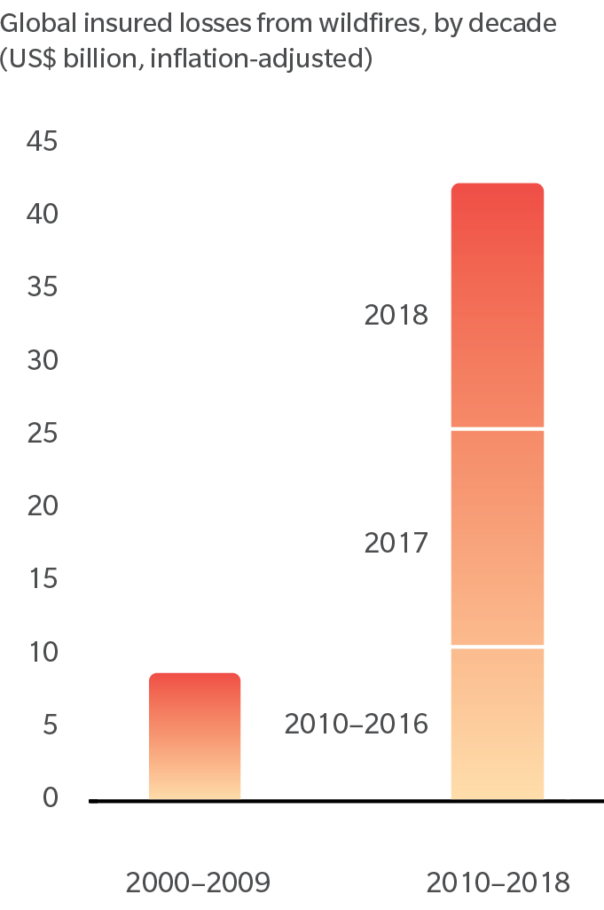

Wildfire Costs Soared for Insurers in 2017 and 2018

Within the past few years, the costs of insured losses due to wildfires have ballooned. Between 2010 and 2016, wildfires cost insurers a little over $1 billion per year. In 2017 and 2018, that figure jumped to more than $15 billion. “This is well beyond the bounds of historical variability,” caution the authors of The Burning Issue: Managing Wildfire Risk, a new report from Marsh McLennan Insights.

Wildfires cause direct damage to property, infrastructure and business operations within the impacted regions; they can also lead to indirect long-term damage to public health and the environment. “Until recently, wildfire losses were considered by reinsurers to be low and predictable in the context of overall catastrophe losses,” write the report’s authors. “This view may need to change.”