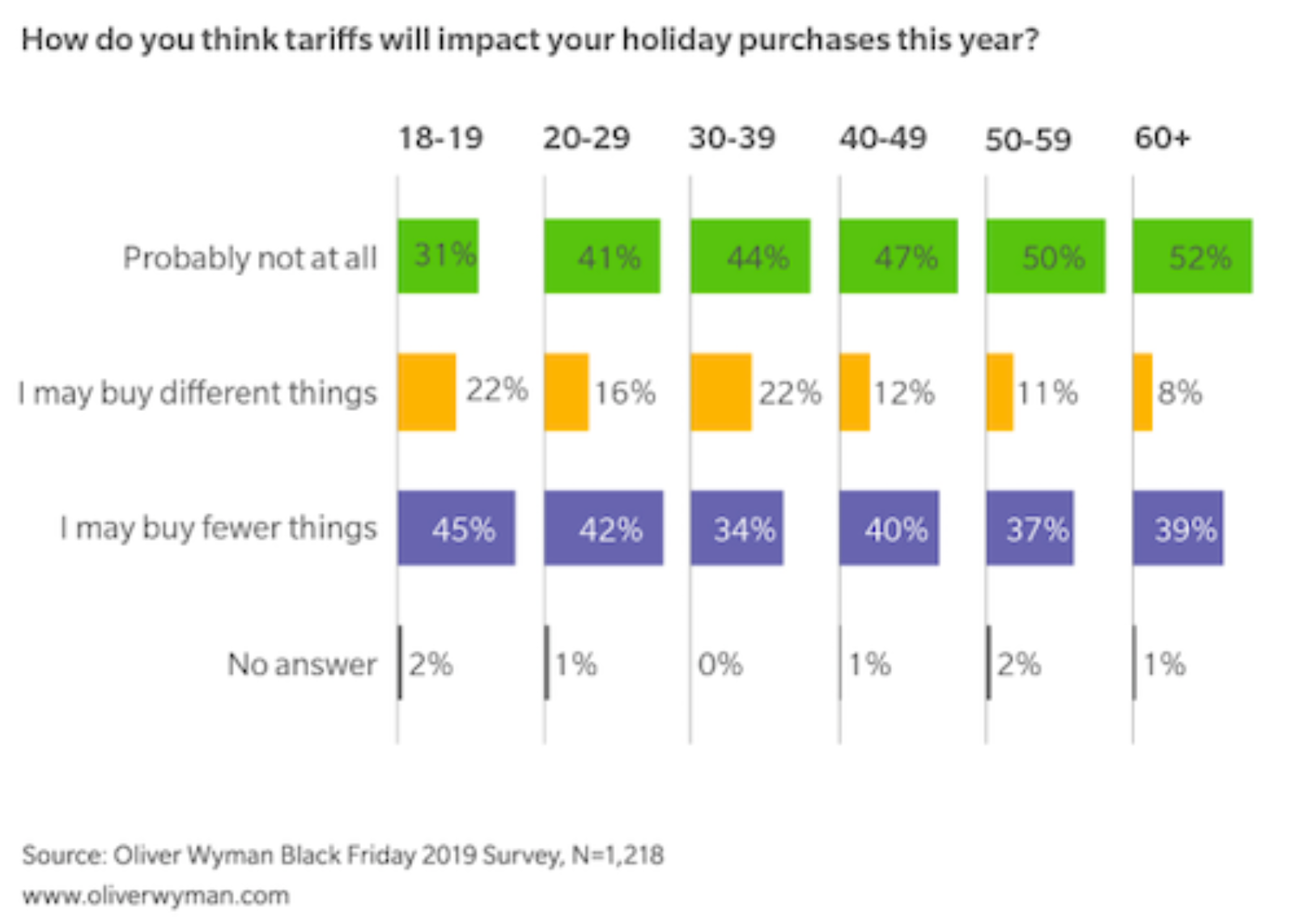

Younger Shoppers Are More Likely to Curtail Holiday Spending Due to Pending Tariffs

More than a third of U.S. shoppers surveyed expect to buy fewer things this holiday season due to concerns over pending tariffs, according to Oliver Wyman’s annual holiday shopping report. Shoppers aged 18-29 are most concerned, with as many as 45% planning to limit spending due to tariffs. However, more than half of U.S. respondents aged 60 and older (52%) are unphased by the risk of tariffs and will spend as usual.

Concerns over a possible recession also played out differently across age groups. “Respondents aged 20-29 were the most concerned about a recession (39%) and planned to cut back on shopping, while respondents aged 60+ were less phased (24%) by the possibility,” the survey findings show.

“Our survey indicates that a potential recession appears to be causing U.S. shoppers to tap, but not yet slam, the brakes in terms of spending. Consumers are still prepared to shop this holiday season and are actively planning what they want to purchase,” says Hunter Williams, retail and consumer goods partner for Oliver Wyman.