Japan's highest mountain Mount Fuji (top L) is seen behind the skyline of the Shinjuku area of Tokyo at sunset. Japan has experienced 26 years of low productivity growth.

Photo: Kazuhiro Nogi/AFP/Getty Images

Investing in Asia is challenging, particularly given the region’s great diversity in terms of economic development, regulatory landscapes, demographics and capital markets infrastructure, among others.

Global macroeconomic developments have contributed to the challenges, too. For example, according to the Asia Pacific Risk Center’s Evolving Risk Concerns in Asia-Pacific report, asset bubbles in Asia ranked as the top risk for executives in seven of those economies, owing to loose monetary policies globally and the subsequent search for yields by investors, which helped create an environment conducive to bubbles.

Rich Nuzum, Wealth Leader for Mercer’s Growth Markets region encompassing Africa, Asia, Latin America and the Middle East, tells BRINK Asia that there is greater investor interest in Asia despite the environment of low global growth and concerns about future growth expectations in non-Asian developed markets. The risk-return perspective of investors vis-a-vis Asia is also changing as a result, he says.

BRINK Asia: What are the key investment challenges posed by Asia’s economic diversity in terms of investing in Asia?

Rich Nuzum: Each country in the region is different, but in general, there is more of a premium in Asia to investing in primary research and obtaining information and more of a premium for good corporate governance. The regulatory regimes around the release of public information are not as tight in some countries across Asia as in other developed markets, and the market for corporate control is not as well-developed either.

Where an investor in the U.S. or in many European markets can free-ride on market efficiency, in Asia, that is not the case. This means that for an investor with the resources to do proper due diligence, there are upsides to investing in Asia.

BRINK Asia: What are some of the biggest opportunities in Asia for long-term oriented investors?

Nuzum: One of the biggest opportunities, in my view, is investing in private equity in Japan. The country has experienced 26 years of low productivity growth. There is a move towards trying to establish better corporate governance, which is a good thing for investors. The legal environment towards hostile takeovers is not as well-developed, but still there is room for private equity investors to effect change and get large returns.

A second major opportunity is in the area of infrastructure investment. The region still has huge infrastructure requirements, and developing this infrastructure requires capital. China’s Belt and Road Initiative, for example, is going to create opportunities for investors. Asia has been investing in infrastructure and that is one reason why the region has seen productivity growth, but there is still a lot to do, particularly in terms of sustainable development—tackling pollution in China is another example.

A third area of opportunity is in helping innovative Asian companies go global with capital and expertise. Innovation in China around fintech, and in China and India around cashless financial services, is enormous. For a long time, there has been an investment thesis that products will be developed for those with low per capita incomes and then move upwards, and we are now seeing that happen in Asia. These innovations can be scaled globally and are an opportunity for investors.

BRINK Asia: What are the benefits and challenges associated with an active investment strategy in an Asian context?

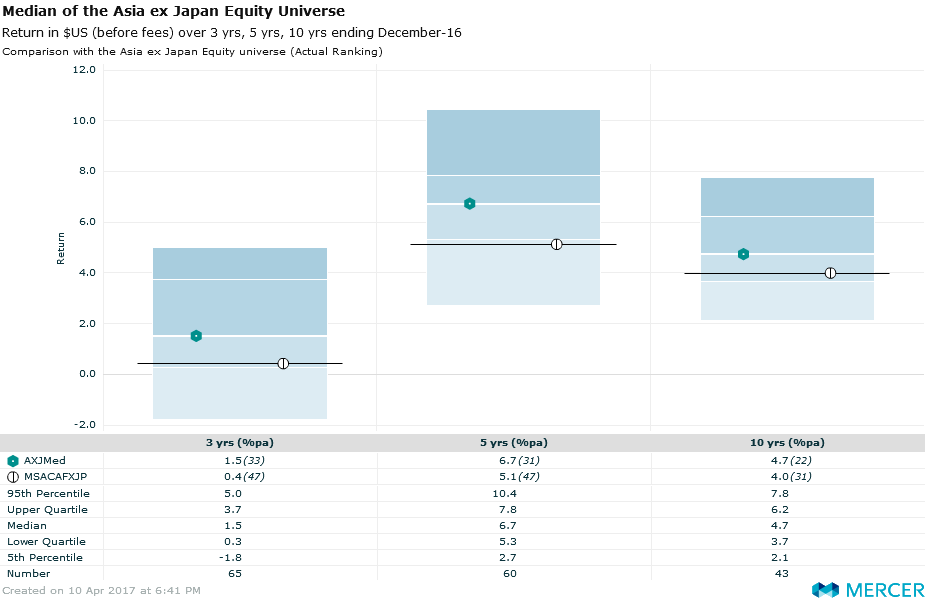

Nuzum: I think the case for active investment in Asian equities is pretty strong. If we look at Mercer’s Asia ex Japan Equity peer group,* the median managers have outperformed the typical benchmark of MSCI Asia ex Japan Equity Index over the 3-, 5- and 10-year period ending 31 December 2016.

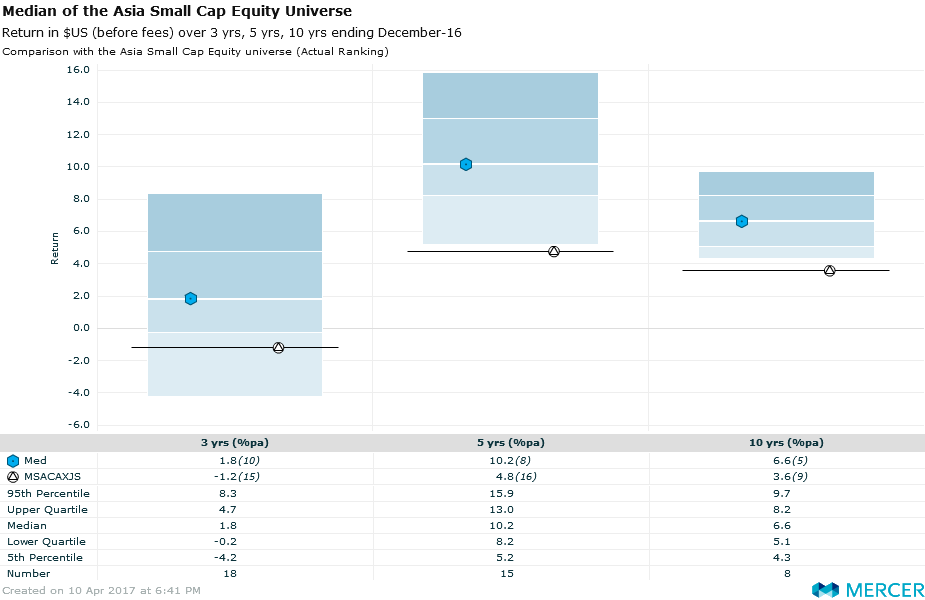

The value add for active management is even more significant for the Asia Small Cap Equity, where the median manager beat the benchmark of MSCI AC Asia ex Japan Small Cap Index by over 3 percent per annum in the 3-, 5- and 10-year period ending 31 December 2016.

One of the pitfalls is that if as an investor you are not skilled, informed or street-smart, then you can get taken advantage of by others who have that advantage. In such situations, the quantitative approaches to investing may run into pitfalls in Asia.

BRINK Asia: One benefit of a passive approach …

Nuzum: Passive approaches are low-cost and they are relatively easy to implement. Those are two advantages of this form of investment strategy in an Asian context.

BRINK Asia: As volatility in the West has increased, has the risk-return perspective of investors vis-a-vis Asia changed, or is it changing?

Nuzum: I think the risk-return perspective of investors is definitely changing and that is driven by low interest rates, low productivity and low expected growth. With low growth and adverse demographics in non-Asian developed markets, there are big concerns about future growth expectations, and that is driving interest towards investing in Asia.

There are country-specific challenges to investing in Asia. Japan, for example, is a rapidly aging society and the market for corporate control is broken. So there are a number of zombie companies, and many are concerned about underlying GDP growth in the country.

A big outlier in determining the region’s performance is China and the Chinese government’s ability to produce high economic growth. In the past 30 years, the government has delivered an economic miracle unprecedented in history; and the government is projecting economic growth of 6.5 percent this year, which while slower than before, is still strong. But there are demographic challenges due to the historical one child policy and that could have a dampening effect on GDP growth, so the ability of the government to navigate through that will be a challenge.

BRINK Asia: One often talked about theme is poor governance in Asia. How can Asian fund managers/money managers improve governance?

Nuzum: I don’t hear it expressed in these specific terms, but there are two areas where concern is expressed.

The first area is a concern about “green-washing.” Most of our asset-owner clients consider themselves to be universal shareholders, in that they hold a share of the global economy, so they want to see engagement from their asset managers on environmental, social and corporate governance issues—or “ESG”—but we don’t see enough of that in Asia. Most European and U.S. managers can tell a good story about how they integrate ESG if you meet with them at headquarters, but in Asia, the same managers don’t have a story because local clients and prospects are not asking them these questions. When we ask the same questions about ESG and get different answers from those implementing a strategy locally than the answer we got at the headquarters, we see that as a sign of green-washing.

Second, retail money is the main source of investing in most of Asia. Some intermediaries are focused on casino-style marketing and sales to generate commissions, as opposed to providing long-term focused advice on savings and investment. We believe that the individual wealth space needs massive change in Asia. We are starting to see citizens even in cultures that have been categorized as casino-focused now asking the right questions and becoming more discerning. That is the second area that needs reforms in Asia—and it isn’t just with fund managers, but for intermediaries and distributors as well.

*This is a group of managers that focus on Asia ex Japan markets and comprise Mercer’s Asia ex Japan performance universe—they typically adopt MSCI All Country Asia ex Japan (or something similar) as their benchmark.

Important Notices

References to Mercer shall be construed to include Mercer LLC and/or its associated companies.

© 2017 Mercer LLC. All rights reserved.

This does not constitute an offer to purchase or sell any securities. This does not contain investment advice relating to your particular circumstances. No investment decision should be made based on this information without first obtaining appropriate professional advice and considering your circumstances.

The findings, ratings and/or opinions expressed herein are the intellectual property of Mercer and are subject to change without notice. They are not intended to convey any guarantees as to the future performance of the investment products, asset classes or capital markets discussed.

Some information contained herein has been obtained from third party sources. While the information is believed to be reliable, Mercer has not sought to verify it independently. As such, Mercer makes no representations or warranties as to the accuracy of the information presented and takes no responsibility or liability (including for indirect, consequential, or incidental damages) for any error, omission or inaccuracy in the data supplied by any third party.