Why Are Central Banks Creating Digital Currencies?

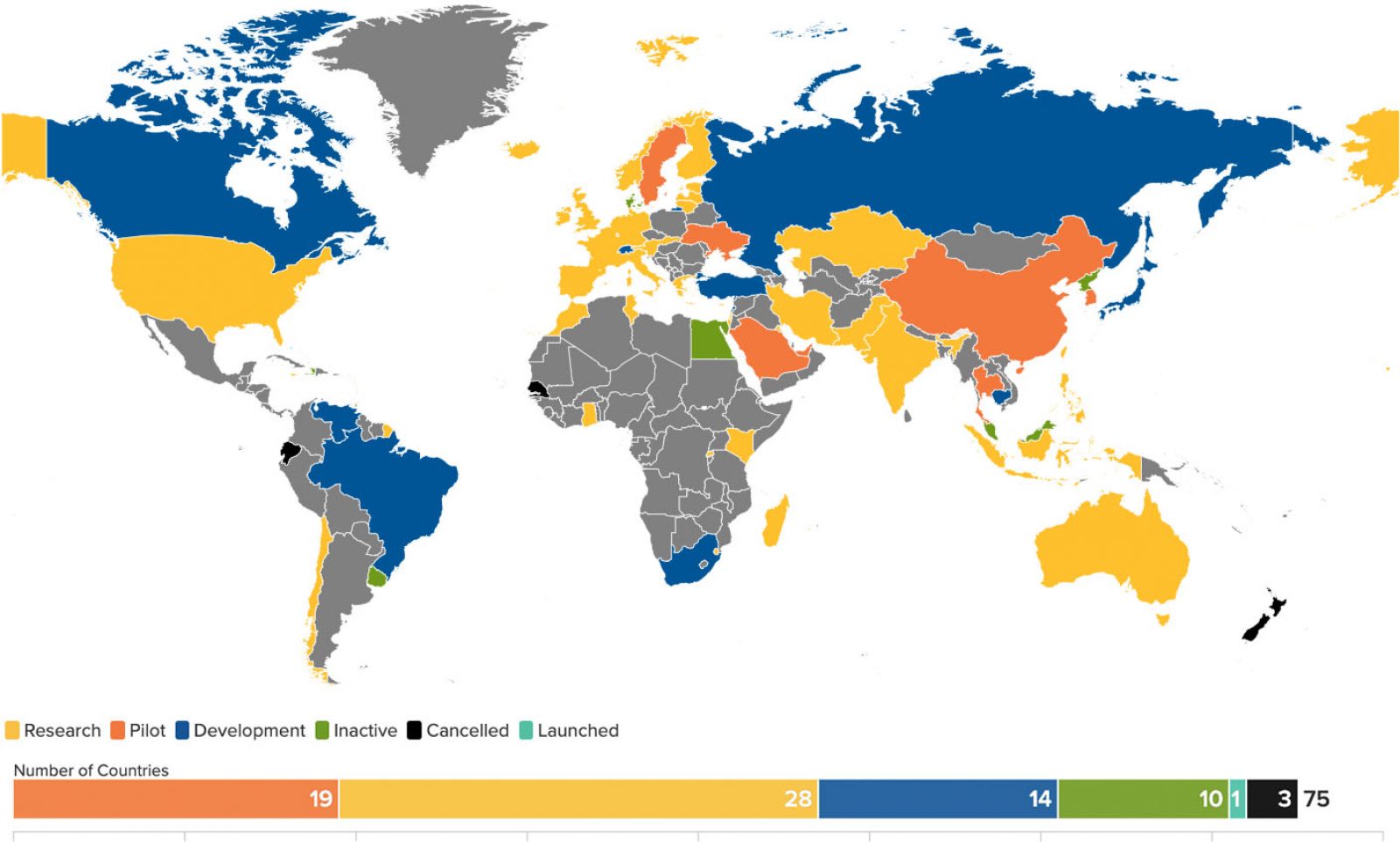

Source: Atlantic Council

Nineteen countries have started to test a central bank digital currency (CBDC) on a small-scale with a limited number of participants. The Atlantic Council defines CBDC as “the digital form of a country’s fiat currency that is also a claim on the central bank.”

As of today, the People’s Bank of China (PBOC) and the European Central Bank (ECB) are prominent players in the digital currency realm. The United States currently lags behind in the research phase, yet the Federal Reserve has expressed continued interest in the digital dollar.

As digital currencies expand globally, there are challenges ahead — the legal, political and regulatory properties of CBDCs remain unclear. But the IMF notes that there are also multiple benefits to having government involvement in digital currencies, including lower cash transfer costs, greater accessibility to banking services and easier implementation of monetary policies.