How Insurers Can Better Serve Retirees in Asia Post-Crisis

With COVID-19, Asia's retirees will be looking for greater security, and value it more than they did in the past.

Photo: Pexels

The elderly have been severely impacted by COVID-19: Their mortality rates have been the highest, clusters have quickly spread in retirement homes and aged care facilities and the financial impact from the investment market disruption is acutely felt by those in or approaching retirement.

Caring for the more vulnerable isn’t just a positive social action and government policy imperative, private sector organizations stand to gain financially and enhance their reputation by serving this population in a holistic way. With the status of retirees in Asia changing, there is an opportunity for insurers to respond.

The Opportunity

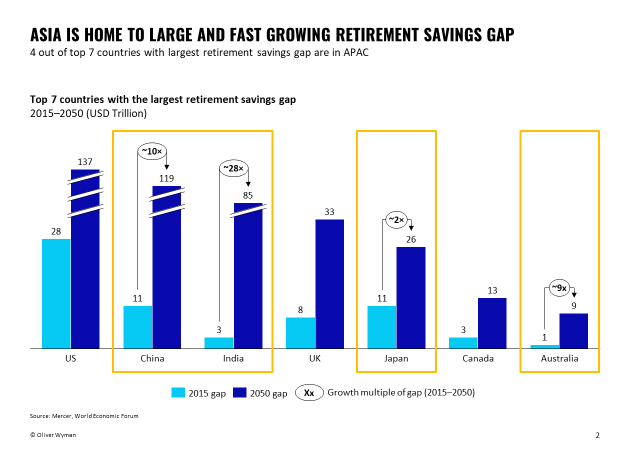

Approximately a quarter of the population in the Asia Pacific Region is expected to be over the age of 60 by 2050, reaching close to 1.3 billion people. Analysis from Marsh McLennan reveals that four out of the seven largest retirement savings gap countries are in Asia, and that this gap is expected to increase multifold by 2050 (see exhibit 1).

The Challenge

The needs of retirees are diverse and not very well-understood, typically including a combination of affordable non-clinical care, comfortable accommodation, independence, maintenance of social connections and desired lifestyle, liquidity of assets and financial security, and wealth transfer after their time.

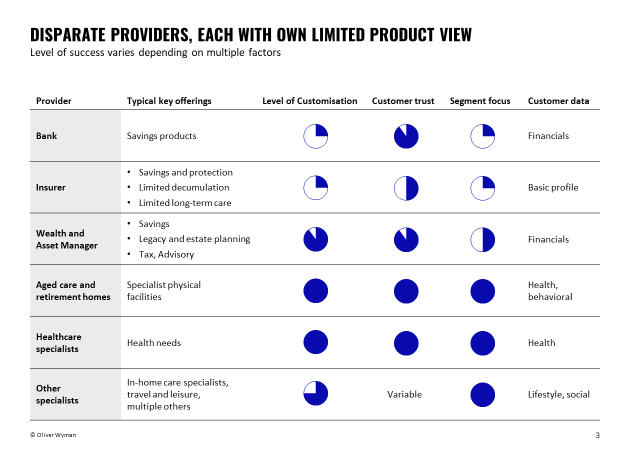

But the products that exist in the market today are quite narrow and are provided by a diverse set of players, each with a different degree of understanding of and focus on the retiree population. Providers from each sector have taken an existing product-led view, serving a limited need, based on limited data (see exhibit 2).

For some sectors and providers, for example, retirement homes and health professionals, this business model has been quite successful, given the large extrinsic demand, typically high barriers to entry and government or policy support. However, many financial services providers, particularly insurers and wealth and asset managers, have struggled to serve this population in an economic manner. Reasons for that are numerous and include limited understanding of the true customer need, reduced internal focus, short-term investment horizon and limited willingness to collaborate with other players.

The Way Forward

Today’s new senior consumers are very different: They are aspirational, more aware and better-prepared, but despite that, they are still worried about their multiple unmet needs. Insurance companies in Asia can economically serve this population, but they need to go beyond the traditional product-led approach. They need to better understand the broader customer needs, innovate on propositions, stress-test the economics and partner with a range of providers to be able to own the segment.

Innovate: Traditional retirement products have had multiple challenges. For the customer, they have been addressing a narrow need and are often expensive. For insurers, they have been uneconomical and hard to sell. The combination of both has stymied innovation. But we are already starting to see some innovation: In China, multiple insurers are investing in retirement care community living projects with end-to-end services, including medical care and entertainment facilities that address multiple key needs of the senior population.

In Japan, insurance products and services like dementia insurance, home care services, lifestyle support desks and customer quizzes on dementia are being used to tackle the challenges of Japan’s aging population and help the senior population live with a sense of security. Other insurance companies are forming partnerships with asset managers, health care providers, service vendors and others to address the needs of this population by forming an ecosystem of products and services.

Partner: Retiree needs may be broad and diverse, but given that their dependency on the external world is significantly high, most of the needs are core needs and not just good to have. For example, retirees have advisory needs for broader financial and asset management beyond insurance and that has implications for core product offerings as well; similarly, they have needs for health care. Insurers can serve some of the financial needs via the products they manufacture, but a holistic approach requires more than just the core insurance and retirement products. A range of partnership options are now available across asset management, health care, service providers and more, and the partnership models are rapidly evolving. At the core of this is the operating model, which insurers need to reshape and perfect (see exhibit 3).

Stress-test the economics: Players need to take a holistic view of the economics of serving this segment rather than just purely focusing on traditional standalone product economics. Many insurers and wealth managers may completely lose these customers as they enter retirement and cancel traditional products, but there is a significant opportunity to retain these customers longer.

The COVID-19 crisis will increase awareness among retirees on the need to reassess how their financial and health needs will be met in the future. They will be looking for greater security and may value it to a greater extent than they did in the past. Governments and health care players will re-examine the effectiveness and sustainability of their services. Insurance players have the opportunity to not only create material financial value, but also to provide peace of mind to those who need it most.