What Is the Future of Alternatives to Traditional Insurance Markets?

Workers analyze graphs in an office setting.

Source: Shutterstock

There’s been much discussion in risk finance circles over the past decade about alternatives to traditional insurance markets. Much of the focus has been on the provider side—the pension funds, sovereign wealth funds, and other investors that provide the capital behind so-called alternative risk transfer (ART) solutions.

Once available primarily in the reinsurance sector, ART solutions are now common in the primary insurance market. And as the nonstandard risk transfer marketplace grows, providers and financiers continue to develop innovative solutions for companies of all sizes.

How Do End Users View the New Solutions?

Are end users open to shifting away from traditional insurance solutions? What opportunities do they see, and what obstacles stand in their way?

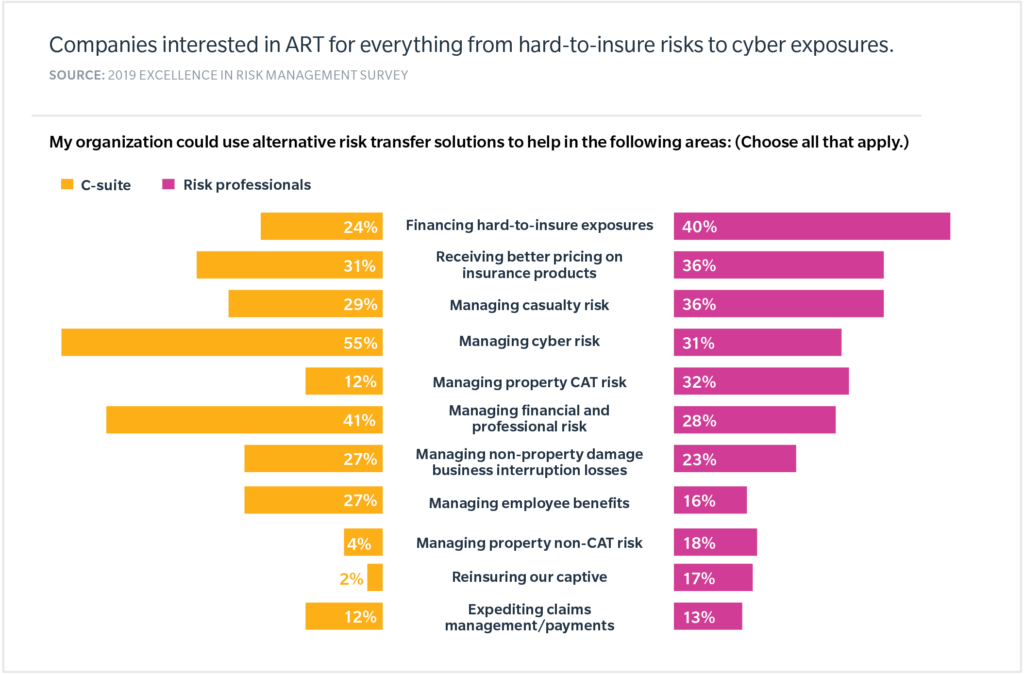

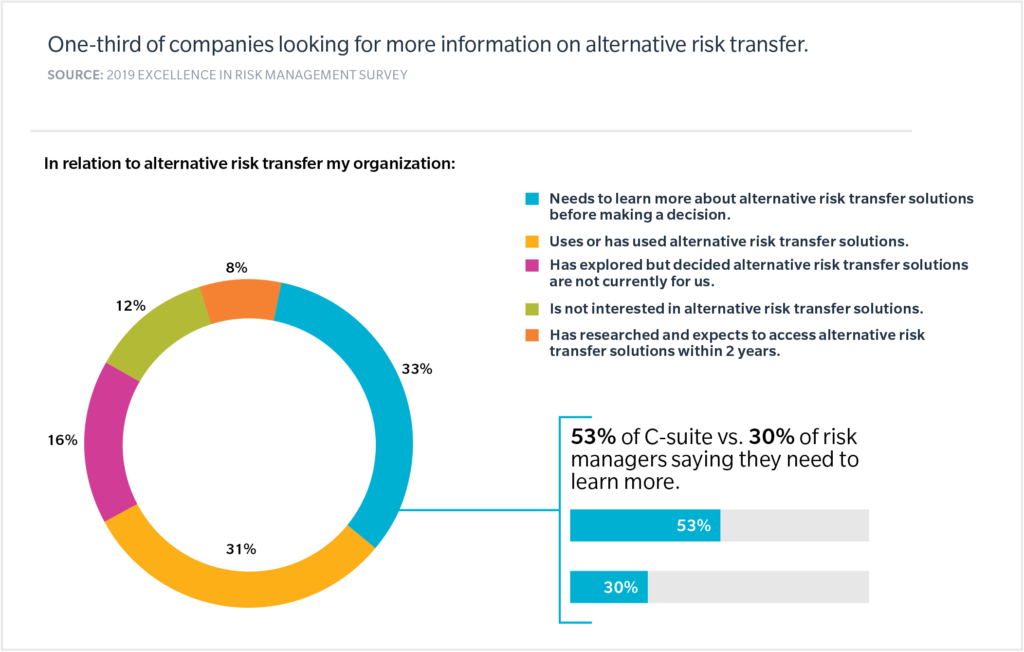

The 2019 Excellence in Risk Management survey found that nearly 40 percent of respondents’ organizations are using, have used, or expect to soon use ART solutions. And while 28 percent are not currently interested, another one-third say they need to learn more before making a decision.

Figure 1: 33 Percent of Respondents Said They Need To Learn More About ART Solutions

Alternative risk solutions include products that combine coverages, cover risks that are typically difficult to place, and/or allow for consistent, multiyear pricing. Large organizations, for example, are increasingly interested in nonstandard integrated risk solutions, which bring multiple lines of coverage into a single, multiyear contract. Such solutions help organizations avoid surprises by providing a clearer view into long-term premium costs.

The Popularity of Captive Insurance

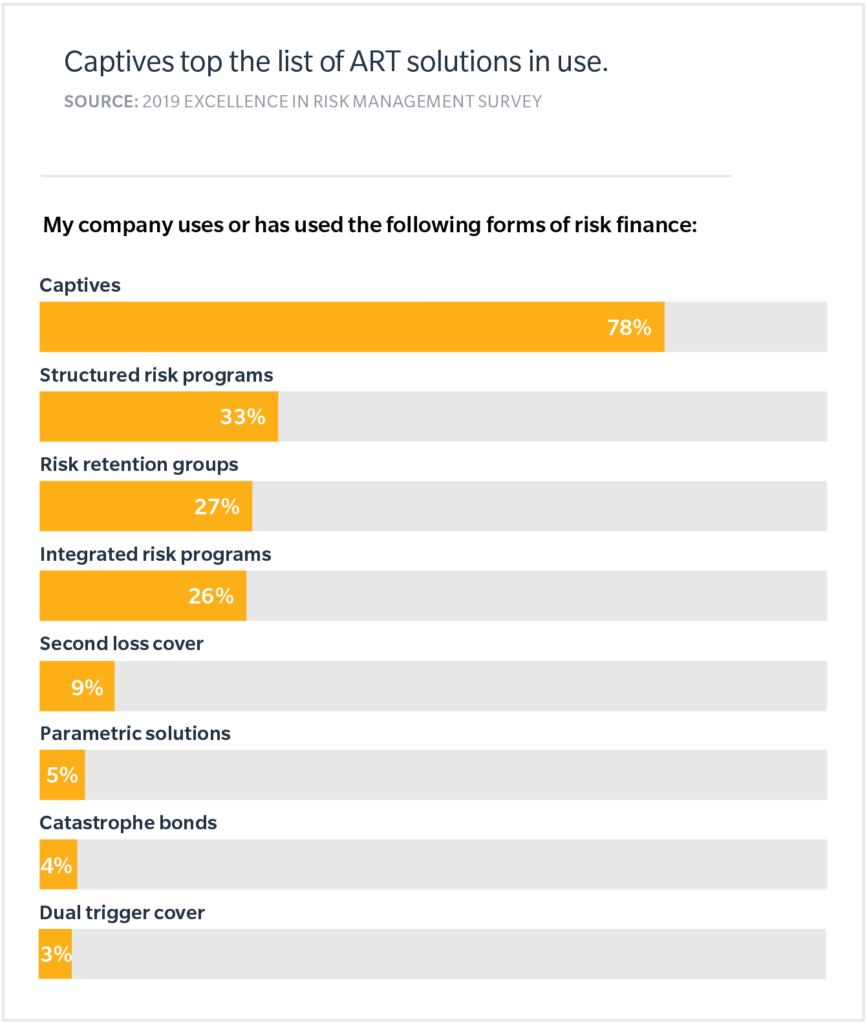

Alternative solutions can also offer coverage in such hard to finance areas as business interruption for non-physical damage, pandemic and epidemiological risks, “black swan” events, and weather risks. To no surprise, the most common ART solution in use by the survey respondents was a captive insurance company (see Figure 2), which, simply defined, is a licensed, formalized mechanism to finance self-insured risks or access the reinsurance market.

Captives have been around for more than 50 years, and thousands of companies now employ one to manage an ever-expanding range of risks. But captives have a key difference from other ART solutions—they use a company’s own capital, not a third party’s.

Figure 2: Which Type of Alternative Risk Transfer Solution Does Your Organization Use?

Captives aside, the most popular ART solutions were structured risk programs, which are tailored products that include a portion of self-insurance; risk retention groups, which allow insurers to underwrite all types of liability risks, aside from workers’ compensation; and integrated risk programs.

Integrated risk programs dominated (42 percent) among respondents who said they are looking to use ART solutions within two years, followed by structured risk programs (29 percent). The percentage anticipating the use of catastrophe bonds rises from 4 percent now to 13 percent who are expecting to do so in two years, while parametric solutions showed a small likely increase from 5 percent to 9 percent. Parametric solutions are index-based with a predetermined payout mechanism that comes into play when predefined parameters are met or exceeded.

Cost and explaining how the solutions work were the main obstacles to using ART solutions cited by respondents.

Main Obstacles to Using ART Solutions:

- Cost

- Explaining benefits to others in the organization

- Data/analytics to justify/make choices

- Don’t understand how products work

- Size (too small)

In addition, more than half of C-level executives and 30 percent of risk professionals said they need to know more about these solutions before they can make a decision to deploy them. Among the C-suite, the lack of understanding regarding ART was, by a large margin, the main obstacle.

So Where Should Companies Start?

An essential first step is to take an analytical look at current insurance coverage. Is it solving your company’s problems? Are there gaps that leave your organization vulnerable? And if so, what is the potential cost to your company if that vulnerability were to be attacked?

Posing the questions is the easy part; answering them with some degree of accuracy tends to be a lot trickier. Why? Because, despite the abundance of data available, many companies are still not satisfied with their data and analytical capabilities. In fact, the survey respondents identified improving their use of risk data and analytics as the top priority for improving their organization’s risk management capabilities.

The Future of ART Solutions

As with so many risk issues today, cyber was top of mind for C-suite executives. More than half (55 percent) cited cyber risk as an area they want to explore as they consider ART solutions (see Figure 3).

And while risk professionals are, of course, well aware of cyber risks, they were far less likely to cite it as an area in which they would apply ART solutions (31 percent). The disconnect points to the need for risk professionals and C-suite leaders to engage around emerging risks, particularly those associated with cyber and technology, and align on strategies to address them.

Figure 3: Organizations See Potential for ART Solutions in a Number of Areas

Alternative risk capital grew by just over 9 percent in 2018, reaching $95 billion by year’s end, according to Guy Carpenter. This followed a 16 percent growth in 2017, even after providers replenished following the record insured losses from that year’s natural disasters. And more growth is expected, with an estimated $1 trillion earmarked by pension funds and others to invest in risk finance.

Diversifying Investments

Capital owners are looking to diversify their investments. Capital seekers, meanwhile, want opportunities for diversification, channels to smooth volatility, and additional capital pools to tap into to efficiently and effectively finance risk. By leveraging advances in risk modeling, ART solutions can be positioned at the forefront of innovation, providing coverage for traditionally difficult-to-quantify risks—for example, insurance for the financial repercussions of a pandemic.

To improve risk finance strategy, C-level executives and risk professionals need to consider the emerging risks facing their organizations and the many options available in today’s capital markets.