Top Commodity Traders Revamp Strategy as Industry Matures

Top commodity traders have revamped their strategies as the industry matures. The traditionally slow moving asset-backed trading giants are now melding their operational expertise with the entrepreneurial style and culture of independent traders.

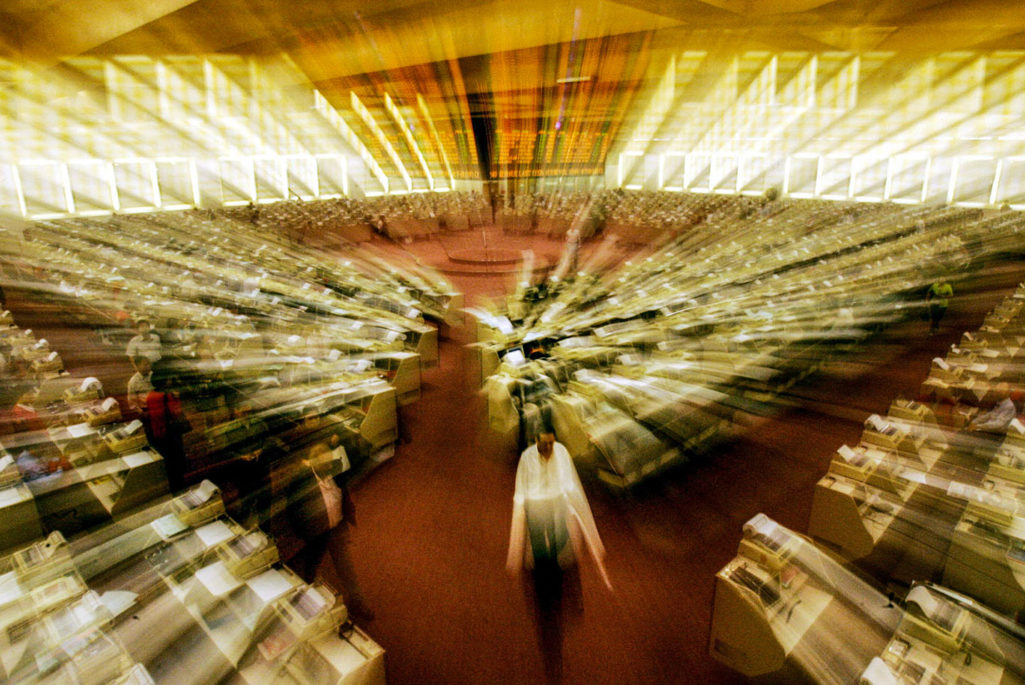

Photo: Mike Clarke/AFP/Getty Images

Ever since the financial crisis, a group of traditionally slow-moving asset-backed trading giants have been pushing to meld their operational expertise with the entrepreneurial style and culture of independent traders. They are being rewarded handsomely by the new trading model that they have pioneered with rock-solid trading results at a time when the market is stuck at rock-bottom prices for everything from copper to crude oil.

The five top asset-backed traders have been growing their gross margins more than three times as fast as independent traders since the financial crisis. As a result, they have grown their gross margins as a group by more than 15 percent every year since 2010. By contrast, the gross margins of the top five independent traders have expanded annually by only 5 percent.

This revolutionary shift is the outcome of an evolutionary transition of nonconformist commodity trading into a mature industry. The commodity traders that have come closest to achieving established, institutionalized global machines designed to generate earnings reliably in spite of market conditions are now at the head of the pack.

In short, they are industrializing.

The New Normal of Commodity Trading

The “new normal” of commodity trading no longer only hinges on superstar, siloed individuals living off their ingenuity, agility and speed. Instead, today’s standout results are systematically driven by transforming market and competitor intelligence gathered from personal networks into tradable institutional knowledge, offering structured customer solutions and monetizing “optionality,” defined as the options available to run, manage and extract the most value from their portfolios globally. Leading players are becoming one-stop shops able to finance, store, transport, refine and distribute commodities globally with machine-like efficiency, avoiding operational or financial strain.

Leading energy companies are now reaping the rewards of refining their ability to incorporate their longstanding operational expertise into their trading divisions’ cultures. Over the past several years, they have cut costs by standardizing, automating, and outsourcing processes. They have also improved their ability to act nimbly by educating all of their stakeholders and breaking down the barriers between logistics operations and their supply and trading divisions.

As a whole, these efforts are having a significant impact. For example, in the first three months of 2015, BP’s profit fell only 20 percent compared to the same period in the previous year, even though crude oil prices were cut in half. Similarly, the trading arms of Total and Shell helped to support their overall group results by taking advantage of favorable forward market conditions and storage capacity along their logistics chains. One leading asset-backed player was able to reduce the ratio of costs to trading income by more than 10 percent simply by standardizing and outsourcing more work.

The “new normal” of commodity trading no longer only hinges on superstar, siloed individuals.

Industrialized Culture Shift

So now, other asset-backed traders and maverick independent traders, too, are attempting to institutionalize their operations without sacrificing nimbleness and entrepreneurial drive. At the same time, they are shifting toward a more rules-based management-run model, with explicitly defined delegations of authority and institutionalized processes around investment decision making and capital allocation. Many are also building out their corporate functions such as corporate finance, strategy and external communications.

Traditionally, private independent commodity traders are starting to involve their compliance and legal departments more in complex issues such as customer relationships. Some are going so far as to outsource and offshore routine administrative work and to publish comprehensive annual reports.

Successful strategists are designing large systems and industrialized platforms that can maintain the high degree of entrepreneurship and individual talent required for them to act swiftly on monetizing opportunities.

Hence, the question becomes: Will all commodity traders be able to industrialize to the degree required to reach the next level? And if independent commodity traders improve their resilience, will the top asset-backed traders be able to go on building out their capabilities and gaining market share at the same pace?

The Next Five Years

The commodity-trading industry is moving from its roots as a fragmented band of maverick traders stepping in to smooth out the vast global supply and demand imbalances and information asymmetries to an industrialized group of nimble, global one-stop-shops for multiple commodities, also providing financing, risk management and logistics.

Within five years, we predict that commodity traders will morph into organizations with all the benefits and challenges of other mature industries. And as commodity traders’ business models become increasingly homogeneous, they will be under even more intense pressure to distinguish themselves from the pack.

The recent transformation of top asset-backed traders underscores what leading independent traders and other asset-backed traders need to do in order to grow and become more resilient. If the past is an indicator for the future, independent players will find nimble and swift ways to adapt and lead again.

Conversely, even those asset-backed traders that are presently the industry’s front-runners will need to continue to push the envelope in professionalizing the industry and strive to be more agile by exploring new, innovative ways to inexpensively optimize all of the options available in their massive global operations. No one can afford to sit still.