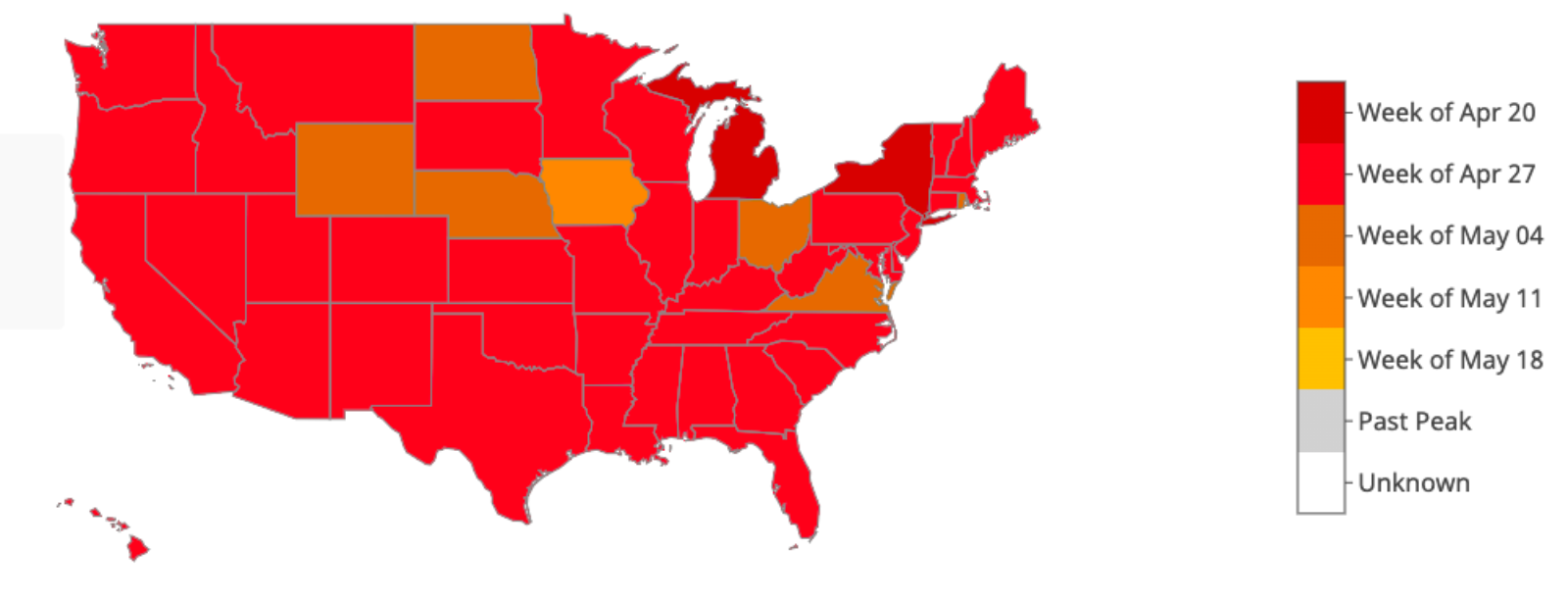

Most US States Expected to Hit their Coronavirus Peak in May

Source: Oliver Wyman, COVID-19 Pandemic Navigator

A number of U.S. states have declared they’ll proceed with a lifting of restrictions on non-essential businesses this week, despite not having hit the expected peak number of coronavirus cases.

Georgia is leading a number of southern states in re-opening businesses, but the state won’t hit its peak of confirmed infections until early May, according to Oliver Wyman’s COVID-19 Pandemic Navigator. Ohio, Texas, Tennessee and South Carolina have also discussed easing restrictions and plan to do so before their expected peaks in late-April to early-May.

Oliver Wyman’s Pandemic Navigator is updated regularly with coronavirus infection rate projections for nations across the world, helping public officials and decision-makers plan social distancing measures to combat the virus.