World Bank: Coronavirus Exacerbating Poverty in Southeast Asia

Source: World Bank, East Asia and Pacific in the Time of COVID-19

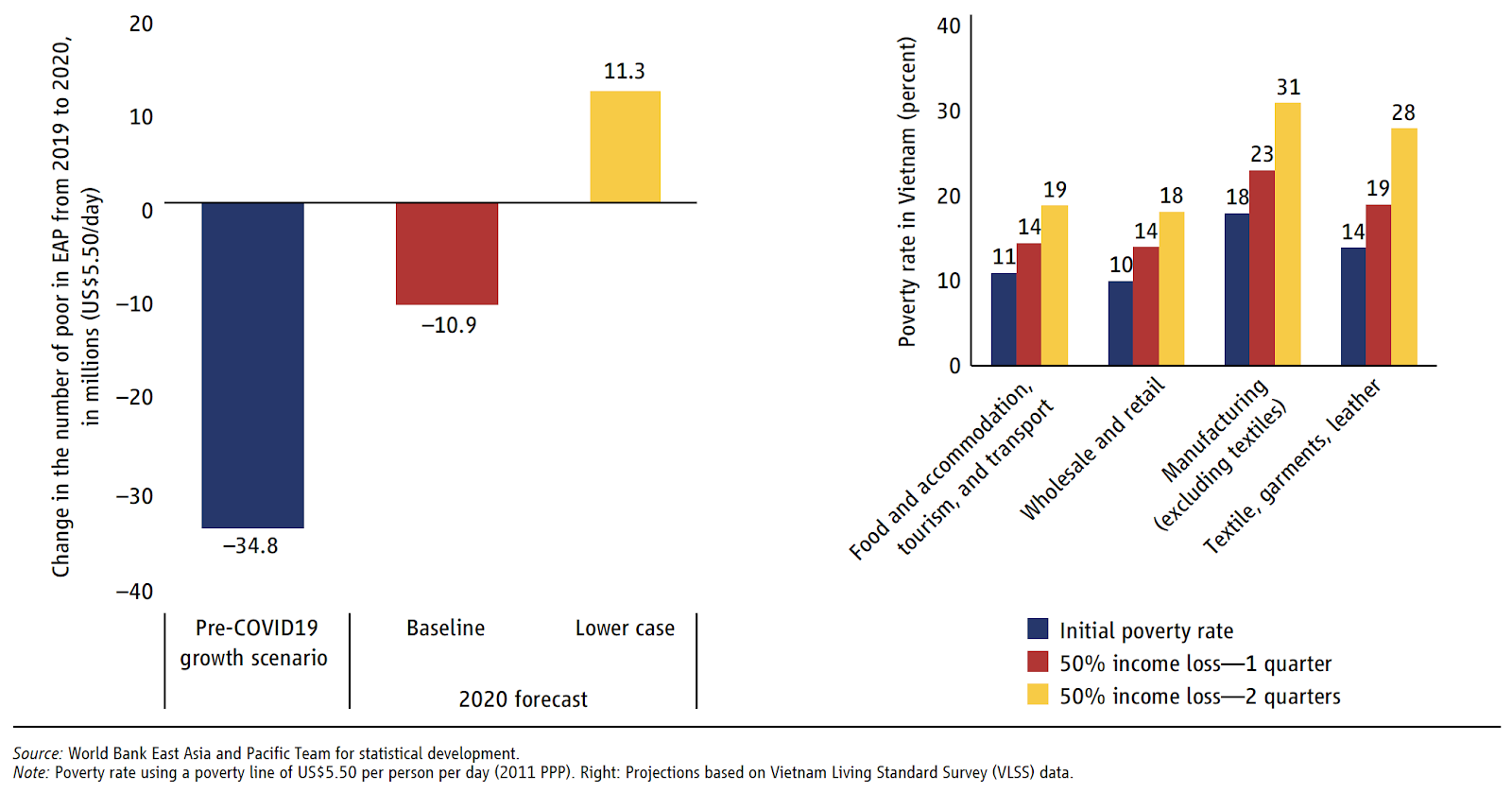

As many as 24 million fewer people will escape poverty in Southeast Asia this year as a result of the unprecedented economic shocks caused by the coronavirus. And that’s only the baseline estimate from the World Bank’s latest report on the region; its worst-case scenario has the number of impoverished people in East Asia and the Pacific rising by 11 million.

The impact varies per sector, with households reliant on the manufacturing sector for income to be hit the hardest. “Poverty rates could double among households in Vietnam linked to manufacturing reliant on imported inputs and in some Pacific Islands where tourism is an important source of employment,” the report reads.

The report points to the effective containment measures in Singapore and South Korea — which limited the economic disruptions from the crisis — as role models for other Asian countries to follow. “The sooner other countries create such containment capacity, the sooner they can end the economic pain caused by stringent suppression measures.”