Chinese M&A Activity Plummets During COVID-19

Source: Rhodium Group

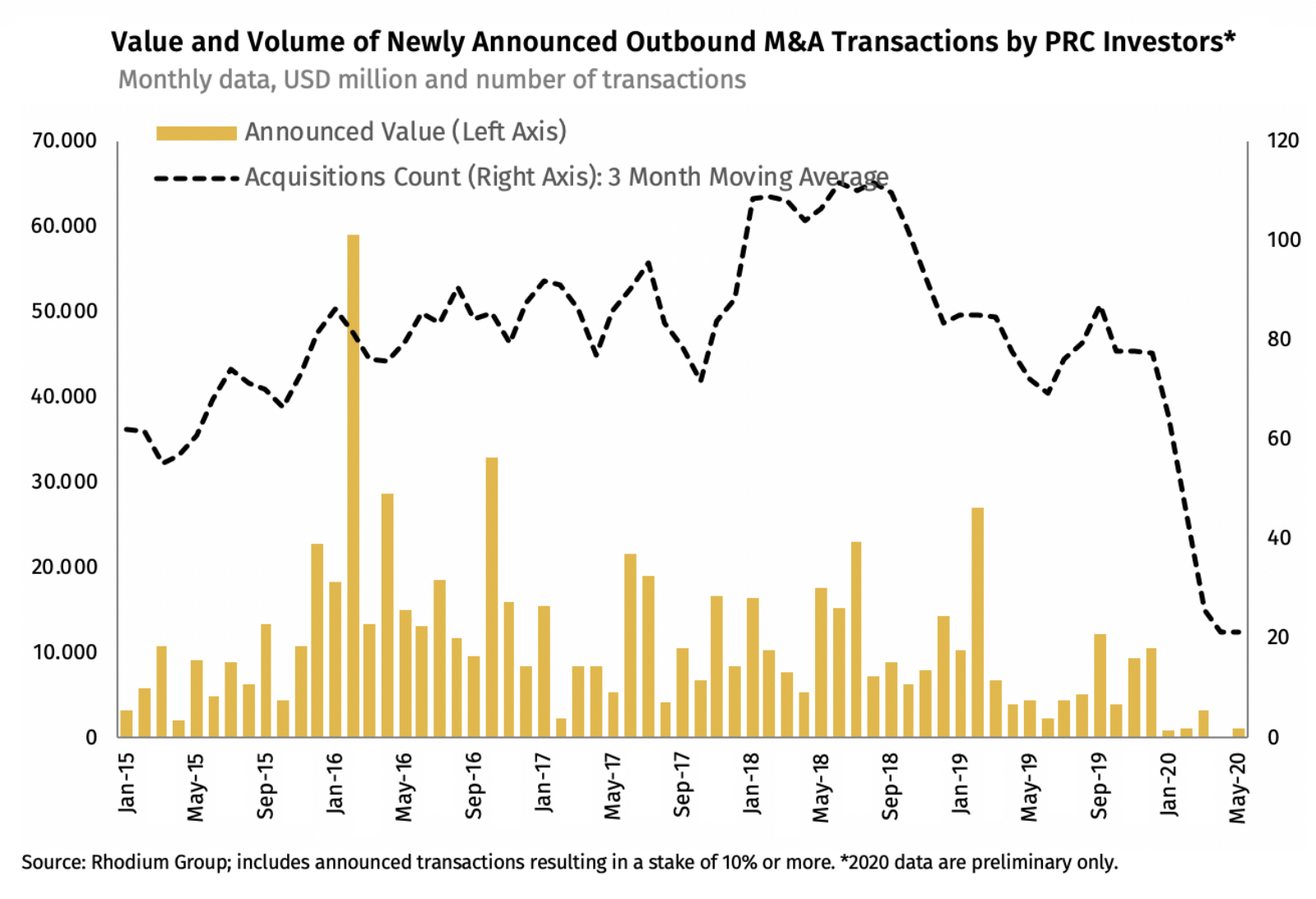

China’s outbound M&A activity contracted by two-thirds between January and May, 2020, according to a report from Rhodium Group, compared to the average monthly count between 2016 and 2018. For the first time in 10 years, foreign investment deals into Chinese firms are outpacing those coming out of China.

Companies have braced for investment activity from China amid the economic recession, but “there are no signs of a Chinese outbound investment boom, like the one seen after the global financial crisis a decade ago,” the report notes. “Instead, takeovers are headed in the other direction: into China.” Foreign investors are pursuing Chinese assets as the country’s consumption has risen along with its middle class. Policies that previously limited foreign investment in the country have also been lifted, and Chinese firms are seeing increasing maturation.

Although China is the second-largest economy in the world, its fate as a global investor is not certain. Moving forward, China will need to succeed in certain domestic policy reforms and gain the trust of foreign investors, the report says — neither of which is guaranteed.