Marketing Insurance Through Banks Is a Big Opportunity

Bancassurance customer journeys are often complex, largely due to systems not being integrated and lack of process harmony between the two parties.

Photo: Shutterstock

In Asia, the strategic importance of bancassurance — the channel for insurance sales through bank partners — has increased for banks as well as insurance companies, but notable challenges are evident that are limiting the potential benefits for both parties.

For banks grappling with a sustained period of low interest rates, bancassurance provides a way to strengthen earnings as well as an opportunity to deepen customer relationships. For insurers, it has become, in many markets, the largest life insurance distribution channel.

The insurers’ interest in doubling down on bancassurance is epitomized by the large sums of money paid for exclusive distribution partnerships: Since 2013, there have been more than 50 deals in Asia, and of the 15 deals that disclosed figures, roughly $6 billion was paid by insurance companies to banks in up-front fees alone.

Questions About Performance

While some partnerships have flourished, many have not delivered on their promise.

With time, the euphoria associated with doing more deals has been replaced by questions from shareholders and senior management of the insurance companies on justifying the multiples paid and delivering on the promised plans. The scrutiny has intensified of late as it has become clear that there are large gaps in the performance of these partnerships and that the initiatives to improve productivity are not delivering per expectations.

Big Productivity Gaps Across the Region

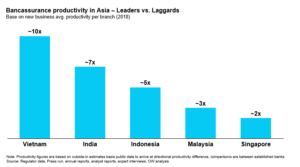

We analyzed roughly 53 bancassurance partnerships for life insurance distribution across five markets in Asia. Our analysis reveals that the productivity gaps in terms of average life insurance business per branch range from ~2x to ~10x and persist across multiple markets.

While a number of uncontrollable factors (size, brand, franchise etc.) and deal-specific factors may influence this, the fact that the difference is in multiples rather than percentage points demonstrates that there is huge opportunity for improvement. Even when comparing the median players with the leaders, the productivity gaps range from ~1.5x to ~4x.

There are a number of factors that can help to differentiate the leaders from the laggards.

Joint Partner Alignment

Alignment of the vision, culture and priorities is usually clear up-front but tends to reduce over time, typically due to a change in priorities for one of the parties, change in management and/or frustration at lack of progress. Establishing strong governance at the outset, with clear success metrics and roles and responsibilities is critical. This needs to be supplemented by a periodic, honest assessment of how the partnership is progressing, what is working well and what needs to change.

The Customer Journey

Bancassurance customer journeys are often complex, largely due to systems not being integrated and lack of process harmony between the two parties. Ensuring the journeys are seamless isn’t straightforward for most insurers, given technology challenges and their limited focus on this type of partnership in the rest of their business, but ignoring this is no longer an option.

Understanding Customer Needs

We see significant potential for insurers to work with banks to better understand customer needs, more efficiently target them, develop propositions that are more relevant and, importantly, engage with them in a more meaningful and privacy-compliant manner. This remains the area of greatest untapped potential for insurers, and those that win will have created the right capabilities and processes to unlock value.

Expanding Customer Segments

Many insurers have typically focused on optimizing leads in branches and bundling insurance with loans, largely for retail customers. We see significant potential for insurers and banks in optimizing non-branch channels (call center, digital etc.) and extending the products to other segments of the bank.

Executing on this requires this being viewed as a priority for the bank and for the insurer to be able to develop bespoke product propositions and optimally service these segments while delivering the bank’s desired experience.

Embedding Effective Sales Practices

Financial incentives are typically a less effective mechanism as insurance sales contribute a very low percentage of KPIs for bank sales staff and banks in many markets are concerned about conduct risk. Due to this, insurers need to pay more attention to sales force effectiveness and take a disciplined approach with a focus on continuous improvement.

Digital Channels

Driven by changing customer behaviors, banks are increasingly engaging with customers through digital/mobile channels. Many insurers are not even integrated into the bank’s digital journeys, let alone optimizing their performance through them. Further integration here also provides insurers the opportunity to deepen their engagement through participation in the banks ecosystems/partnership network and generate more leads.

We believe there is a strong future for bancassurance in Asia. By effectively executing the suggested practices, banks and insurers can continue to accelerate value creation for themselves and continue serving the end customers in more meaningful ways.