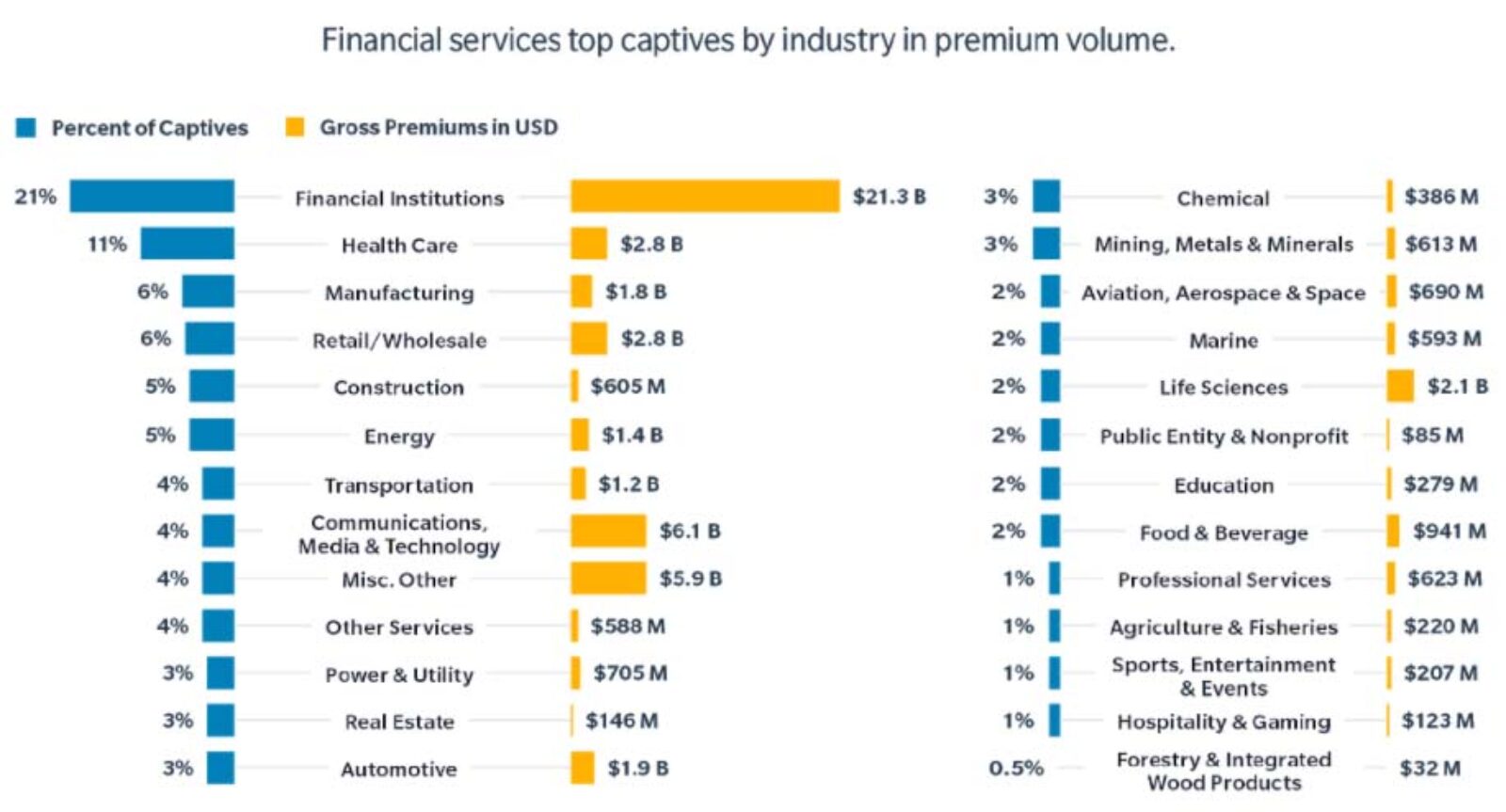

Use of Captive Insurers Expands Across All Sectors

Source: Marsh

The financial services and health care sectors continue to be the biggest users of so-called captives, a wholly owned insurance company. However, many other industries are expanding the use of captives to accommodate the new risks from the COVID-19 pandemic, according to the 2020 Marsh Captive Landscape report.

As a result of the hardening insurance market, the energy, financial, communications and construction sectors saw higher than average “all risk” premium growth. Other industries have expanded their captive use in specific ways. For example, there was a 72% year-over-year increase in product liability premium among manufacturing industry captives, as commercial insurers increasingly require organizations to take higher retention. Excess liability capacity began to shrink in the commercial market and some organizations, particularly in health care, are filling gaps in their excess liability towers by using their captives.

In the past, captives have been an effective tool to help businesses navigate disruptions, and are increasingly seen as alternatives to traditional insurance.