Report: China’s Debt Sustainable—For Now

A Chinese bank worker counts stacks of 100 yuan notes at a bank in Huaibei, in eastern China's Anhui province. According to a recent report, the scale of China’s debt is “not yet a concern” and the fears may be overblown.

Photo: STR/AFP/Getty Images

There is much concern about the high levels of debt in the Chinese economy, but according to a recent report by the Mirae Asset financial group, the scale of the country’s debt is “not yet a concern,” and the fears may be overblown.

However, the report adds that the pace of China’s increasing debt levels is unsustainable and can pose severe problems if not curbed. China should look to lessons learned from Korea’s currency crisis and Japan’s asset price bubble, the report says.

According to the report, fears of an impending debt crisis in the country are exaggerated at the moment, owing to China’s low dependence exposure to foreign debt as a share of its total debt.

Structural Change and Debt Status

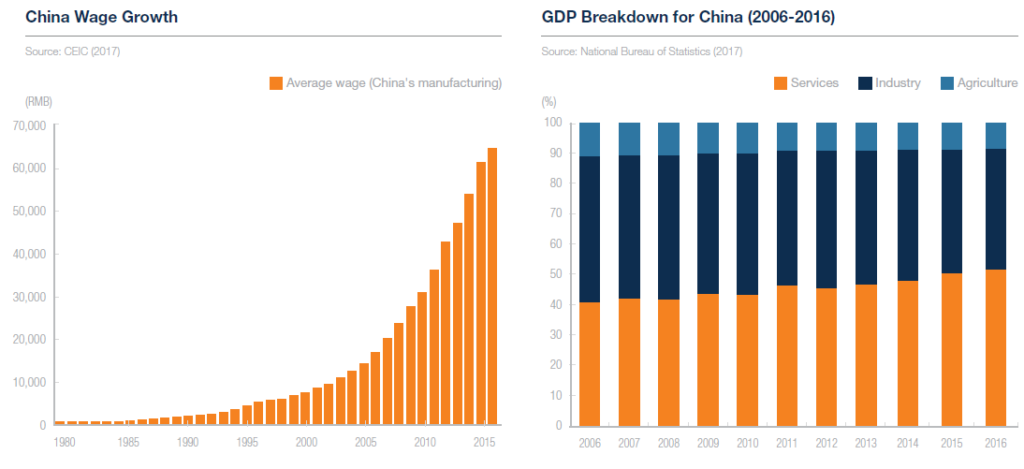

Over the past few years, China has sought to address the structural imbalances in its economy, taking steps to limit its reliance on fixed investments and manufacturing and shift to a more consumption- and services-driven economy.

In making this shift and trying to avoid a significant economic slowdown at the same time, China is “running up an imposing mountain of debt, triggering global concerns over the possibility of another classic [emerging markets] debt crisis,” according to the report.

One of the ways China is doing this is by trying to promote wage increases to establish a consumer class capable of supporting sustainable growth without an increase in the levels of debt. There is, however, still a long way to go before China successfully makes this transition, and meanwhile, policymakers are relying on debt to bolster economic growth that is needed to make a successful transition. This has been done mainly through lending by state-owned banks to state-owned enterprises, resulting in some concerns over a potential debt bubble.

How Much of a Worry?

According to the report, one important factor to note is that many debtors and creditors in China presently are part of a closed domestic financial apparatus that is helmed by the Chinese government—this characteristic provides greater flexibility in managing debt and debt repayment schedules.

In addition to this, the country’s debt structure is much different from what it was in Korea in 1997-98. For starters, the share of foreign debt in China’s total debt is significantly lower than it was for Korea. And while the proportion of foreign debt is increasing, the People’s Bank of China maintains the ability to manage currency and foreign exchange reserves via numerous policy levers that were not available to Korea during its currency crisis. In the case of Korea, a structurally weak banking system, rising corporate borrowings and a high reliance on foreign debt created a dangerous cocktail of risk.

In fact, evidence suggests that China today is more similar to Japan at the time of its asset price bubble collapse. Back then, Japan tackled the effects of a domestic property market meltdown by providing a monetary stimulus, and, in the process, managing to avoid a devastating financial crisis. Other similarities China shares with the Japan include substantial domestic savings, large trade surpluses and strong economic growth.

Moreover, the report points out that China has additional policy “bullets” at its disposal that even Japan did not enjoy; one example of which is the managed currency float.

Days to Come

“Over the long term, simply preventing a financial crisis may not be sufficient,” the report says, adding that “the risk of following in Japan’s footsteps and slipping into a decades-long growth slowdown should be a concern for any economy sensitive to potential social unrest.”

In the short term, China’s key challenge is to make difficult decisions that may have negative consequences in the short term but are crucial for long-term growth. To ensure efficient allocation of capital, China could consider greater financial system liberalization, particularly in areas such as lending rates, currency and capital flows.

If China does that, and given the policy bullets at its disposal, “China should maintain some measure of stability for many years—likely buying enough time to avoid a black swan event altogether,” the report says.