What Ordinal NFTs Mean for Bitcoin

A billboard that reads, "I hate NFTs!" is seen behind people sitting on the red steps in Times Square during the 4th annual NFT.NYC conference on June 20, 2022 in New York City. The four-day event will feature 1,500 speakers from the crypto and NFT space and will host over 14,000 attendees.

Photo by Noam Galai/Getty Images

The Bitcoin community is in turmoil. Ordinal NFTs — also referred to as “Digital Artifacts” and “Ordinal inscriptions” — surfaced on January 21, 2023, on the Bitcoin network. Bitcoin maximalists are furious — they believe NFTs are spamming and attacking the Bitcoin network. Other Bitcoin enthusiasts argue that Ordinal NFTs make the Bitcoin network not only more fun but also can help generate more revenues for Bitcoin miners.

Bitcoin is now home to 100,000+ Ordinal NFTs, including a playable DOOM game clone, and JPEGS of “Taproot Wizards,” “Astral Babes,” and “Ordinal Punks.”

Heated debate has primarily focused on whether Ordinal NFTs are a positive or negative development for the Bitcoin network. The answer depends on whether one believes Bitcoin should be purely a monetary system or serve multiple use cases.

Whether one loves or hates them, the fact is that Ordinal NFTs exist and will continue to be minted on the Bitcoin network — in the absence of a soft or hard fork.

Given that Ordinal NFTs have arrived, what do they mean for Bitcoin? Here are my thoughts on three implications:

- Blockchain upgrades can bring significant, unintended consequences.

- Ordinal NFTs could pose a threat to Bitcoin as a medium of exchange and as a store of value.

- Bitcoin is decentralized in technology and decision-making — especially because Satoshi Nakamoto has disappeared.

A Brief History of Bitcoin NFTs

Immortalizing non-monetary data (e.g., JPEGs, video files, etc.) on the Bitcoin network is not new. In fact, the Genesis block — the very first Bitcoin block ever created by pseudonymous Bitcoin creator Satoshi Nakamoto included a message: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

Buying/selling immortalized data is also not new to Bitcoin. Counterparty NFTs are an example of Bitcoin-based NFTs that have existed since 2014.

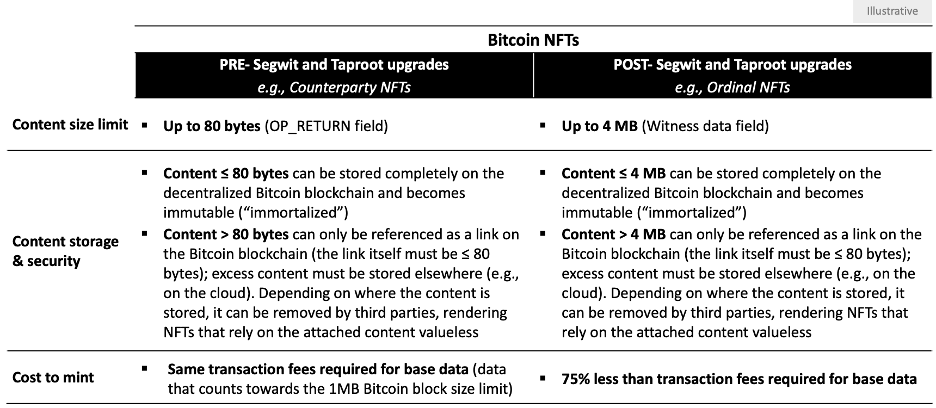

But three technical features distinguish Ordinal NFTs from previously existing Bitcoin NFTs: 1) content size limit 2) content storage and security 3) cost to mint (i.e., create an NFT).

Two soft-fork upgrades enabled these net new technical features on the Bitcoin network.

- The SegWit upgrade in 2017 increased the total data that a block could carry to 4MB and created a cheaper category of data. This is how Ordinal NFTs can upload up to 4MB of data to the Bitcoin network relatively cheaply.

- The Taproot upgrade in 2021 which enabled the mechanism by which content attached to Ordinal NFTs gets published to the Bitcoin network.

Implication 1: Blockchain upgrades can bring significant, unintended consequences

Without both Segwit and Taproot upgrades, it would not be possible to upload 4MB of content completely and relatively cheaply onto the Bitcoin network.

Yet, the motivations behind the Segwit and Taproot upgrades were far from seeking to enable anything akin to Ordinal NFTs.

Some have dismissed Ordinal NFTs as “nothing new, Bitcoin goes on” since uploading non-monetary content to the Bitcoin network has always been possible — since the Genesis block.

These critics are missing the point. Bitcoin NFTs prior to Ordinal NFTs did not achieve mass popularity, at least partly because they were too expensive to mint, and only up to 80 bytes of content could be stored on the Bitcoin blockchain itself. This meant that NFT enthusiasts were incentivized to turn to other blockchains, such as Ethereum, where they faced less restrictive content size (compared to 80 bytes) and fee limitations when minting NFTs. This incentive no longer exists with Ordinal NFTs due to the three new technical features outlined above in Figure 1. Today, more content can be immortalized and secured per NFT on Bitcoin than on other blockchains, including Ethereum, for significantly reduced fees.

Implication 2: Ordinal NFTs could pose a threat to Bitcoin as a medium of exchange and as a store of value

Bitcoin maximalists are furious about Ordinal NFTs because they believe that the sole purpose of Bitcoin should be to serve as a peer-to-peer electronic cash system, as articulated in Satoshi Nakamoto’s whitepaper. Ordinal NFTs attack this vision as they take up block space that would otherwise be used for financial transactions, increase the bandwidth required to operate a full Bitcoin node, and drive up transaction fees for financial transactions on the Bitcoin network.

Ordinal NFT proponents argue that the Bitcoin network can be used by anyone for anything, including funny JPEGs, so long as they can pay the associated transaction fees. After all, the Bitcoin protocol itself permits uploading non-financial content for a price.

If Ordinal NFTs gain and maintain popularity, they will compete with financial transactions for space on the Bitcoin network. Given the increased demand for block space, the transaction fees needed to transact on Bitcoin will increase. Transaction fees have generally increased since Ordinal NFTs were launched on January 21. Increased transaction fees harm some but benefit others. Those who rely on Bitcoin’s historically low transaction fees — for example, those who send Bitcoin to send remittances — will be negatively impacted. Benefit will accrue to other stakeholders, including Bitcoin miners, whose revenues rely partly on transaction fees.

All else equal, increased transaction fees can threaten Bitcoin’s viability as an everyday medium of monetary exchange in the shorter term. Some would argue that layer 2 solutions, such as the Lightning Network, already solve this potential threat to Bitcoin as a medium of exchange. Yet, layer 2 solutions offer less decentralization and security than the Bitcoin network.

In the longer term, Bitcoin as a store of monetary value may be at risk. Practically anyone can upload anything up to 4MB to the Bitcoin network for a price that many are willing to pay — this could run the whole gamut of funny videos, child pornography, confidential documents, how-to guides banned by governments, etc. In particular, if Bitcoin is associated with immortalizing illegal content in significant volumes, Bitcoin’s perceived legitimacy as a legal monetary system will be put to the test.

Implication 3: Bitcoin is decentralized in technology and decision-making — especially because Satoshi Nakamoto has disappeared

Extreme emotions abound in the “Ordinal NFTs, good or bad for Bitcoin?” debate.

Yet, no one can unilaterally take any action.

The current conflict between Bitcoin maximalists and Ordinal NFT proponents — where arguments are vehement and actions are curtailed — reflects Bitcoin’s decentralized nature, not only in technology but also in decision-making.

The decentralized nature of decision-making in the Bitcoin community is likely only possible due to the disappearance of Satoshi Nakamoto.

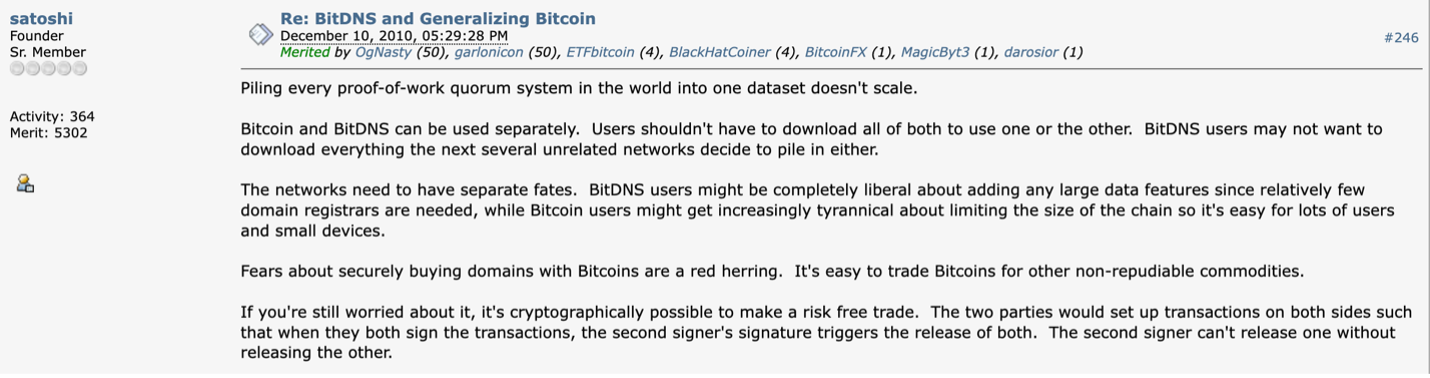

The debate about the legitimate use cases of the Bitcoin network has existed since the beginning. In 2009, Nakamoto explicitly indicated their belief that Bitcoin should be used for financial transactions and that financial and non-financial use cases should not mix on a blockchain network (see Figure 2).

A counterfactual scenario to consider: If Nakamoto were still present today, their voice and reason would likely hold significant sway over the Bitcoin community, similar to how Vitalik Buterin’s voice and reason hold weight in the Ethereum community.

Bitcoin As Money Is At Stake

Bitcoin upgrades are highly technical. Translating these highly technical changes precisely and comprehensively into non-technical terms is often challenging. It is incumbent on technical and non-technical Bitcoin stakeholders to work together to think through not only the intended implications for blockchain operations but also the potentially inadvertent implications that often result from a complex web of incentive structures. Thinking through potential unintended consequences is particularly important in a decentralized system, where achieving majority consensus to do — and undo — actions is incredibly difficult.

It remains to be seen whether Ordinal NFTs will seriously compete with financial transactions on the Bitcoin network. One thing is clear — resources to develop the Bitcoin network are limited. When competing priorities exist, no single priority can get full attention.

This article originally appeared on Metaverse Musings on Substack