Reinventing Life Insurance Underwriting

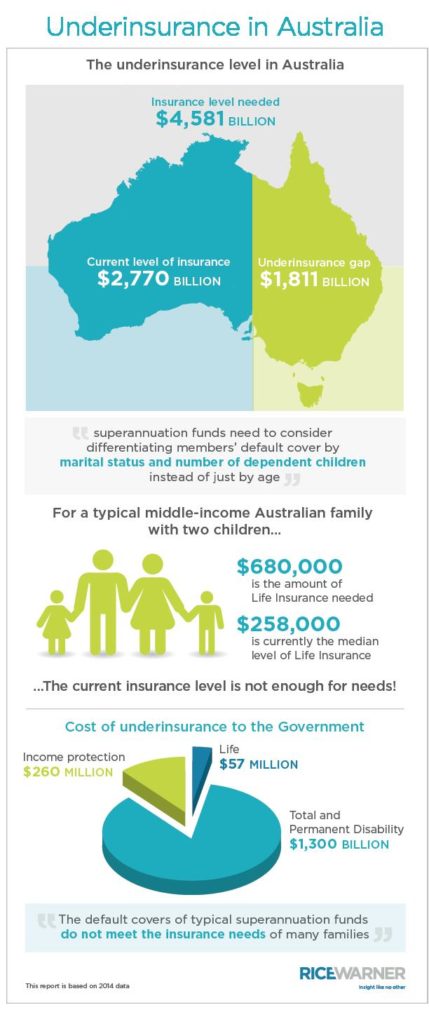

Seeking insurance coverage in Australia, or indeed in other parts of Asia, is no easy task. In fact, only 30-37 percent of Australians between the ages of 18 and 69 have life insurance. Just 11-18 percent held disability cover, income protection insurance, or critical illness and trauma cover. On the whole, Australia remains underinsured to the tune of A$1.8 trillion.

Photo: Mark Wilson/Getty Images

Seeking insurance coverage in Australia, or in other parts of Asia, is no easy task. The process typically involves the individual meeting with a financial planner and selecting the right insurance plan. While the process of getting insurance cover is considered a mere formality for young, healthy individuals, it almost never is. The experience for most customers can be frustrating.

In fact, only 30-37 percent of Australians between the ages of 18 and 69 have life insurance. Just 11-18 percent held disability cover, income protection insurance, or critical illness and trauma cover. On the whole, Australia remains underinsured by A$1.8 trillion.

The Process

Individuals are required to fill out underwriting forms that are rather cumbersome, with much of the information seemingly inconsequential. Even if there have been past transactions with all details filled out and all records are present with the bank or insurer, the entire process needs to be redone. The best route is for the bank or insurer to fill out the form and for the individual to wait to sign off.

For example, Section 10 of the form can ask for ‘Family history.’ The first question is along the lines of: “Have any of your blood related parents, brothers or sisters (living or deceased) been diagnosed with, or suffered from, any of the following conditions?” and it then lists 18 medical conditions followed by a nice “any other familial disorder” catchall. How can individuals be familiar with 18 medical symptoms or conditions, even if they are from a medical background?

Section 14 asks for “Health details” comprising over 50 questions on various symptoms, disorders and conditions. Leaving sections incomplete adds to delays and increases the chances of the need for medical underwriting.

This is the point at which many customers give up and storm off.

Not much has changed since the 1980s. Customers who are in greater need of the insurance product are patient (the process could even take three months), but those like our customer in the scenario above, who are intentionally pursuing an insurance policy, walk out.

Why is it Cumbersome?

Several factors can illustrate why insurers are dragging their feet over this process:

Culture–Why fix what has always worked? There is little desire to question a process that seems to have worked for centuries. Moreover, many of the professionals working in the industry take comfort from the degree of due diligence done in the underwriting process. After all, more information generally means better assessment of risk.

Business cases don’t stack up. Given the long time periods associated with paybacks from improvements in risk selection and the potentially large spend associated with system replacements, the business cases for taking a comprehensive review of the underwriting process are often not as attractive as other areas with more immediate paybacks (such as sales, claims improvement).

Complexity. Related to the business case, this is a complex problem to solve and often requires cooperation across multiple business lines/functions (actuarial, finance, underwriting, advisors, distribution, technology, operations), and coordinating a program across so many diverse stakeholders is challenging to stand-up let alone execute, especially when many of the stakeholders don’t see what the problem is.

How can Underwriting be Revamped?

Be clear on success metrics. Improvement in customer experience, faster decision making, better alignment with risk appetite, and uptick in sales are typical, high-level vision statements associated with such programs. However, it is important that clearly measurable metrics are defined and tracked for each such vision statement. It is also important to be clear on the prioritization among these, as that can shift the focus of activity.

Redesign the end-to-end process rather than fixing the as-is. Far too often, underwriting “transformation” initiatives are focused on fixing existing processes, particularly improving the back-end, with technology seen as the main answer, e.g., straight-through processing. While that is a useful ambition to have, it risks only partially fixing the problem. Insurers need to start by designing the desired end-to-end underwriting (and sales) process from a customer and advisor’s perspective. The focus should be on minimizing hassles and improving comfort and engagement through the process.

Harness the power of data analytics. Insurers have been investing in data analytics for sales and pricing focused initiatives, but limited attention has been paid to risk selection. Some considerations for insurers to think through: Which data points are the most critical for risk selection? From the more than 100 questions being asked, how many can be removed? What alternative sources of data can be used to better understand the customer’s risk profiles?

Automate ruthlessly. Leading insurers globally have been testing the use of Robotic Process Automation (RPA) to automate processes across the value chain. There is a significant opportunity for insurers to cast a critical eye on all repetitive and manual elements in the underwriting decision-making process, and to start exploring how these elements can be automated. Pre-populating forms with existing information (from banking partners and other data sources), further automation of the rules-based decisions, and the processing/fulfillment at the back-end should be three areas of immediate focus.

Set up the right team. Typical project teams of project managers and business analysts are helpful, but they need to be supplemented with critical skill sets. Examples of the types of roles that many insurers are including in such programs include but are not be limited to: UX/UI designers for rapidly developing the desired customer experience, technical designers for rapid prototyping, behavioral psychologists for testing customer response to how questions are asked, and SMEs from other industries to inject fresh perspectives and continue innovating.

Implement in an agile manner. References to the agile work process have irked me in the past but having recently migrated from doing multiple agile courses to actually launching a product from concept to in-market in 14 weeks, I have become a true believer in this approach to project management over the traditional waterfall-based approach still dominant at most organizations. Given the cross-functional span of underwriting, it is important to rapidly test new concepts with customers (such as shorter forms, different questions, willingness to divulge new information) and advisors and incorporate learnings in redesigning the future state process.

Look outside the industry for inspiration. Given the slow pace of change in the life insurance industry, it is helpful to look at how underwriting processes are changing in others. The mortgage industry has many parallels to the life insurance industry: largely intermediated businesses and an overly complex underwriting process. Players such as Quicken Loans have rewritten the rule books by recently launching an online mortgage where customers can get full approval in as little as eight minutes. Similar changes are appearing in SME lending, where a number of fintechs and incumbents have redesigned their underwriting processes using better data, advanced analytics and customer-centric interfaces to not only improve existing customers’ experiences, but also to tap into underserved segments that had been turned down by banks using traditional methods.

Risk selection lies at the core of an insurance business’s operations. Insurers have the opportunity to not only fundamentally enhance this process but also realize material cost savings and deliver a superior experience to customers and advisors. Redesigning an underwriting process is not a straightforward task, but given the large size of the opportunity and increasing amounts of venture capital flowing into insurtechs, incumbents need to act now.