Dining Out Is More Appealing Than Going to a Concert — What Consumers Are Thinking About Opening Up

Source: Morning Consult

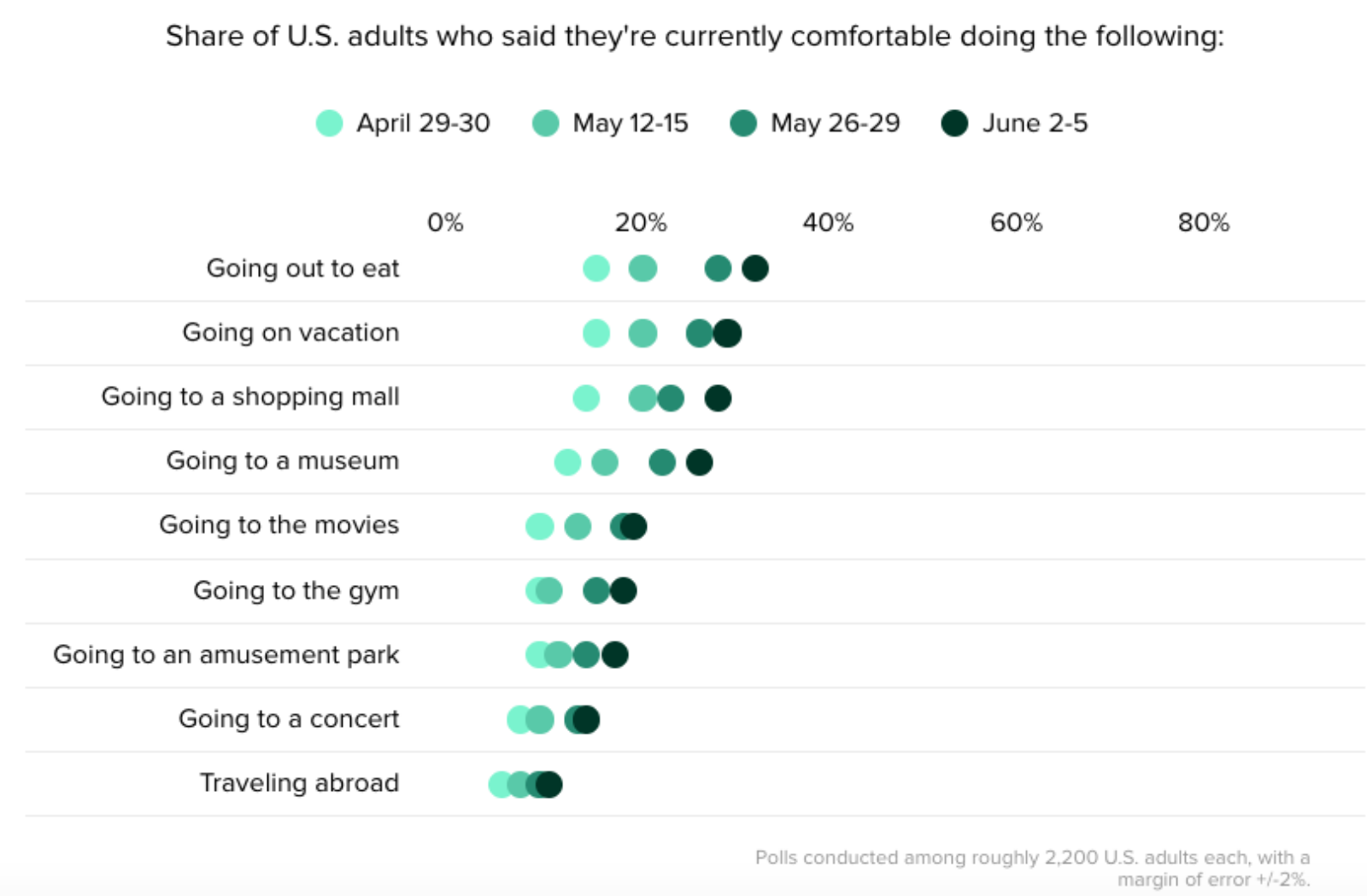

A majority of U.S. adults still aren’t comfortable engaging in leisure or social activities, despite an increasing number of “nonessential” businesses reopening across all 50 states. Morning Consult has been tracking public opinion on this topic since late May and conducted its latest poll in early June.

Only about 25% of respondents, on average, say they feel safe participating in activities like going out to eat or going on vacation. However, the general trend is inching toward increased comfort in all categories, and respondents who would feel at ease dining out increased by 31% since late-May. In the poll, 22% of respondents say they could see themselves dining out within three months.

Respondents are most uncertain about attending concerts and traveling abroad. Notably, 44% say they won’t feel safe traveling internationally until at least the end of the year.

A new analysis found that after reopening nonessential businesses, 21 states saw a spike in coronavirus cases. This has prompted both Oregon and Utah to hit pause on lifting their states’ lockdown restrictions.