Why the Number of US Homeowners Grew During COVID-19

Source: Pew Research Center

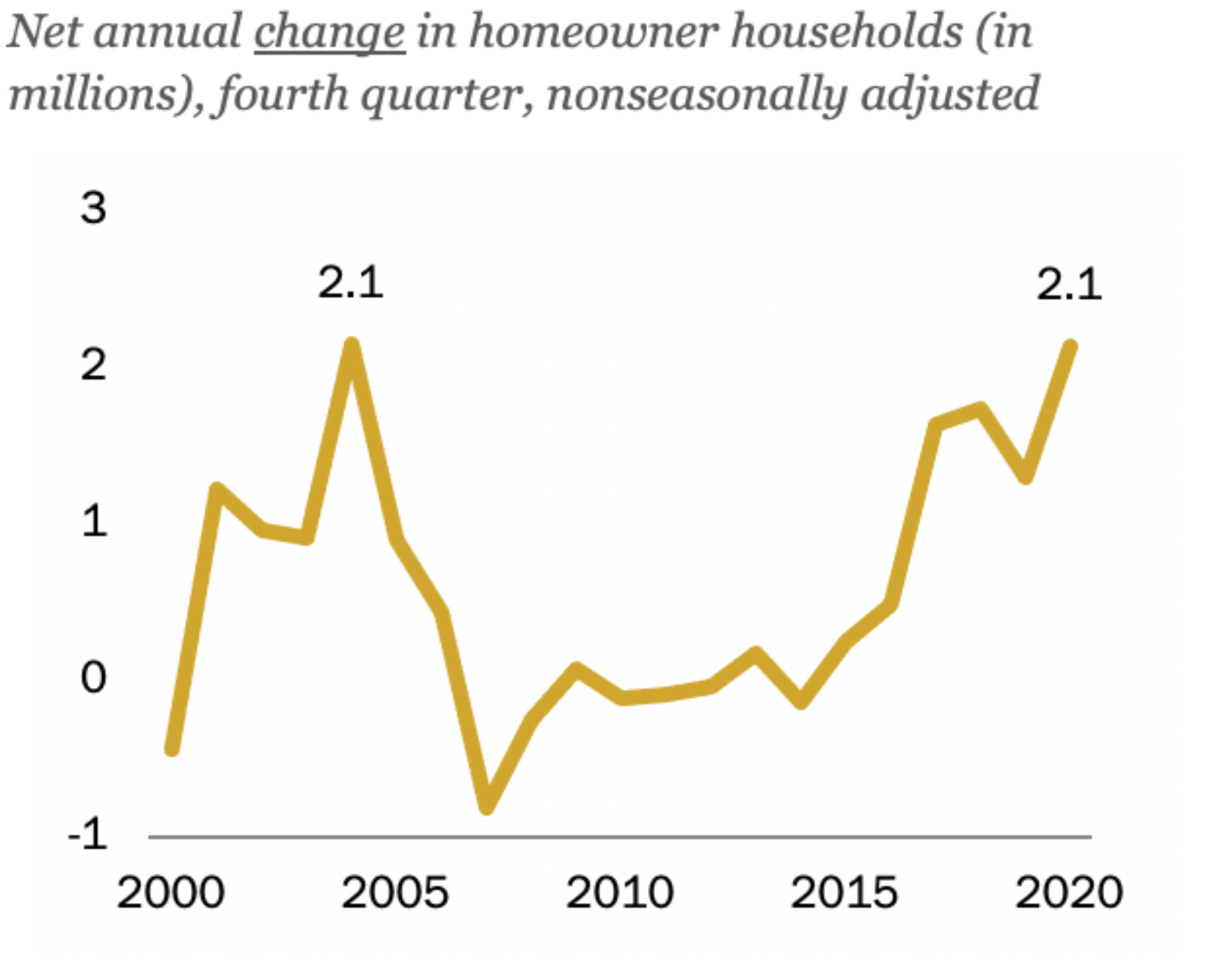

The number of homeowners in the United States grew by 2 million over the last year, reflecting a 2.6% increase. This is the seventh-largest percentage increase in homeowners since 1965, according to Pew Research Center. By the fourth quarter of 2020, there were around 83 million owner-occupied homes in the U.S.

This growth in homeownership, Pew Research Center states, resulted from economic growth and an increasing number of households over time. Although the unemployment rate during COVID-19 skyrocketed, job losses fell heavily on young adults and low-income workers, who are less likely to be potential homebuyers. In 2020, interest rates were at record lows, there was a slowdown in foreclosures and household incomes were at a high before the pandemic — all factors made it easier to enter the housing market. Experts predict that the housing market will remain strong in 2021, driven by low mortgage rates, the vaccine distribution and growing consumer confidence.