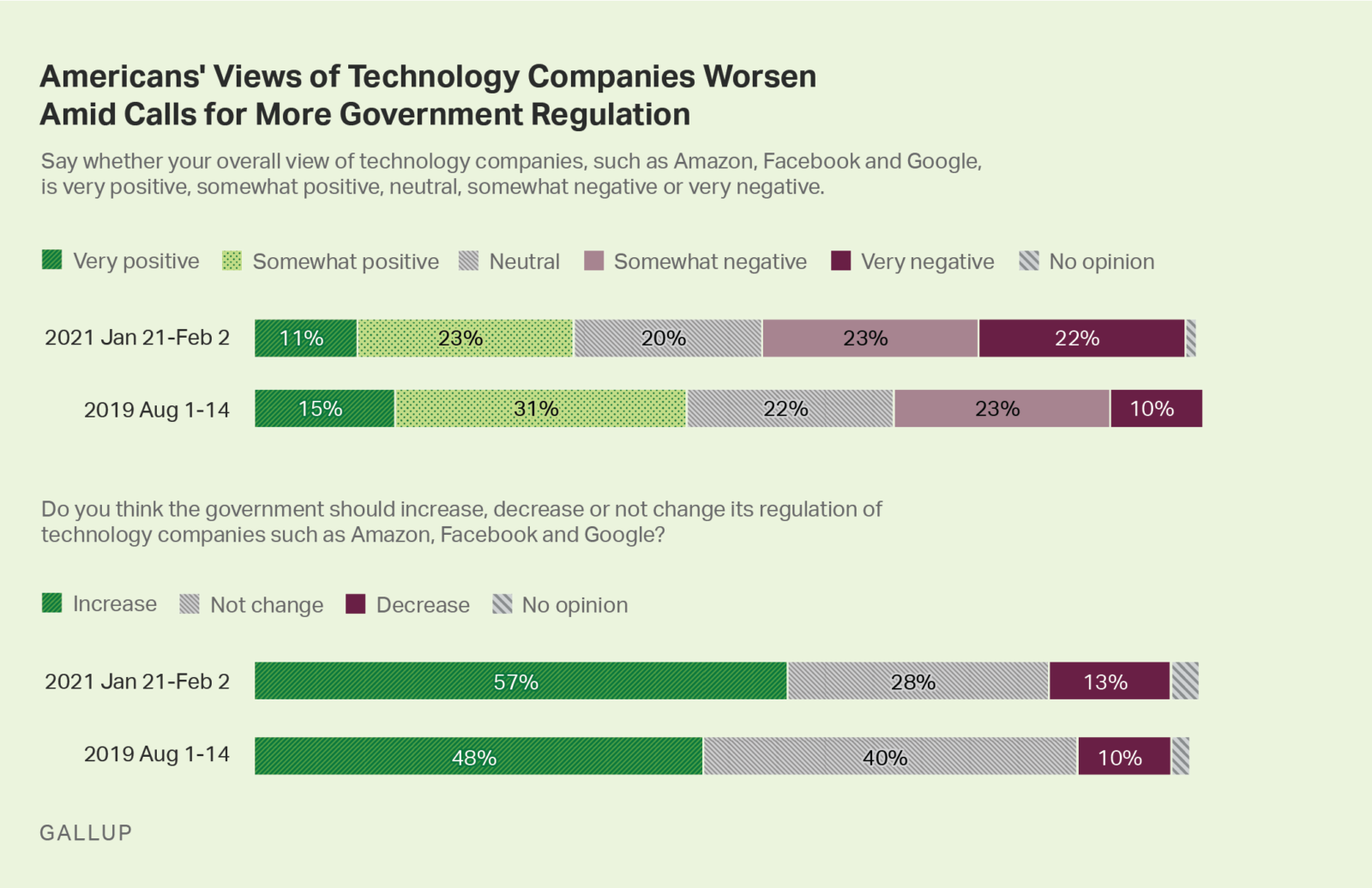

Support for an increase in government regulation for big tech companies rose from 48% to 57% across all political party lines between August 2019 and January 2021.

Forty-five percent of U.S. adults surveyed by Gallup now have very or somewhat negative opinions of large technology corporations — a 12% increase since August 2019. Thirty-four percent of Americans have a very or somewhat positive opinion of these companies, while 20% remain neutral, according to a recent Gallup poll.

Respondents expressed concern regarding “the spread of misinformation on the internet, the size and power of large technology companies, online hate speech, foreign interference in U.S. elections and the privacy of personal data online.” Many of these technology firms have escalated their efforts to flag and remove misinformation from spreading across their platforms, especially during the U.S. presidential election and the COVID-19 pandemic. But they continue to face scrutiny from the federal government, as it tries “to modernize the antitrust laws.”